Among U.S. states, the largest surge in unemployment from December 2023 to December 2024 was in South Carolina with the rate jumping 170 basis points.

Source: RealPage

Among U.S. states, the largest surge in unemployment from December 2023 to December 2024 was in South Carolina with the rate jumping 170 basis points.

Source: RealPage

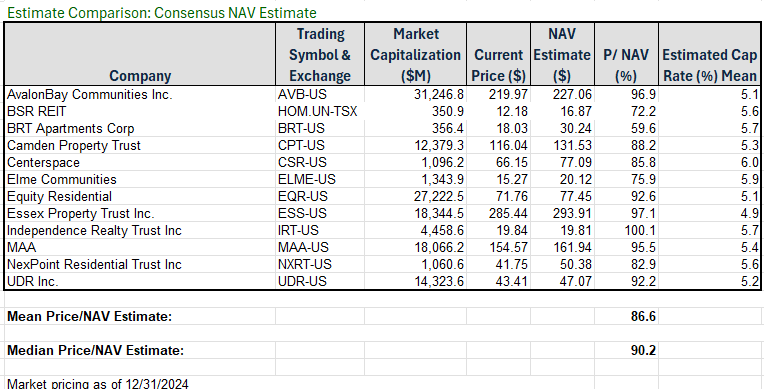

Multifamily REITs currently trade at discount of about 12% relative to their Net Asset Value. A discount to NAV means the stock prices is lower than the total value of the properties the company owns.

For example, if the total valuation of the company is $880 million, but the REIT (and the market) believes they can sell every property they own for $1 billion, then the stock trades at a 12% discount to its NAV.

The table below highlights specific multifamily REITs and their discount to NAV (the “P/NAV” column).

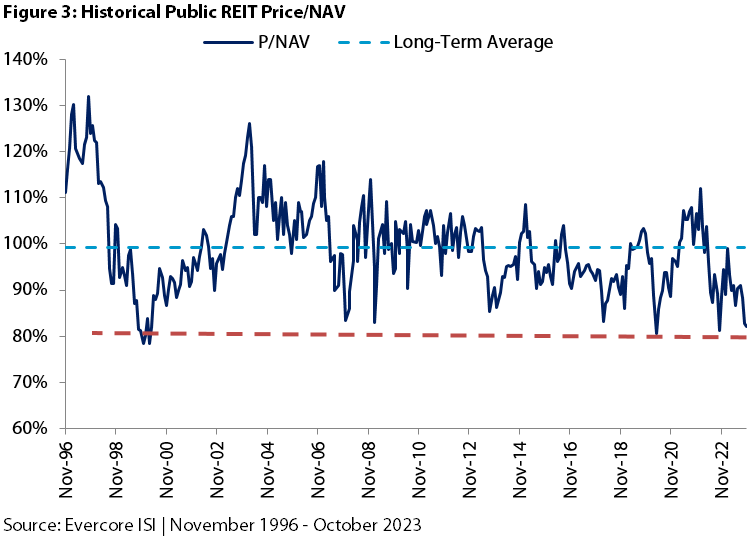

The graph below provides a historical view of all public REIT types going back to 1996, illustrating the fluctuations in price-to-NAV, where values above 100% represent a premium and values below 100% indicate a discount.

Sources: Multi-Housing News & Seeking Alpha

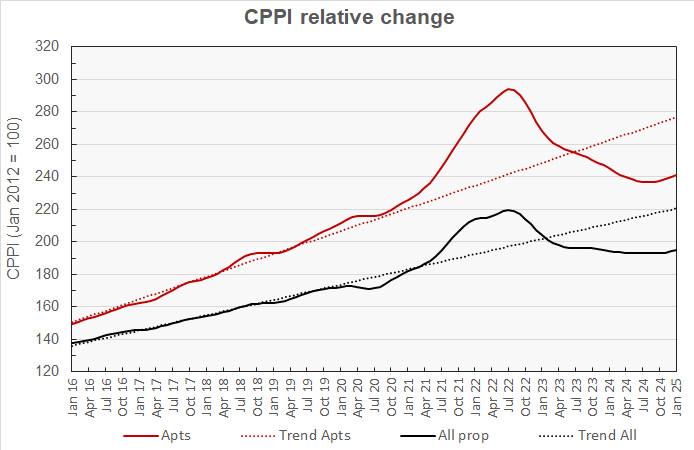

MSCI Real Capital Analytics reported multifamily property prices rose 0.7% month-over-month. The chart below (red line) shows that multifamily prices bottomed in February 2024, and over the last 5 months prices have been moving higher at a speed that nearly matches the pre-pandemic trend.

