The Federal Reserve’s Interest Rate Decision, Statement & Press Conference – 3/19/25

The most significant part of the Fed’s statement is the reduction in the “redemption cap” on Treasury securities from $25 billion to $5 billion. This refers to the pace at which the Fed allows its balance sheet to shrink.

When Treasury securities on the Fed’s balance sheet mature, the Fed has a choice between doing nothing (a form of monetary tightening) or rolling over the position by buying new securities (a form of monetary ease or QE). By lowering the cap, there will be more rollovers and less balance sheet reduction. That is a dovish move that indicates monetary easing – a backdoor form of QE or even a rate cut.

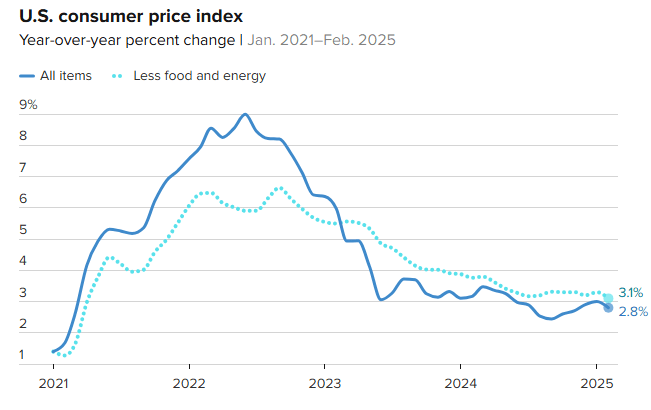

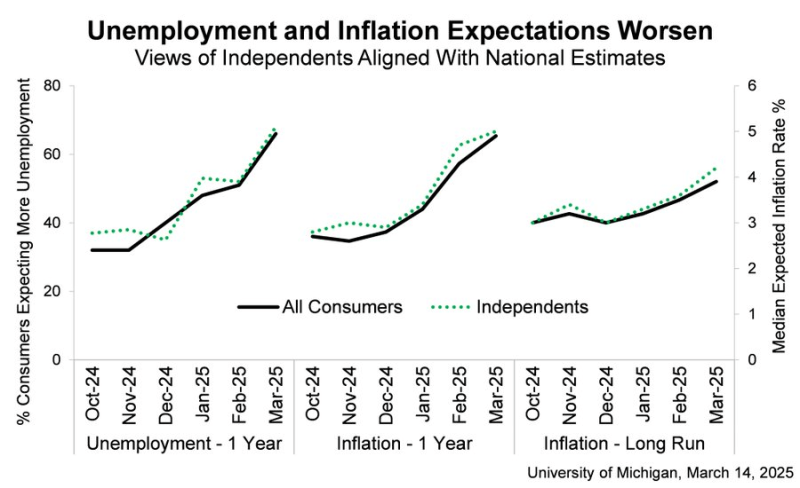

The Fed lowered its inflation expectations and reduced its 2025 U.S. growth forecast from 2.1% to 1.7%. They also kept the unemployment forecast unchanged. Taken in combination with the decision to reduce the run-off in the balance sheet, this is a slightly dovish turn of events. It certainly strengthens the case for a rate cut at the Fed’s next meeting on May 7.

