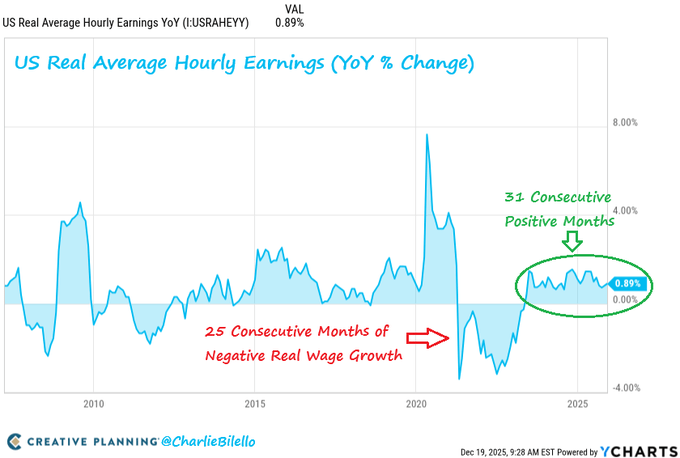

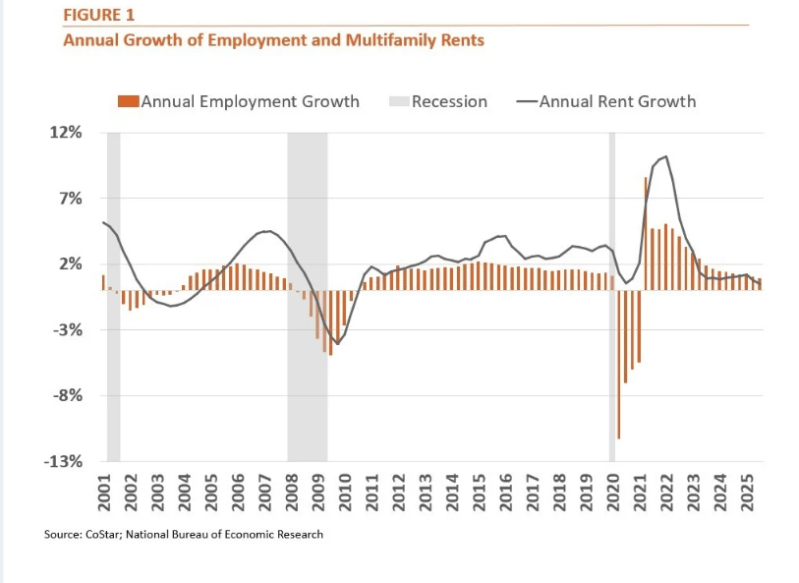

The balance between job growth and rent growth—once a reliable indicator for multifamily investors—has become harder to read. Despite a cooling labor market and record apartment construction, the usual patterns linking employment gains to rising rents no longer hold as tightly.

While job growth has historically had a meaningful, positive impact on multifamily rents, the past few years have upended that relationship.

The labor market weakened this year, with total job growth in the third quarter reaching 187,000—a 53.1% year-over-year decline—and unemployment inching up from 4.0% in January to 4.4% in September. That kind of slowdown would typically damp apartment demand and pull down rents.

Analysis has found that, in 93 of 99 quarters studied, metros with higher multifamily delivery rates experienced weaker rent growth, even after accounting for job growth. Conversely, 94 of the same quarters showed stronger rent gains in areas with faster job growth, once new supply was controlled for.

Yet those correlations have shown signs of breaking down. The pandemic, remote work, and the uneven return to offices may have tightened or disrupted labor-housing linkages that once seemed dependable. Demographic shifts—such as an aging population—and heightened supply volatility could also be adding complexity.

Taken together, the data suggest that while job growth continues to shape rent trends, its influence is now mediated by new market dynamics. The multifamily sector’s long-trusted economic compass is no longer pointing straight.

Source: Globe Street