____________________________________

The Monthly PCE Report – released 2/28/25

____________________________________

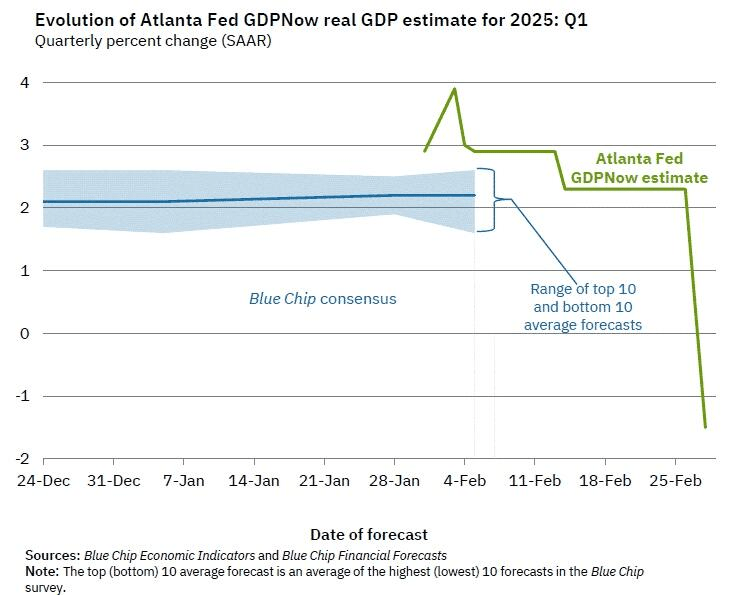

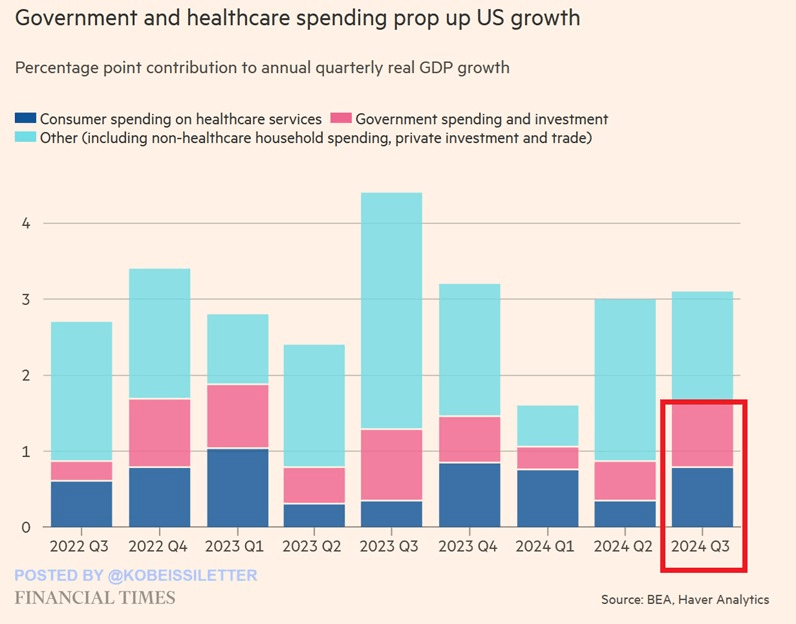

The Atlanta Fed’s GDPNOW model, forecasting US economic growth, just downgraded its estimate of Q1 2025 GDP growth from positive 2.3% to negative 1.5%. A slowing economy makes investors more likely to be defensive (buy treasuries) and makes the Fed more likely to cut interest rates.

_______________________________________

Bloomberg Economics estimates that if DOGE attempts to go for savings of $600B per year, GDP could fall by 2% by the end of this year, the unemployment rate could rise by nearly a percentage point, and CPI year-over-year could fall by nearly 0.9 percentage points.

The Fed has a dual mandate, low inflation and low unemployment, so this scenario would dramatically speed up their rate cutting cycle over the next 18 months.

________________________________________

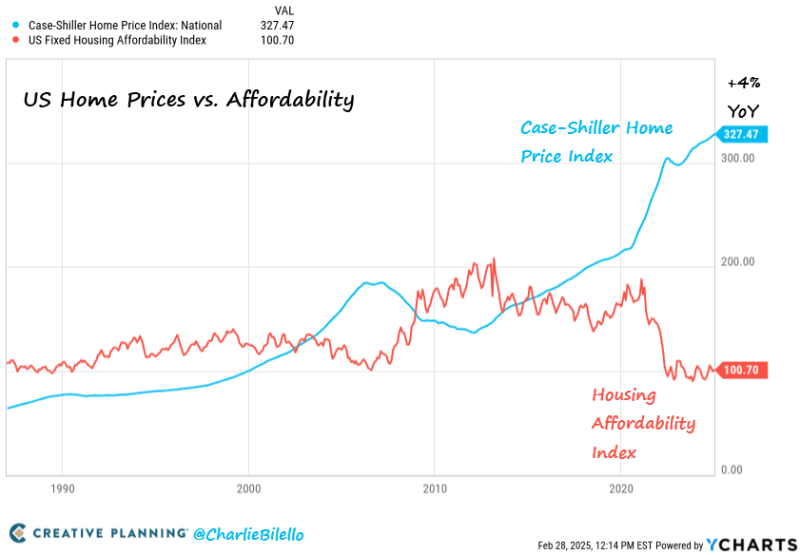

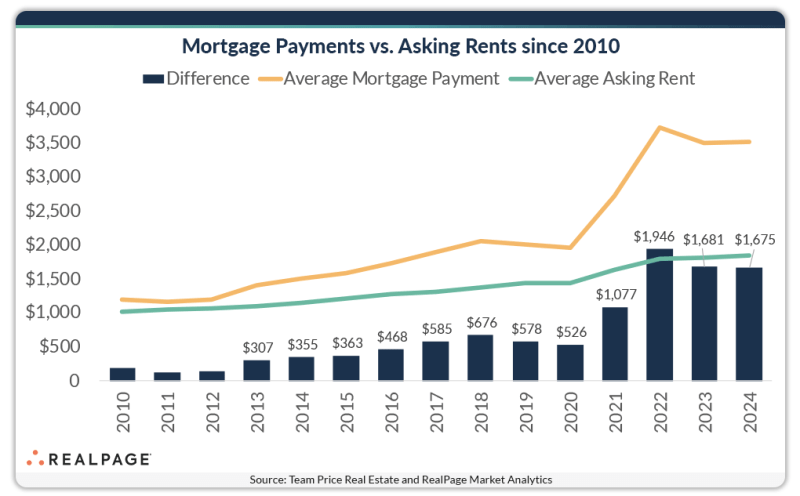

The Case-Shiller Home Price Index reached a new all-time high this month, rising over 4% from the prior year. Affordability remains near record lows for home buyers:

