Source: Jay Parsons

Source: Jay Parsons

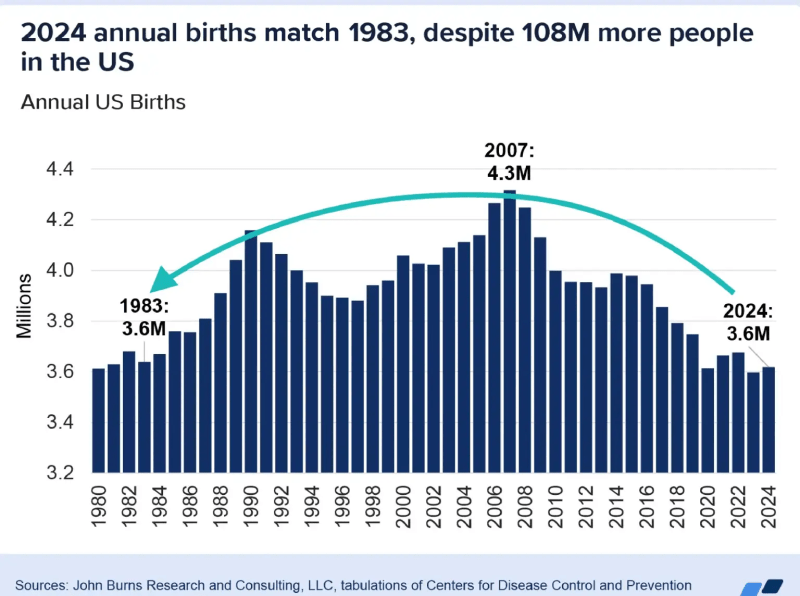

3.6 million babies were born in 2024, down from the peak of 4.3 million in 2007, marking a 40-year low. This is especially significant because the US population has grown by approximately 108 million people since 1983.

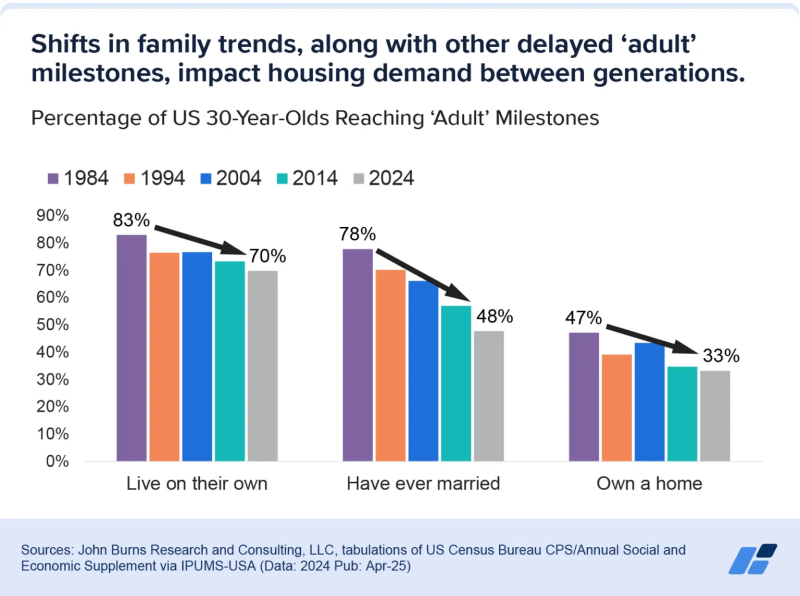

Changes in family formation are part of a broader trend where major life events happen later. Among today’s 30-year-olds:

These shifts didn’t just start recently. Each generation since the baby boomers has reached these milestones later than the previous one.

