Apartment demand in North Carolina and South Carolina ranks as the strongest in the nation, indexed by relativity. The Carolinas garnered apartment demand for 2.5 times more than the share of existing local stock in calendar 2023, topping every other region for the measure.

Apartment markets in the Carolinas absorbed nearly 25,000 units on net in calendar 2023. That accounted for about 10% of all U.S. absorption. But the Carolinas make up a relatively small piece of existing units across U.S. multifamily stock, with just a 4.2% share. Given the size of existing stock across the North and South Carolina, indexed absorption was especially high here in 2023.

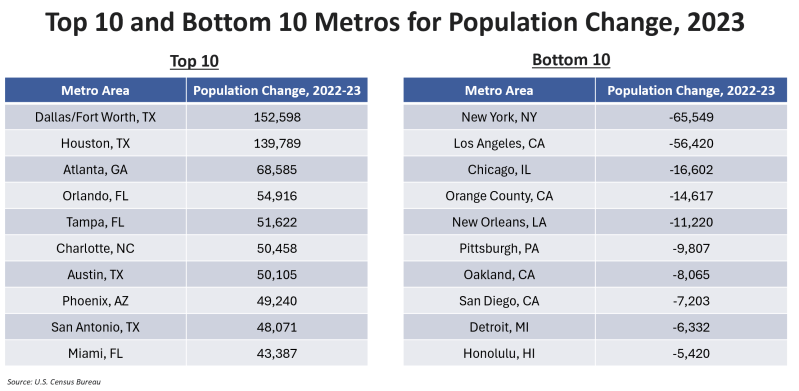

We hear a lot about supply in the multifamily world right now, but don’t forget about demand. The following are the Top 10 metros in terms of population growth over the last year:

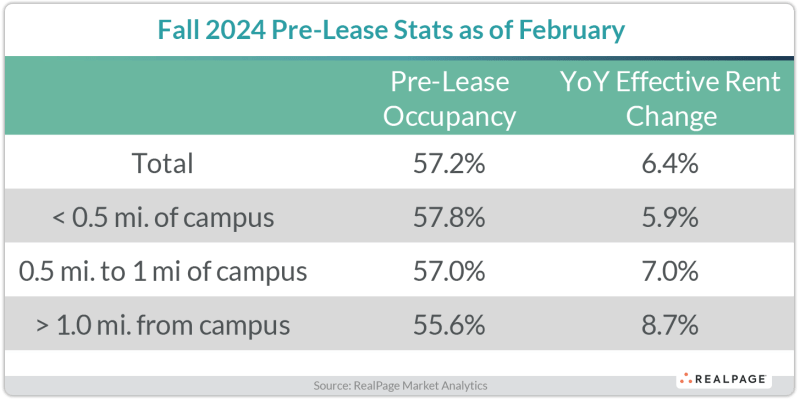

The February pre-lease rate is just below last year’s all-time high of 58.2% through February 2023. The long-term average is around 50% through February.

