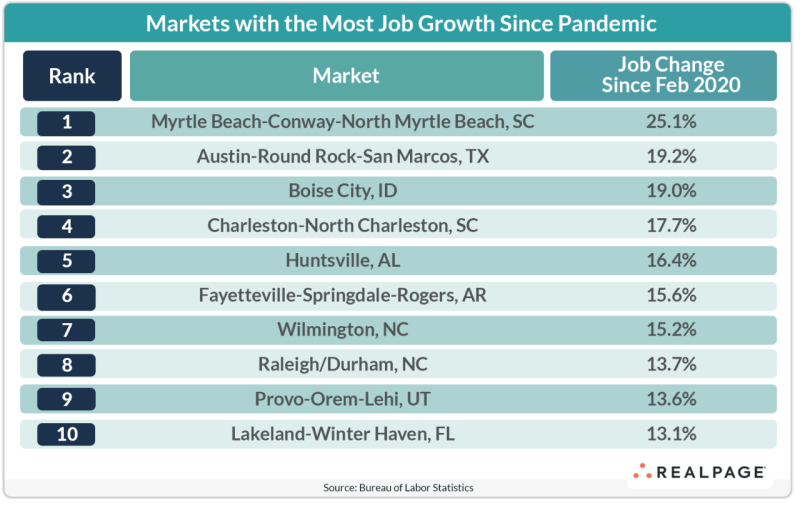

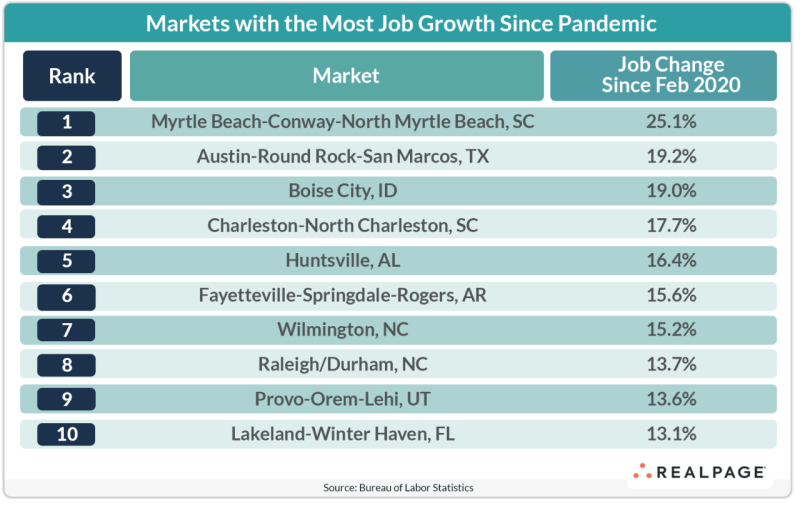

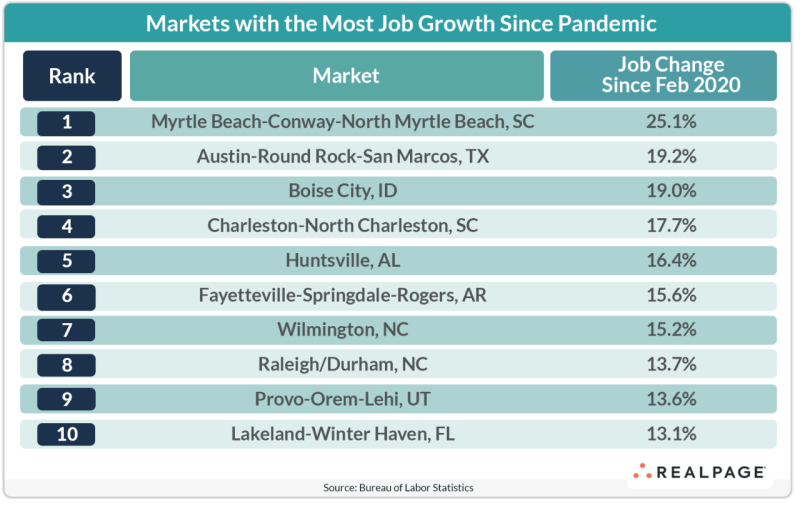

Markets With The Highest Job Growth

Source: Jay Parsons

As of 2nd quarter 2025, Class A rental rates were up 2.3% year-over-year, while Class B stock grew 0.8% (less than the U.S. average). Class C stock continues to see rent cuts of 1.1%.

Source: RealPage

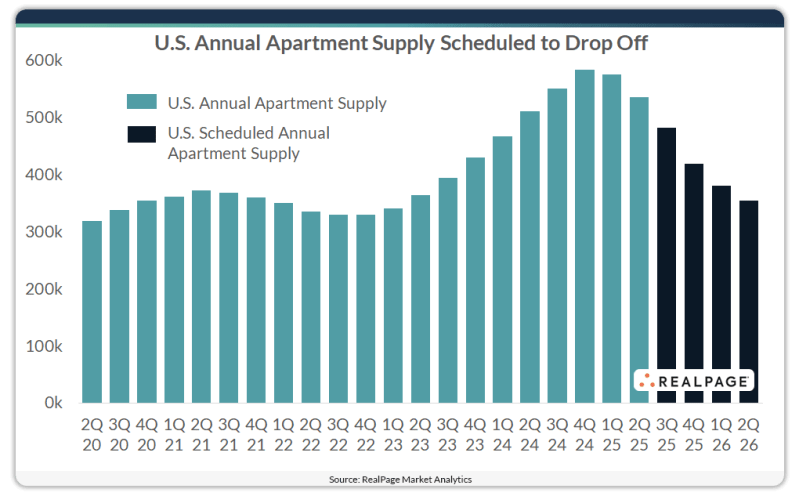

In the U.S. overall, just over 354,000 units were under construction at the end of 2nd quarter and scheduled for completion in the coming year. That is a 33.9% decline from the roughly 535,800 units completed in the year-ending 2nd quarter 2025.

Source: RealPage

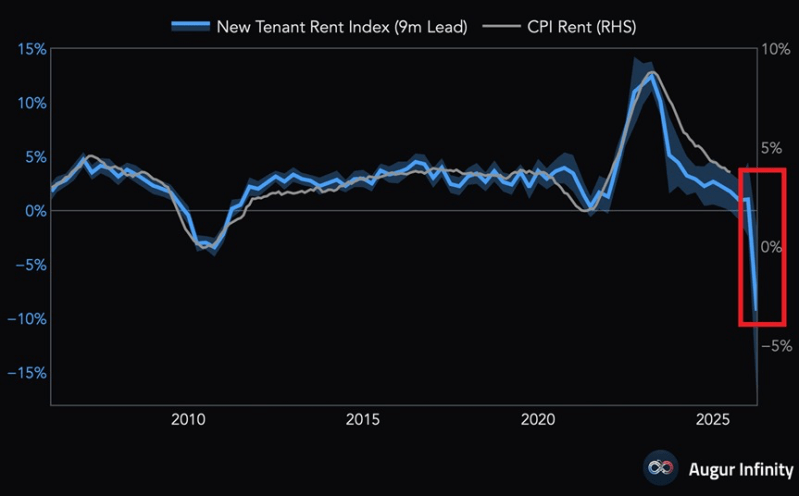

The BLS’ New Tenant Rent Index fell 9.3% year-over-year through the end of Q2 2025. This data tracks what is happening with rents much closer to real time and tends to lead the shelter component of CPI (which tracks the rental market on a significant lag and uses a concerning amount of survey data).

If the CPI’s shelter component “catches down” to the New Tenant Rent Index it would provide significant downward pressure on CPI prints in the coming months.

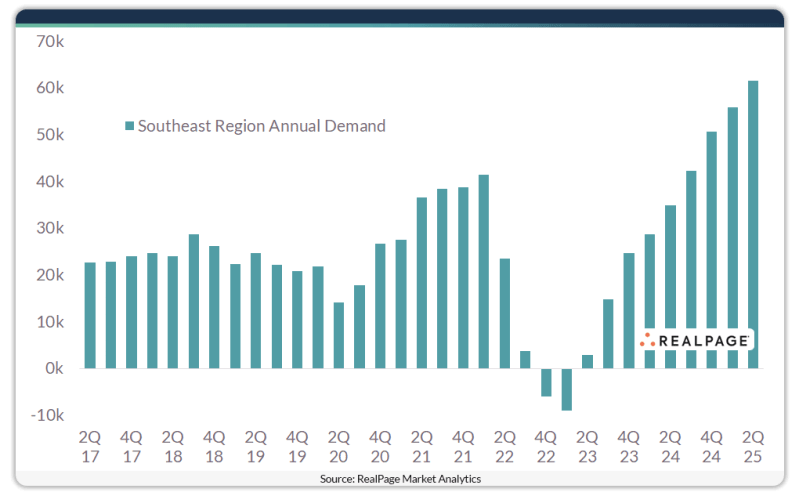

Annual absorption topped 60,000 units in the Southeast in the year-ending second quarter. That was the region’s strongest apartment demand reading in decades. The Southeast has been enjoying an outsized performance relative to other regions, inspired by solid in-migration, resilient job growth and affordability advantages.

Source: RealPage

From Jay Parsons: It’s not just interest rates. Sales volume has remained weak because sellers and buyers are both bullish on multifamily. Sellers want to price in the rebound that buyers are counting on.

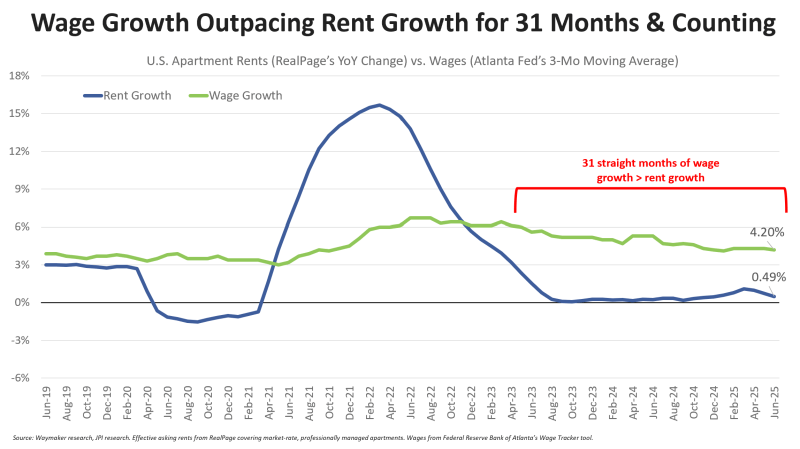

Wage growth has outpaced apartment rent growth for 31 consecutive months, which helps explain why we’ve had extremely strong absorption data.

Source: Jay Parsons