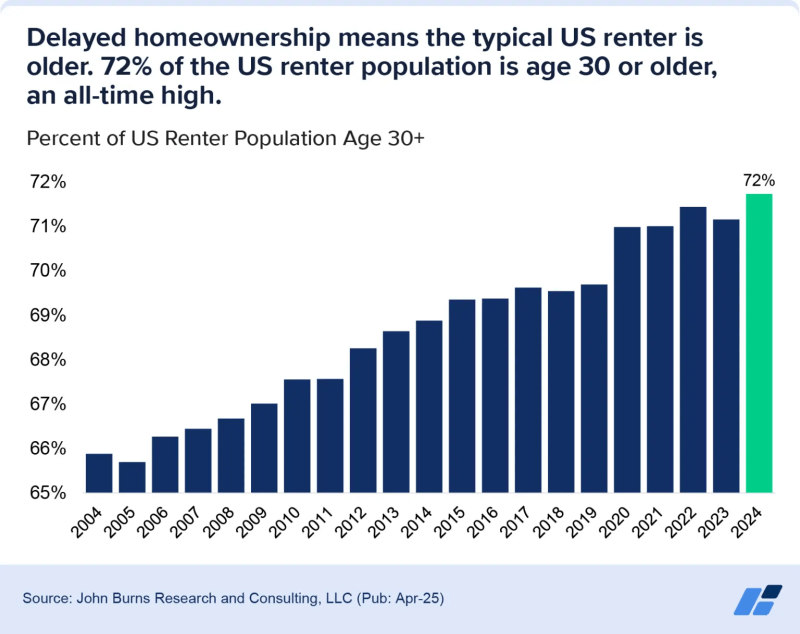

Americans are waiting significantly longer to purchase homes. The typical first-time homebuyer is now 38 years old, compared to 33 in 2020 and an average of 31 between 1993 and 2018. This delayed homeownership creates increased rental demand, with 72% of US renters now age 30 or older—an all-time high.

Source: John Burns Research

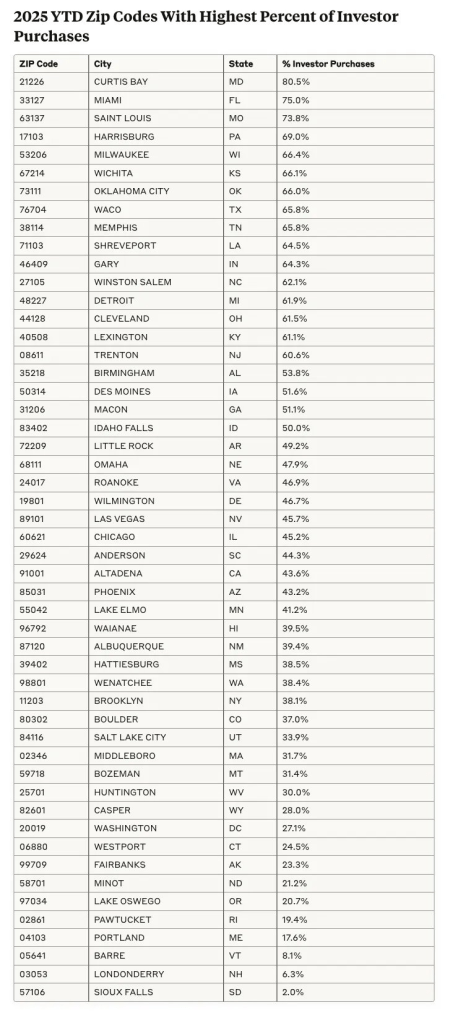

Winston-Salem is the only city in North Carolina with a zip code that made the list.