Source: Real Page

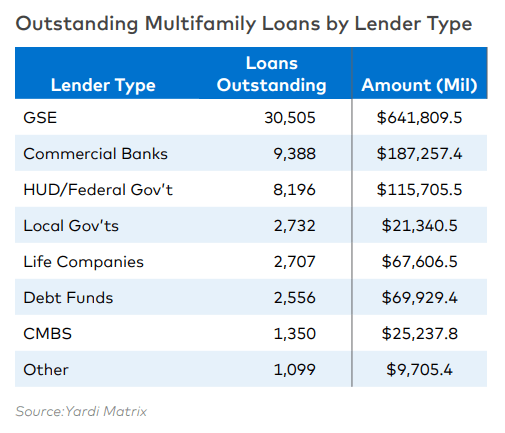

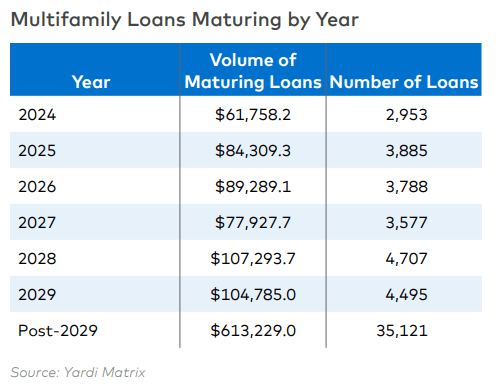

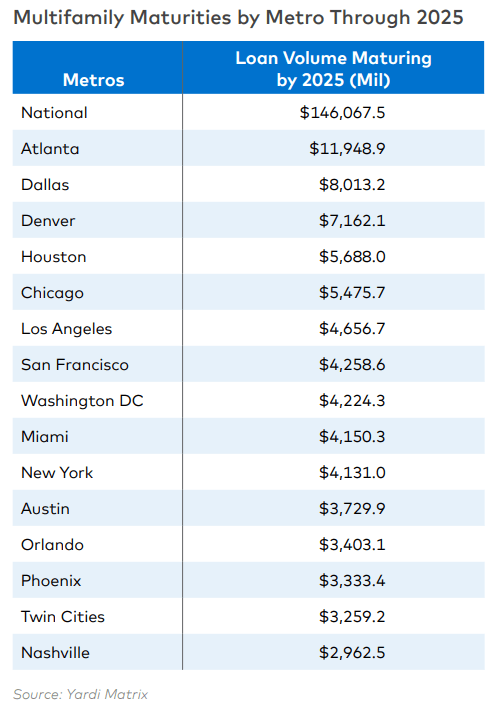

The multifamily debt market totals $1.1 trillion, with about half of those loans set to mature over the next 5 years (58,533 properties).

$150 billion in debt (6,800 multifamily properties) will mature by the end of 2025.

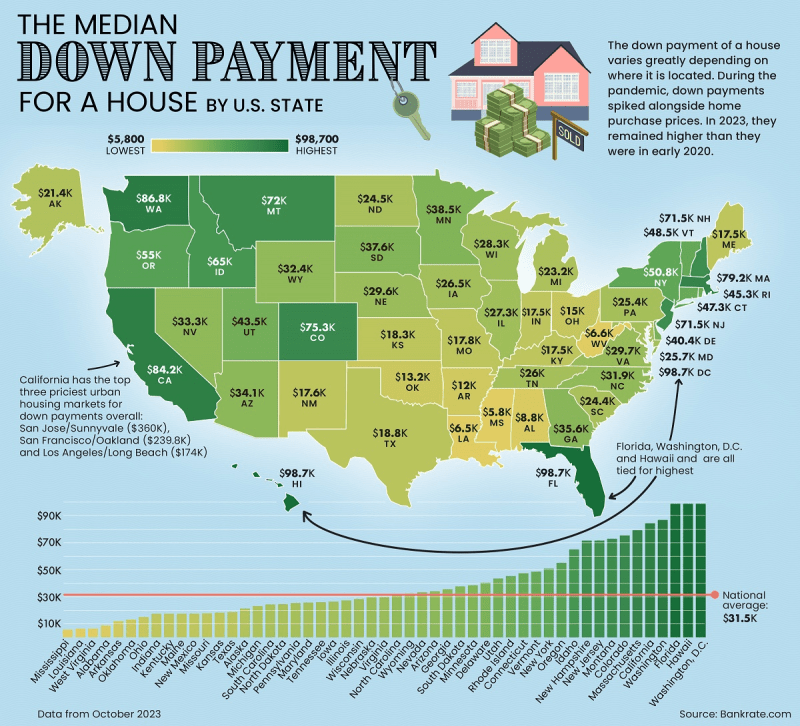

The national average is $31,500, which is a 15% down payment for the home.

The rankings are based on job growth, wage growth, high-tech GDP, broadband access, housing affordability, community resiliency (to natural disasters) and income inequality.

The following are the North and South Carolina cities that made the lists and their rankings:

LARGE CITY RANKINGS:

Tier 1 Large Cities:

2. Raleigh, NC

10. Charlotte, NC (includes Concord and Gastonia)

11. Charleston, NC (includes North Charleston)

Tier 2 Large Cities:

19. Myrtle Beach, SC (includes Conway and North Myrtle Beach)

21. Wilmington, NC

36. Durham, NC (includes Chapel Hill)

38. Greenville, SC (includes Anderson and Mauldin)

Tier 3 Large Cities:

61. Asheville, NC

86. Winston-Salem, NC

109. Columbia, SC

115. Hickory, NC (includes Lenoir and Morganton)

124. Spartanburg, SC

Tier 4 Large Cities:

164. Greensboro, NC (includes High Point)

180. Fayetteville, NC

SMALL CITY RANKINGS:

Tier 1 Small Cities:

(None)

Tier 2 Small Cities:

9. Jacksonville, NC

43. Hilton Head, SC (includes Bluffton and Beaufort)

Tier 3 Small Cities:

63. Greenville, NC

90. Florence, SC

Tier 4 Small Cities:

139. Sumter, SC

158. New Bern, NC

Tier 5 Small Cities:

185. Rocky Mount, NC

193. Goldsboro, NC

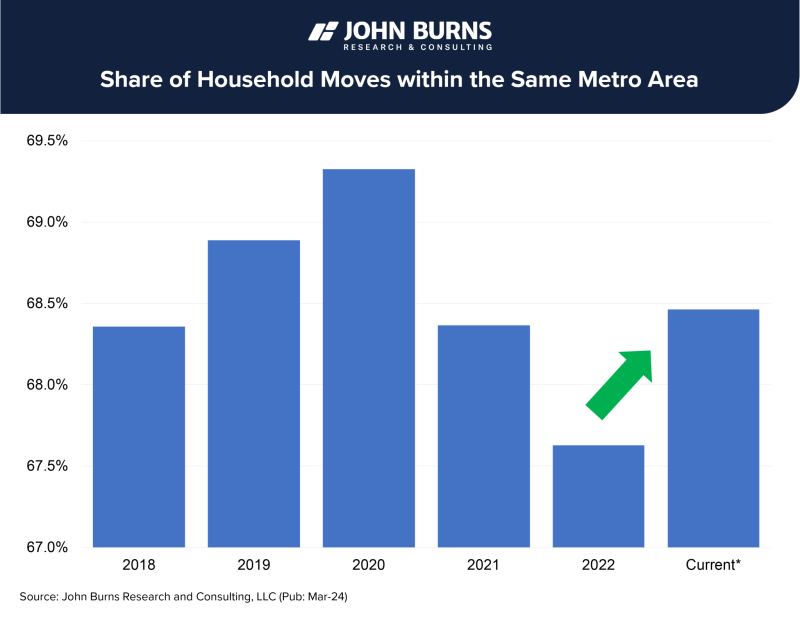

If people do move, a larger percentage are staying in the same Metro area:

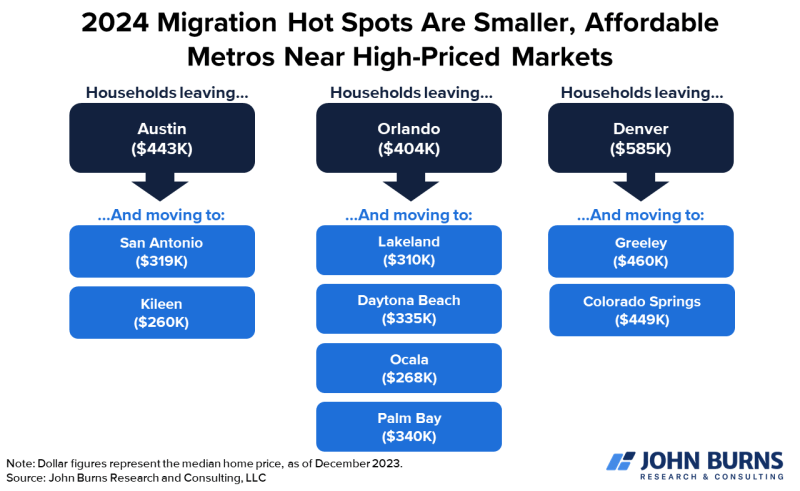

2. High-growth markets have become increasingly expensive to buy and rent homes, forcing many potential home buyers to relocate to a nearby, smaller market with more affordable homes.

3. Some regions are experiencing strong positive migration and housing demand while others are experiencing the opposite:

Source: John Burns Consulting