________________________________________

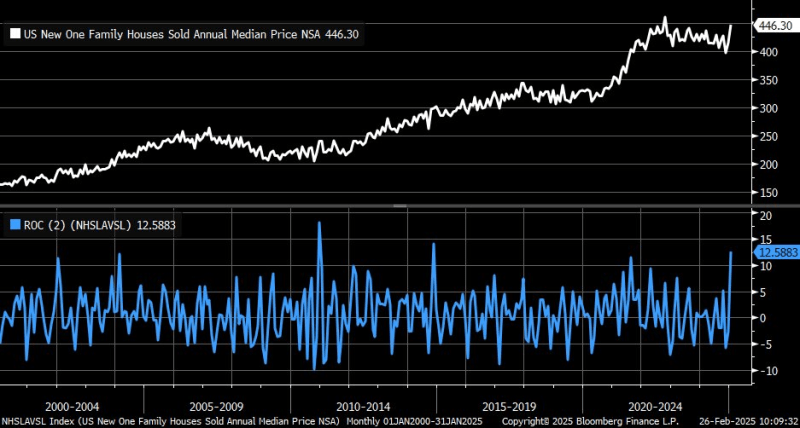

The median new single-family home prices spiked to $446,300 this month. The 2-month change is now up to +12.6%, which is the largest increase since November 2014. Rising home prices push affordability even further way for current renters.

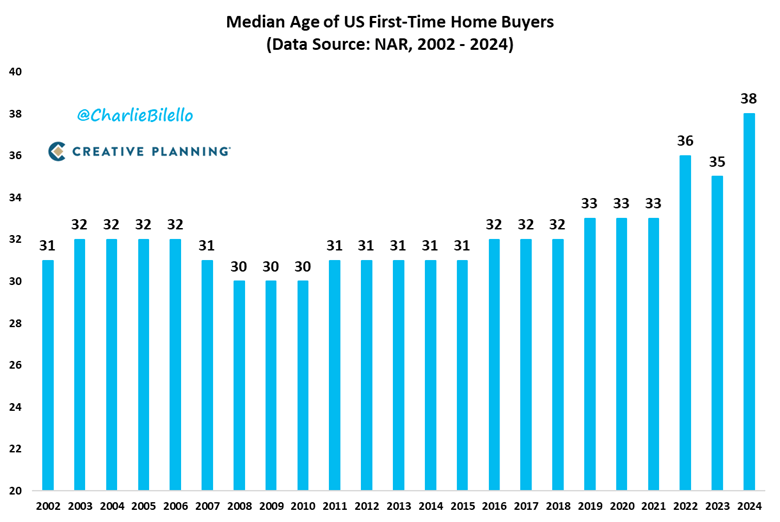

The median age of first-time home buyers continues to rise, creating more demand for rental units:

____________________________________________

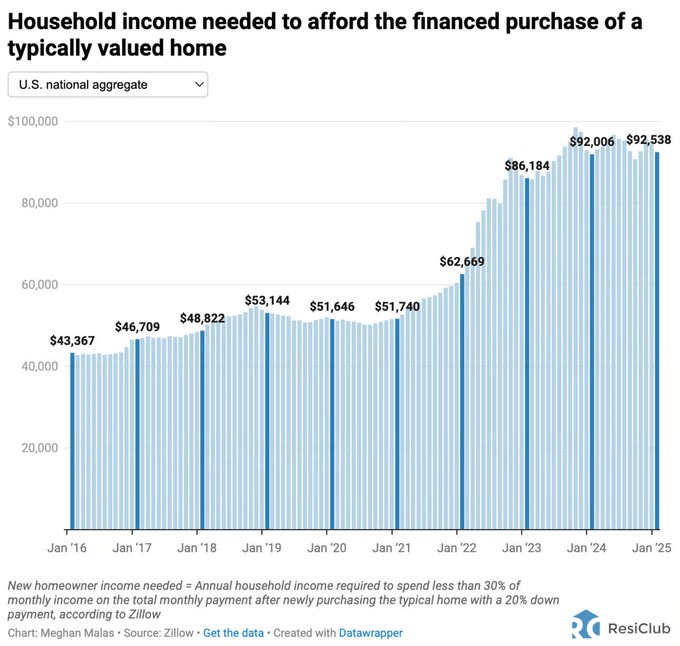

Annual U.S. household income needed to purchase typical U.S. home has risen by 79% over the last 5 years.