Source: Gavin Campbell

Source: Jay Parsons

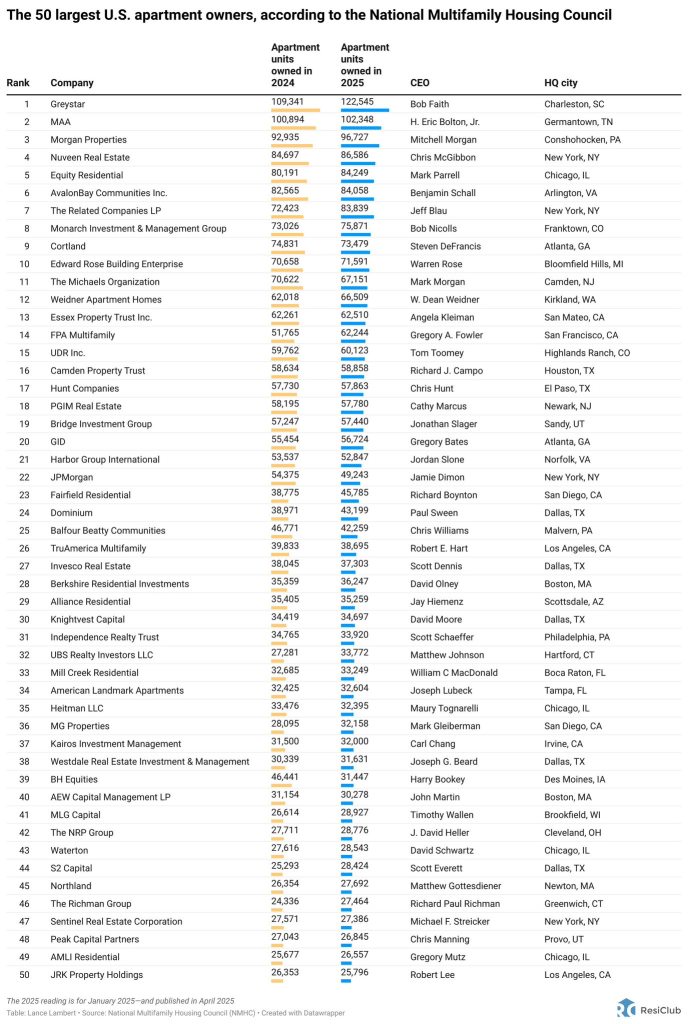

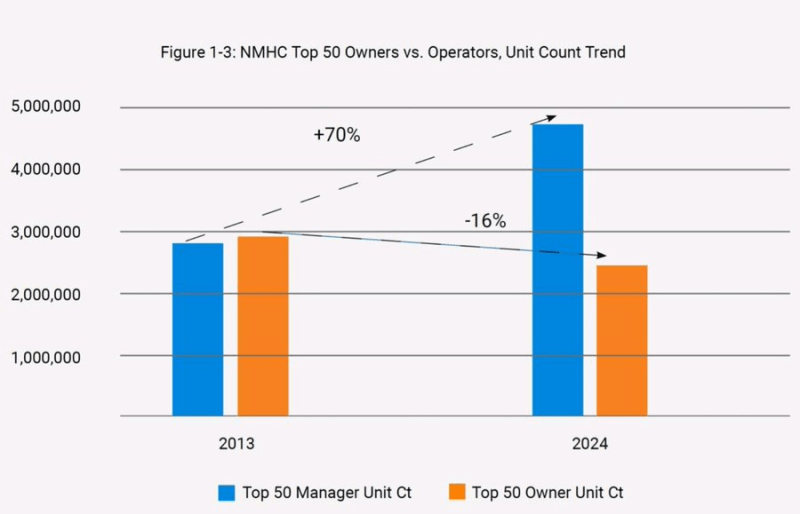

It’s interesting to note that while the largest apartment owners actually have fewer units than they did 11 years ago, the largest third-party property managers have growth the number of units they manage significantly.

