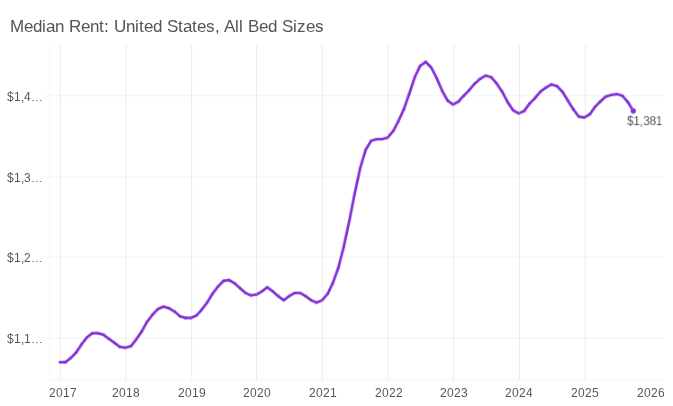

The national median rent fell by 0.8% in October. This was the third consecutive month-over-month decline, as we’re now in the midst of the rental market’s off-season. It’s likely that we’ll continue to see further modest rent declines to close out the year.

Rent prices nationally are down 0.9% compared to one year ago. Year-over-year rent growth has been slightly negative for over two full years, and the national median rent has now fallen from its 2022 peak by a total of 4.2%.

While it’s expected to see rent prices dip slightly at this time of year, there’s been some shifts to the timing of rental market seasonality in recent years. Monthly rent growth peaked at +0.7 percent in March this year, but it then began to gradually trend down during the peak moving months, when rent growth is normally fastest. The flip to negative month-over-month growth also came a bit earlier than pre-pandemic years, making this the third straight year that prices have begun to dip in August.

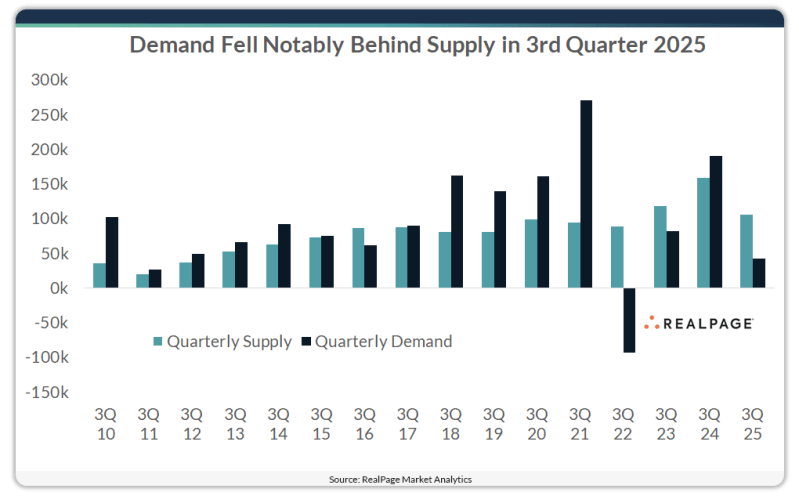

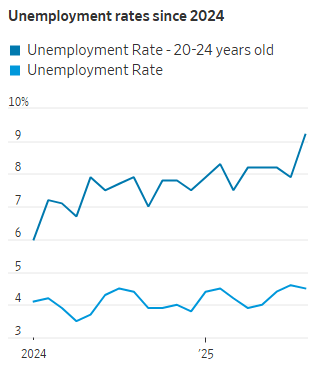

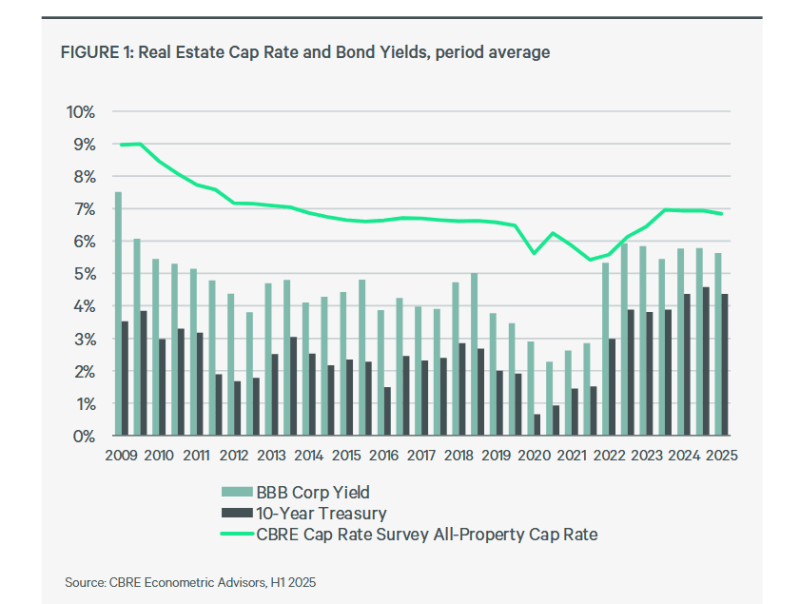

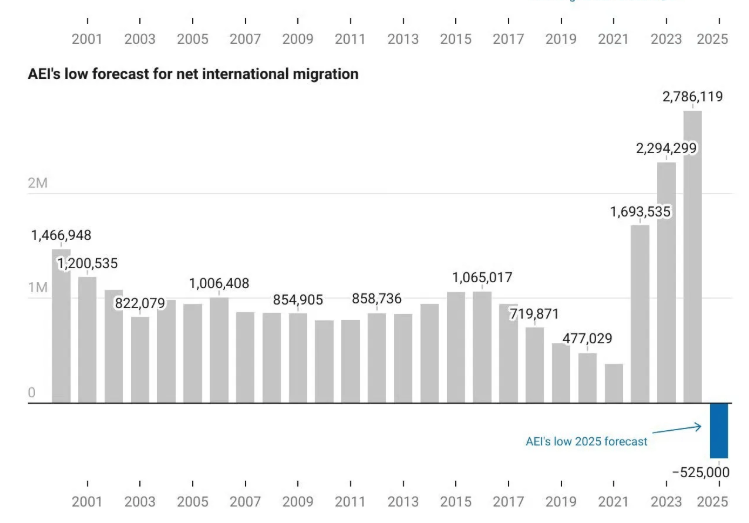

The national multifamily vacancy rose to 7.2%, setting a new record high for the index. A healthy supply of new units are hitting the market and colliding with sluggish demand, causing vacancies to continue trending up.

Source: Apartment List