__________________________________________

The Monthly PCE Report – released 2/28/25

_____________________________________________

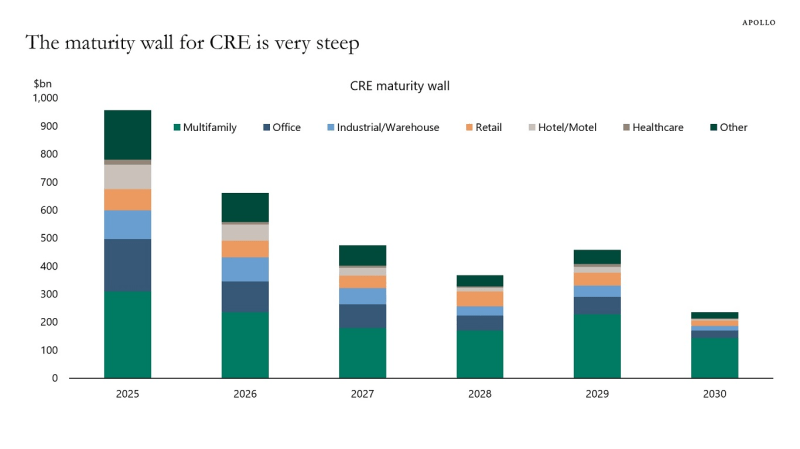

The chart below shows the location in the economy where higher rates equal extreme pain (click here for high resolution chart):

_________________________________________

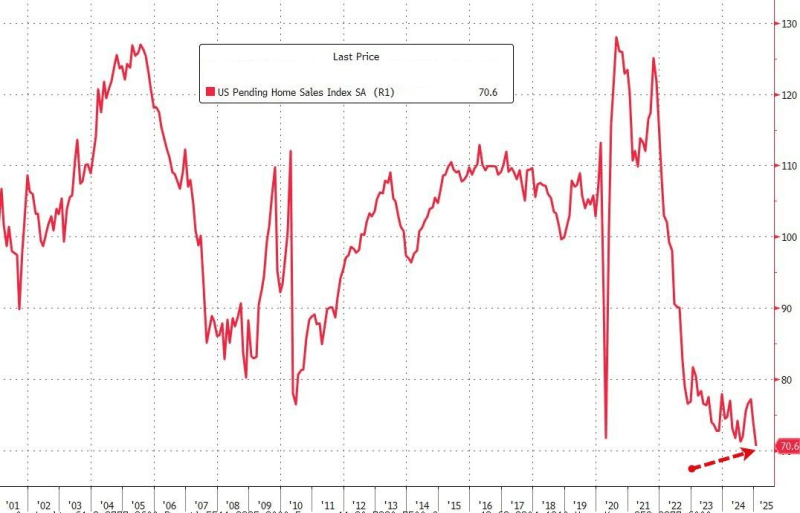

While existing home sales report showed a decline of 4.9% month-over-month, pending home sales fell 4.6% month-over-month and 5.2% year-over-year. The drop pushed the pending home sales index to its lowest level in history (taking out the 2008 financial crisis and Covid lows).

________________________________________

The number of unsold completed new single-family homes hits the highest level since July 2009. New home sales declined by 10.5% month-over-month. A higher supply of homes leading to lower prices (combined with the recent drop in mortgage yields) would improve affordability for those looking to enter the market and reduce the supply of existing multifamily tenants.

______________________________________

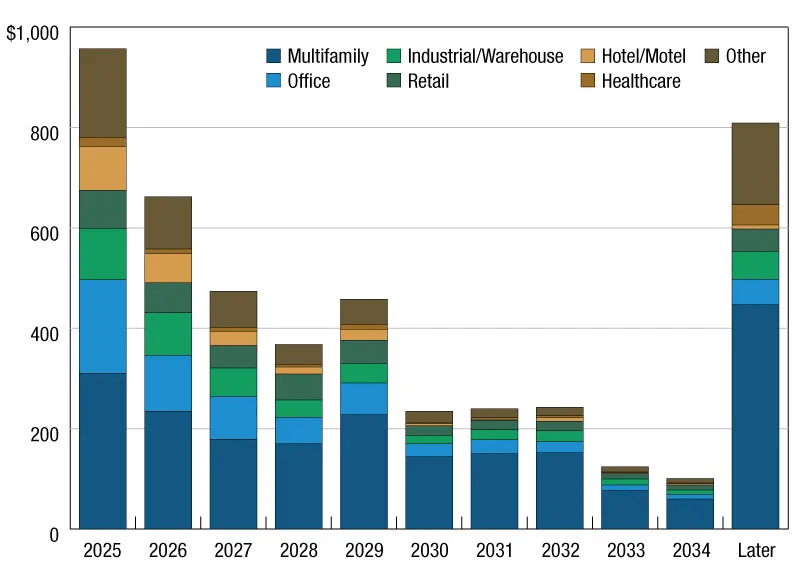

20% ($957 billion) of the $4.8 trillion in outstanding commercial real estate debt will mature in 2025, a 3 percent increase from 2024.

14% of multifamily debt (not including that serviced by depositories) will mature in 2025.

The index measures economic vitality in 200 large metropolitan areas and 203 small metropolitan areas by assessing performance of the labor market, tech sector, and access to economic opportunities. The 2025 version of the index emphasizes jobs, wages, high-tech growth, housing affordability, and broadband coverage, in addition to metrics of community resilience and income inequality.

To ensure that population size doesn’t skew results, the index divides US metropolitan areas into large and small cities, which are then classified into five tiers, with Tier 1 being the highest-ranked cities and Tier 5 being the lowest-ranked cities.

Raleigh, NC ranked as the number 1 city in the country for 2025. Here are the other cities in the Carolinas that made the Tier 1 and Tier 2 lists with their national ranking in (parenthesis).

Large US Cities:

Small US Cities:

Source: Milken Institute

From the Wall Street Journal: “We’re Heading Toward a Landlord-Friendly Era. Expect Higher Rent Prices“

______________________________________

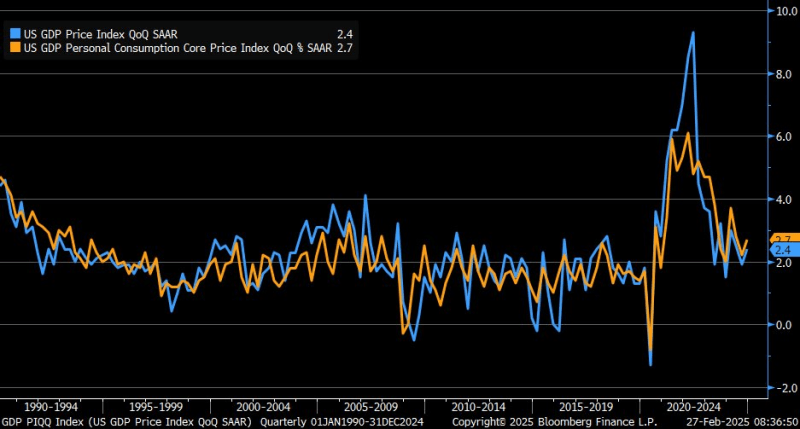

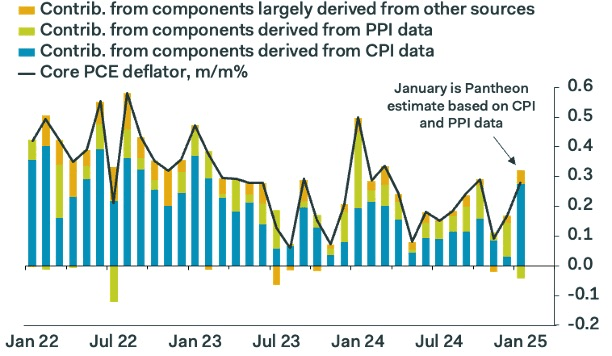

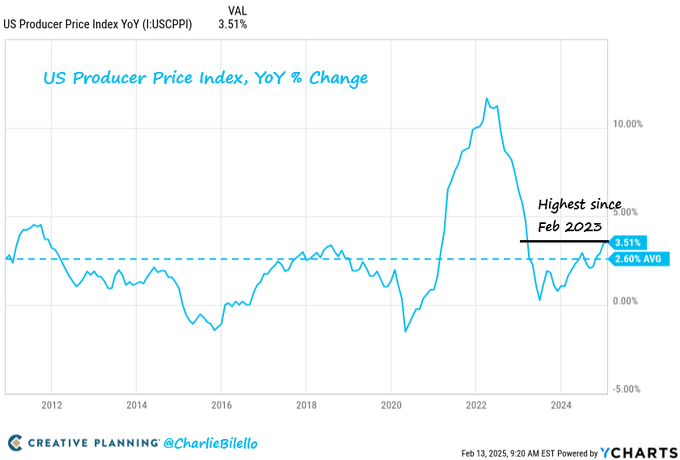

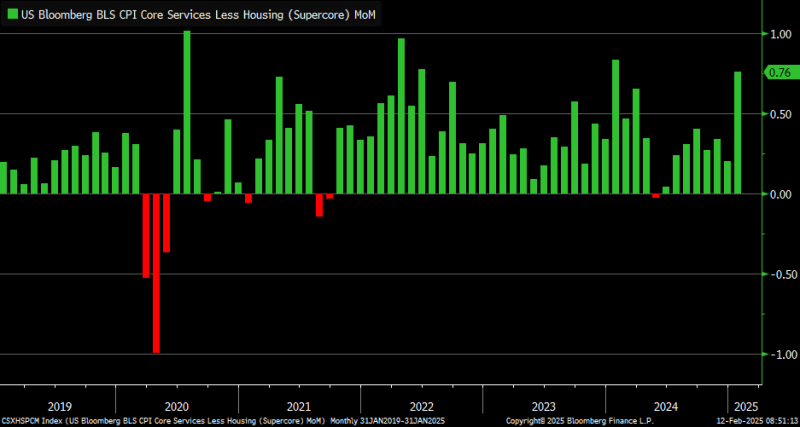

The PPI numbers were a game-changer for the Core PCE print coming at the end of the month (Core PCE is the inflation gauge the Fed believes is most important). We’re now tracking 0.28% month-over-month, 2.6% year-over-year (down from 2.8% in December) All the healthcare and insurance PPI components were weak and airline fares prices fell sharply. About as good as the Fed could have hoped for.

__________________________________________

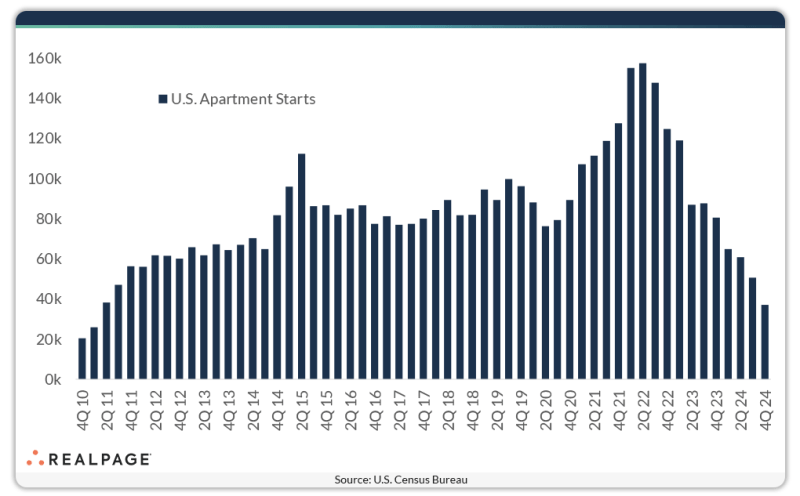

Multifamily Starts Hit Lowest Since 2011:

U.S. multifamily starts have declined precipitously in the past year and a half and hit a 13-year low mark in 4th quarter 2024. A little over 37,000 apartment units got off the ground in the last three months of the year.

___________________________________________

Average hourly earnings in the U.S. grew at an average annual rate of 3.1% between 2010 and 2024. However, during the same time period, the median price of an existing single-family home rose much faster at an average annual rate of 6.7%, more than double the pace of wage growth. By the end of 2024, the median home price had reached approximately $418,000, nearly doubling from $212,000 in 2014.

Rental affordability has followed a different trajectory. The median rent-to-income ratio stood at 22.2% at the end of 2019, peaked at 23.8% in 2021, and then declined to 23.3% by the end of 2023. By the end of 2024, it had settled at 22.5%, just 30 basis points above pre-pandemic levels. This suggests that as inflation has cooled, wages have grown steadily and rents have stagnated over the past few quarters, making renting nearly as affordable as it was before the pandemic, with some variation across markets. In contrast, homeownership has not seen the same affordability improvements, as home prices remain significantly higher relative to income growth.

______________________________________

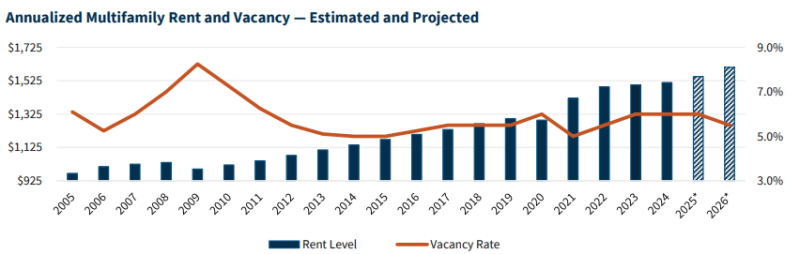

Fannie Mae’s 2025 Multifamily Outlook: Clearer Skies Ahead

We have upgraded our outlook for the national multifamily sector to “improving” for 2025. We expect the multifamily sector will see slow but continued improvement in demand this year, possibly resulting in flat rent growth and a slightly rising national vacancy rate during the first quarter of 2025 due to the amount of new supply entering the market, especially during what is normally a slow lease-up time of year. After that period, we expect multifamily fundamentals will strengthen, with moderately increasing rent growth and stabilizing vacancy levels.

We anticipate that cap rates are likely to compress a bit more during 2025, likely declining to between 5.0% and 5.5% over the next 12 to 18 months, helping to spur more sales transaction volume over that time.

At a national level, we believe that demand for multifamily rental will increase slightly in 2025, based on expected job growth and household formations as well as demographic trends. As of 2022, there were an estimated 68 million people between the ages of 20 and 34 years old, which is the cohort most likely to rent a multifamily unit. The U.S. Census Bureau estimates that this cohort could increase by nearly 1.0% by 2032 — meaning an increase of more than 670,000 people in this age cohort in just a decade. This growth is one key reason we expect demand for

multifamily rental to continue over the long term. In the short term, a rise in new jobs is the other reason. Year-over-year job growth is expected to remain positive through at least 2026, according to Fannie Mae’s latest economic forecast. We expect the economy will add an estimated 4.5 million new jobs between 2024 and 2026. This should help keep new multifamily rental demand steady over the next few years.

Although there are currently more than 632,000 multifamily rental units slated for completion in 2025, we believe it is very unlikely that all those units will be completed before year end, due primarily to ongoing labor shortages and construction delays, notably permitting delays.

_______________________________________

From Cushman & Wakefield’s Quarterly Market Report:

2024 was a banner year for multifamily absorption. More than 436,000 units were absorbed – a 72% increase over 2023 and 56% above the 2017-2019 average. Every one of the 90 markets tracked by Cushman & Wakefield Research posted more net move-ins than move outs, with the Sun Belt continuing to lead in growth.

Construction risk is quickly diminishing. Construction activity has fallen 40% from its peak, with new starts down to just 230,000—the lowest level since 2012. High interest rates, weaker effective rent growth, and rising replacement costs continue to hinder new development. Most apartments slated for delivery by 2028 have already broken ground, setting the stage for a tighter supply environment over the next three to four years.

_________________________________________

From Colliers’ Quarterly Market Report:

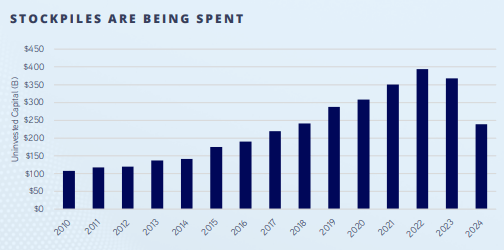

Investors are coming back to the multifamily market with a vengeance. Volume increased by a healthy 22% in 2024, leading all asset classes. Consistent monthly activity indicates the market has turned a corner. Investors are intrigued by the confluence of peaking supply-side pressure, limited new groundbreakings due to elevated borrowing costs, and the high cost of homeownership, keeping renters renewing at historically high levels. This results in a path to rent growth in the quarters ahead. Additionally, many deals are being done below replacement costs, and capital is coming off the sidelines.

Investors are deploying their capital stockpiles, and there is no reason to suggest that multifamily won’t receive its fair share. Timing is important, and with signs of brighter days ahead, expect investors to continue chasing multifamily assets in 2025.

_____________________________________________

US Producer Prices rose 3.5% over the last year, the biggest increase since February 2023.

_____________________________________________

After this month’s hot inflation data and strong jobs growth, the market is not pricing in any Fed rate cuts until 2025.

_____________________________________________

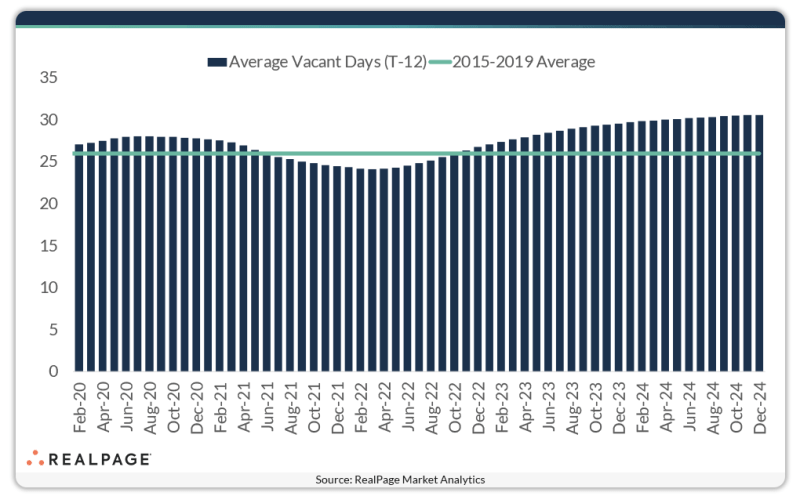

The Average Number Of Days A Unit Is Vacant Has Climbed Above The Pre-Pandemic Level:

With the delivery of more than one million new market-rate multifamily units over the last two years, renters now have more options to choose from than ever before. That has softened occupancy rates and resulted in units sitting vacant for longer. The average number of days a stabilized unit sits vacant before a new tenant moves in is nearly five days longer than it was on average in the five years prior to 2020.

The variance to historic levels may seem miniscule, but extended vacancy works out to an additional $275 per unit in expenses and turnover costs (based on current average. U.S. effective rent of $1,818 as of January 2025). With more than half a million stabilized units unoccupied, the additional impact to property operations quickly adds up.

____________________________________

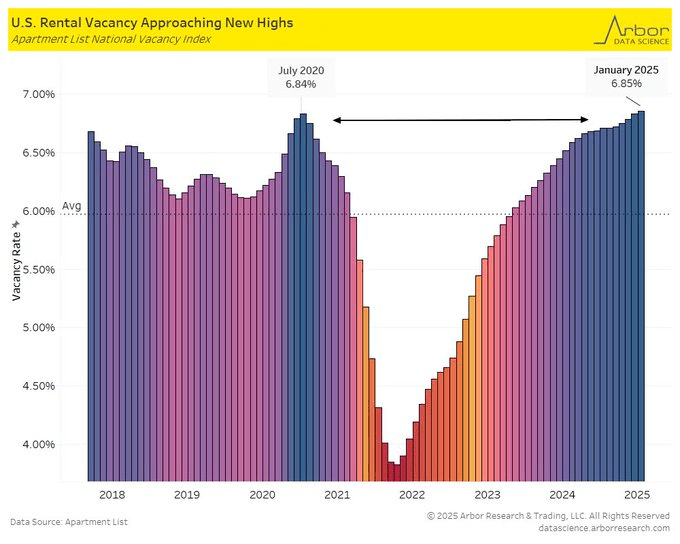

U.S. rental vacancy rate from ApartmentList has surpassed the July 2020 peak, up to 6.85%:

Truflation data is forecasting a steep decline coming in bond yields:

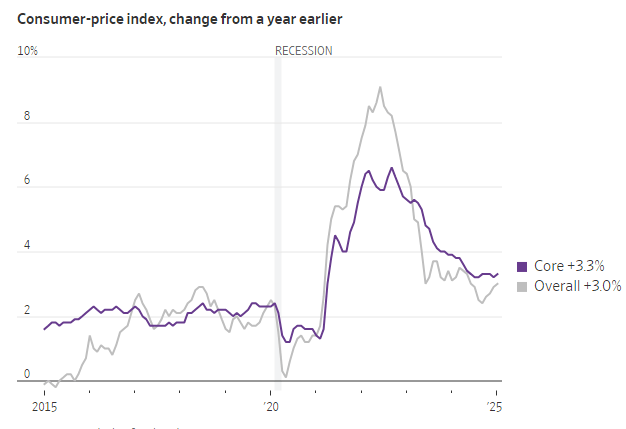

Monthly CPI (Consumer Price Inflation) Report – Release date 2/12/25

_______________________________________________

There were only $12 billion in total 1031 exchanges last year, the lowest since $9 billion in 2012. The chart below shows multifamily 1031 exchanges ($4 billion in 2024):

__________________________________________

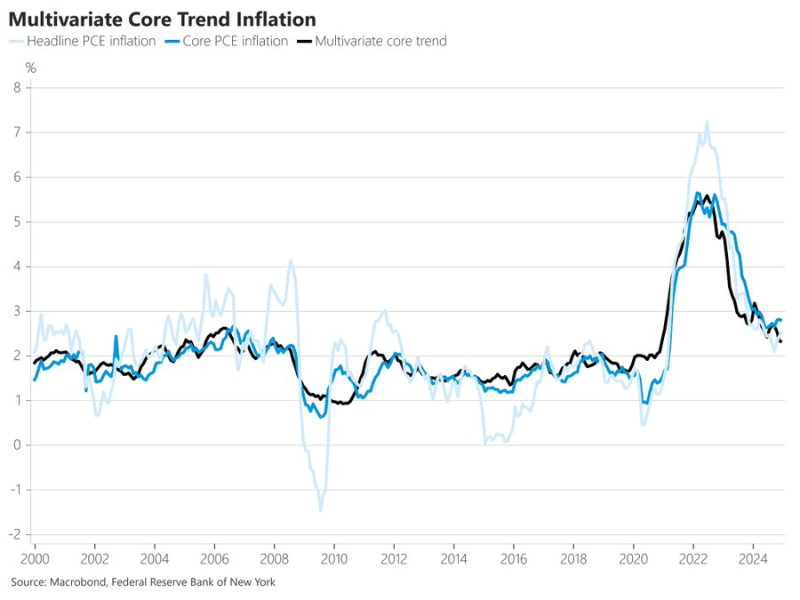

The NY Fed’s measure of inflation persistence (the “multivariate core trend”) fell to 2.3% in December, the lowest level in four years. Almost all of the overshoot relative to the pre-pandemic average comes from non-housing services.

___________________________________

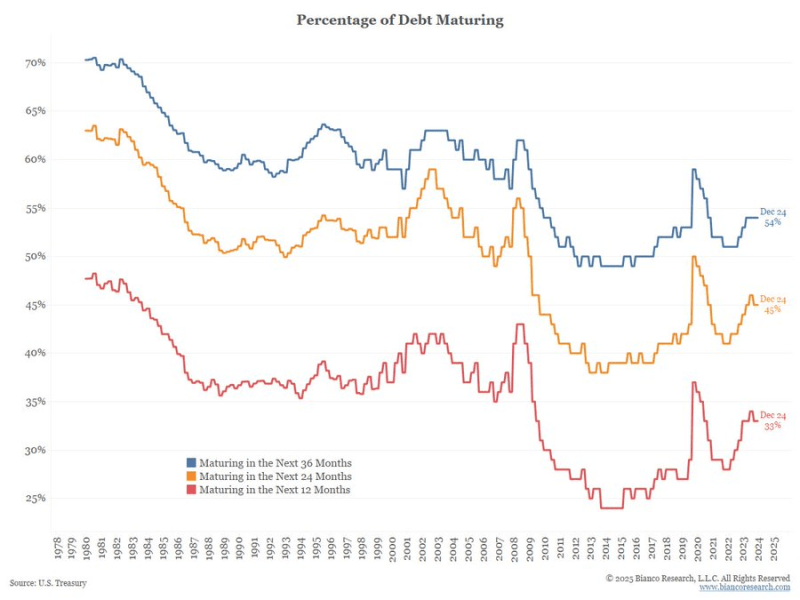

There’s been a fear cycle in the media recently talking about how 1/3 of the federal debt needs to be refinanced in the next year (and how this will negatively impact treasury yields). In reality, 1/3 of the debt always needs to be refinanced in the next year and about half always needs to be refinanced in the next 3 years. See below going back to the late 70’s:

____________________________________

The number of 1-person households continues to rise in the United States. Obviously, 1 person living alone has a far lower need to move out of an apartment to purchase a home.

________________________________

For the past year and a half, smaller apartment markets have garnered stronger rent growth than their large market counterparts. At the end of 2024, the annual change in effective asking rents among the nation’s largest 50 apartment markets (except New York) registered essentially flat at just 0.1%. Among smaller markets with an apartment base of about 24,000 units to just over 100,000 units, rent growth was considerably stronger at 1.4%.

This trend has been consistent since about mid-2023. While stronger rent growth among smaller markets can be inspired by lower inventory growth rates, the more likely scenario is that these markets are less likely to see drastic fluctuations in performance. Smaller markets display more resilience during hard times, missing the declines seen in bigger markets. At the same time, smaller locales don’t benefit from the same upside as larger markets during good times, either.

______________________________________

From this week’s Pensford Letter (2/3/25):

_____________________________________

The monthly Job Openings and Labor Turnover Survey (JOLTS) – released 2/4/25:

____________________________________