Source: Jay Parsons

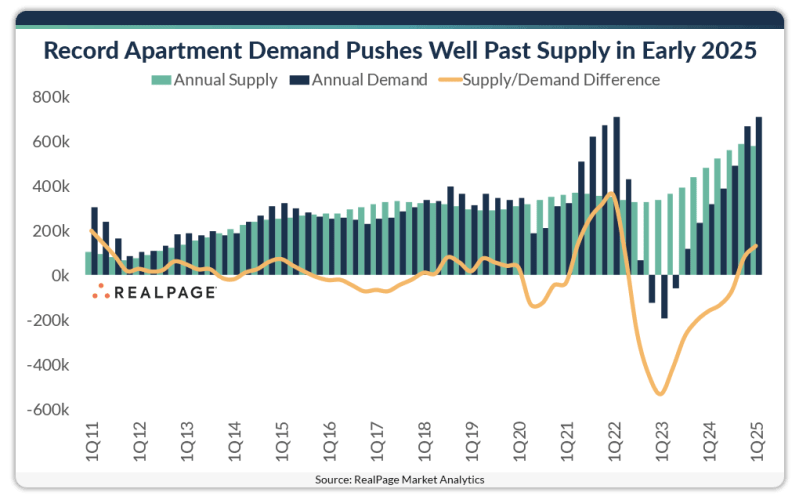

Source: RealPage

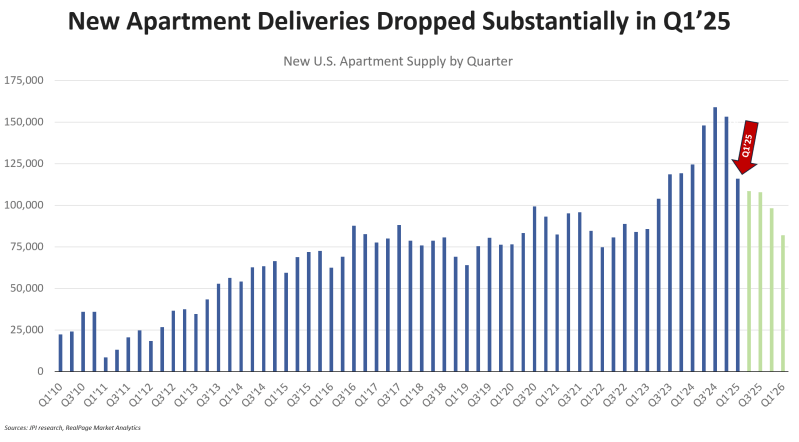

A little over 576,700 units were delivered in the year-ending 1st quarter 2025. That was slightly below the all-time peak of 585,200 units from calendar 2024. From this point on, delivery volumes are scheduled to drop off for the next few years as developers wrap up the current pipeline of projects.

Annual supply is scheduled to drop to about 431,200 units by the end of 2025. After that, deliveries are expected to fall off even further, returning to more historic norms by 2026 if current construction timetables hold.

Source: RealPage

Americans need to earn $116,633 per year to afford the median priced home for sale. That’s 81.8% more than the $64,160 they need to afford the typical apartment for rent—and the gap has been widening.

The cost of buying a home is rising faster than the cost of renting, which is why there’s a growing gap between the income someone needs to afford their own home versus an apartment. The median home-sale price rose 4.5% year over year to $423,892 in February, and has been growing at roughly that pace for months.

The typical U.S. household earns an estimated $86,382—roughly $30,000 less than the income required to afford the typical home for sale. Meanwhile, the median asking rent rose just 0.2% year over year.