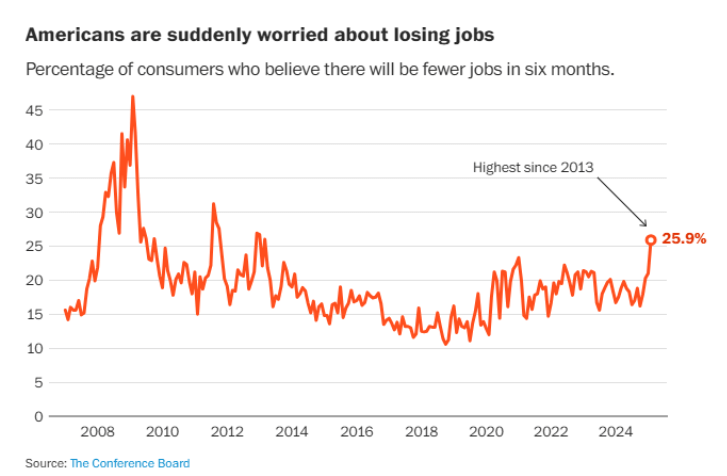

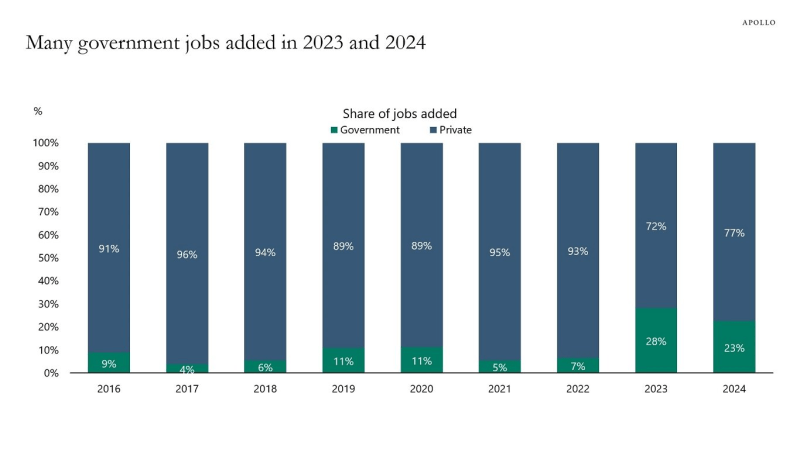

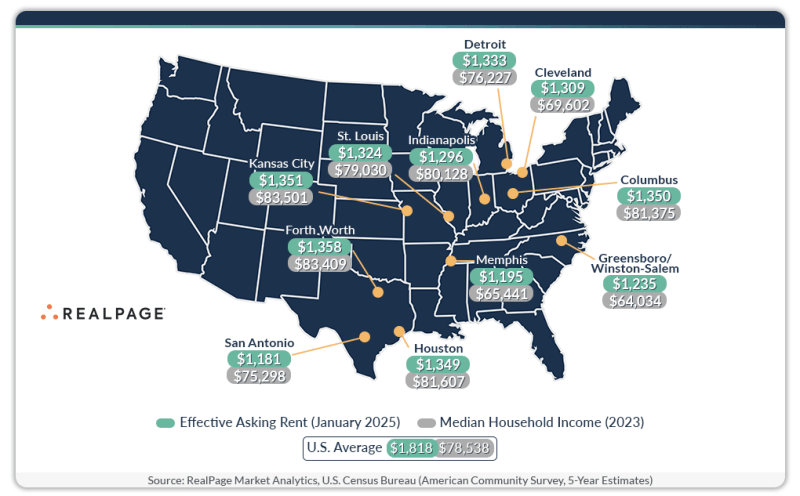

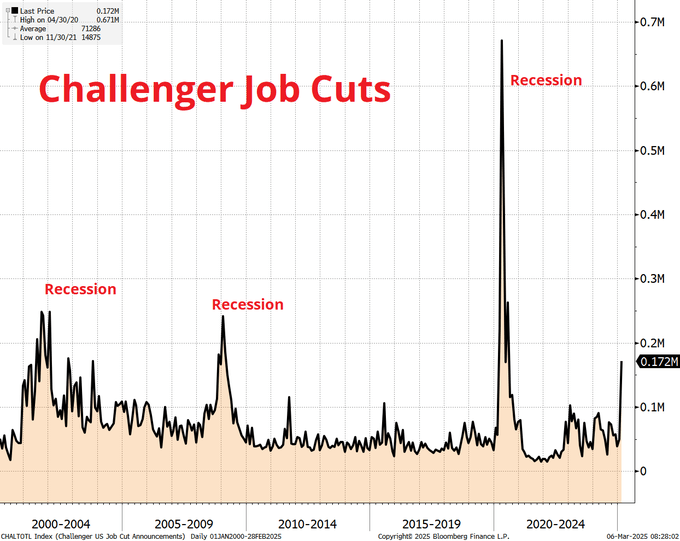

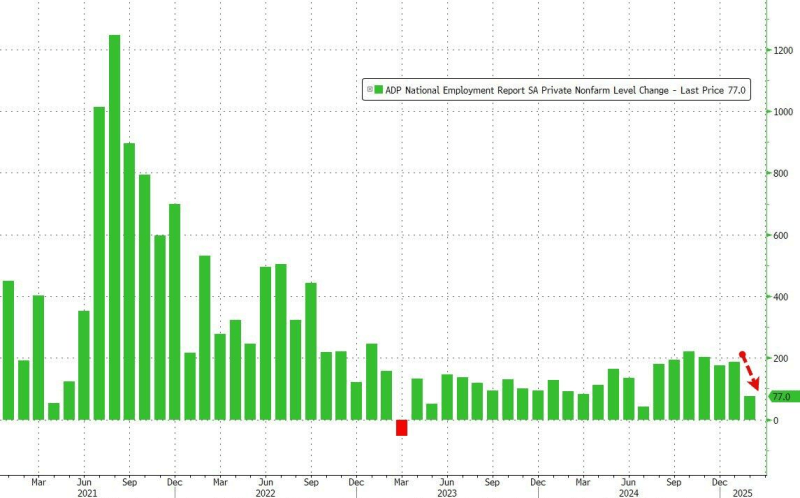

The U.S. unemployment rate hit an interim low of 3.4% in January 2023. From there, it rose to 3.9% in February 2024 then 4.2% in July 2024. Today, the unemployment rate is 4.1%, down slightly from last July but up significantly from January 2023. the labor situation and prospects for growth are worse than the headlines indicate. The household survey, a Labor Department survey different than the employer survey used to calculate the official unemployment rate, showed significant job losses in February. The number of employed individuals per the household survey dropped by 588,000. The Labor Force Participation Rate (total employed divided by total workforce) also dropped from 62.6% to 62.4%.

Major U.S. companies are issuing warnings that earnings in the first quarter will not meet expectations. Walmart, Best Buy, Target, Kohl’s, American Airlines and Delta Airlines are among those who have revised earnings and revenue forecasts downward. These and other developments point in the direction of higher unemployment and slower growth (if not recession).