Source: Redfin

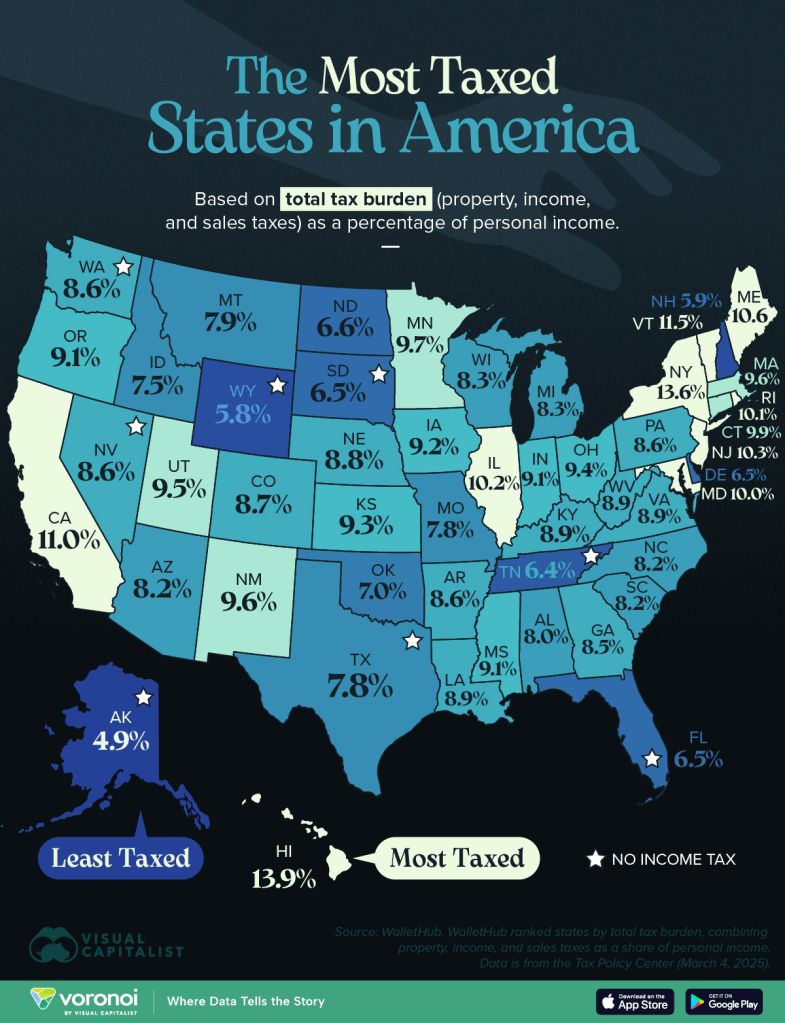

| 1 | Hawaii | 13.9% |

| 2 | New York | 13.6% |

| 3 | Vermont | 11.5% |

| 4 | California | 11.0% |

| 5 | Maine | 10.6% |

| 6 | New Jersey | 10.3% |

| 7 | Illinois | 10.2% |

| 8 | Rhode Island | 10.1% |

| 9 | Maryland | 10.0% |

| 10 | Connecticut | 9.9% |

| 11 | Minnesota | 9.7% |

| 12 | New Mexico | 9.6% |

| 13 | Massachusetts | 9.6% |

| 14 | Utah | 9.5% |

| 15 | Ohio | 9.4% |

| 16 | Kansas | 9.3% |

| 17 | Iowa | 9.2% |

| 18 | Indiana | 9.1% |

| 19 | Mississippi | 9.1% |

| 20 | Oregon | 9.1% |

| 21 | Louisiana | 8.9% |

| 22 | Kentucky | 8.9% |

| 23 | Virginia | 8.9% |

| 24 | West Virginia | 8.9% |

| 25 | Nebraska | 8.8% |

| 26 | Colorado | 8.7% |

| 27 | Nevada | 8.6% |

| 28 | Washington | 8.6% |

| 29 | Arkansas | 8.6% |

| 30 | Pennsylvania | 8.6% |

| 31 | Georgia | 8.5% |

| 32 | Wisconsin | 8.3% |

| 33 | Michigan | 8.3% |

| 34 | Arizona | 8.2% |

| 35 | North Carolina | 8.2% |

| 36 | South Carolina | 8.2% |

| 37 | Alabama | 8.0% |

| 38 | Montana | 7.9% |

| 39 | Missouri | 7.8% |

| 40 | Texas | 7.8% |

| 41 | Idaho | 7.5% |

| 42 | Oklahoma | 7.0% |

| 43 | North Dakota | 6.6% |

| 44 | Delaware | 6.5% |

| 45 | Florida | 6.5% |

| 46 | South Dakota | 6.5% |

| 47 | Tennessee | 6.4% |

| 48 | New Hampshire | 5.9% |

| 49 | Wyoming | 5.8% |

| 50 | Alaska | 4.9% |

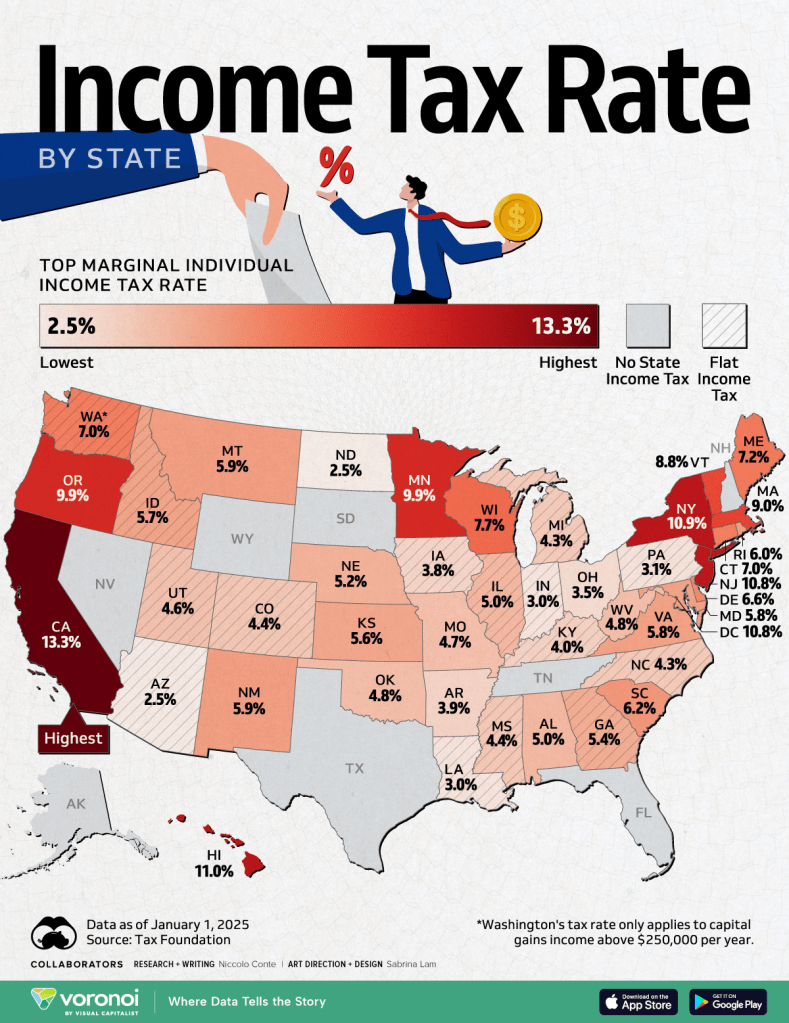

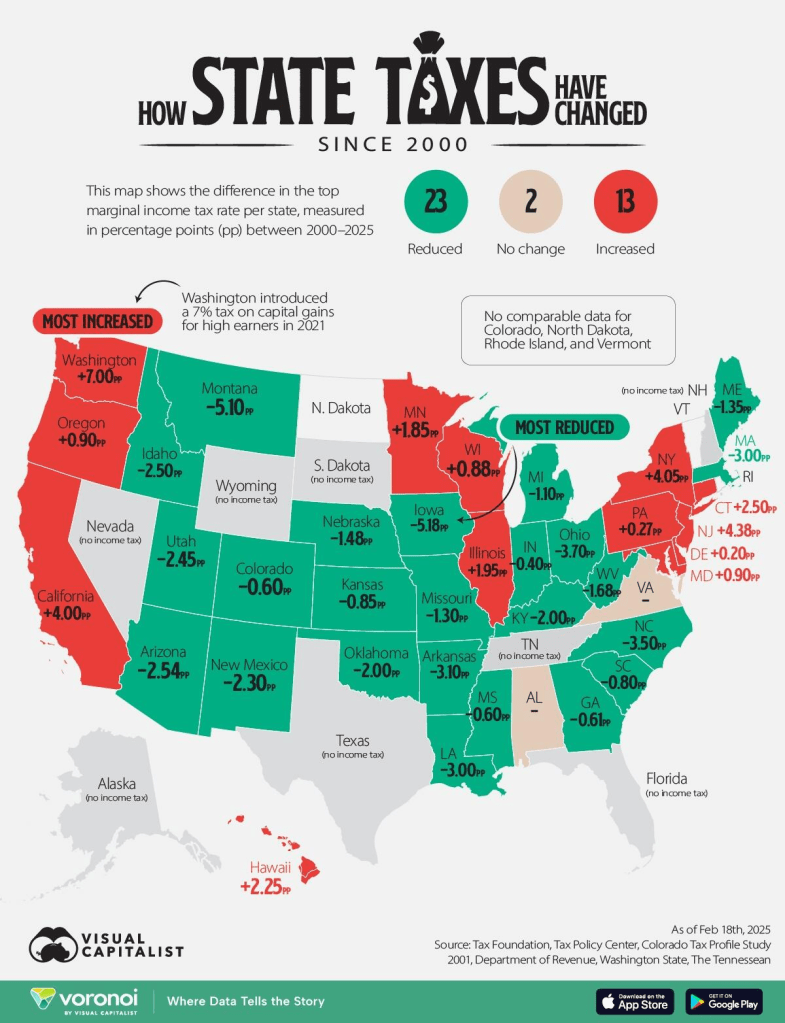

The graphic below shows how state income taxes have changed between 2000 and 2025. The gray states have no taxes. Changes are not compared for four states (Rhode Island, Vermont, North Dakota, and Colorado) since their 2000s tax rates were charged as a percentage of federal liabilities owed. As a result, they have been grayed out on the map

And the highest marginal income tax by state, shown below: