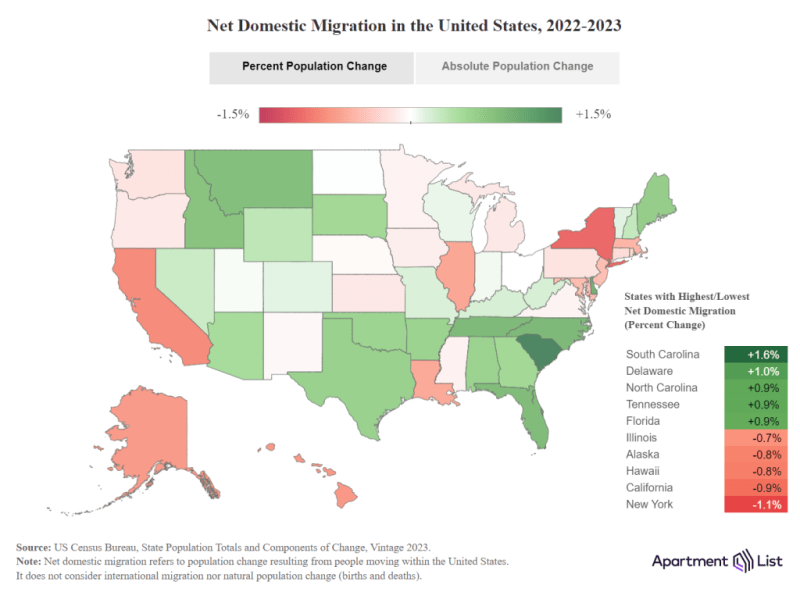

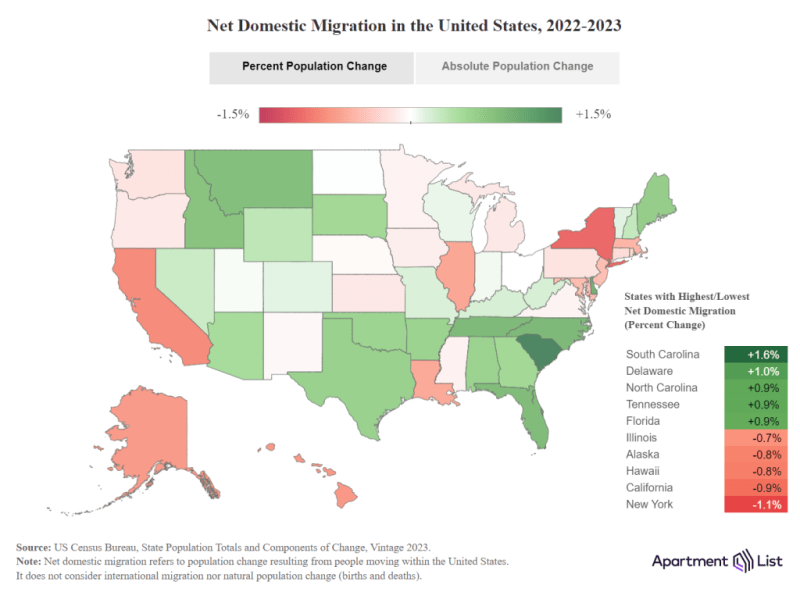

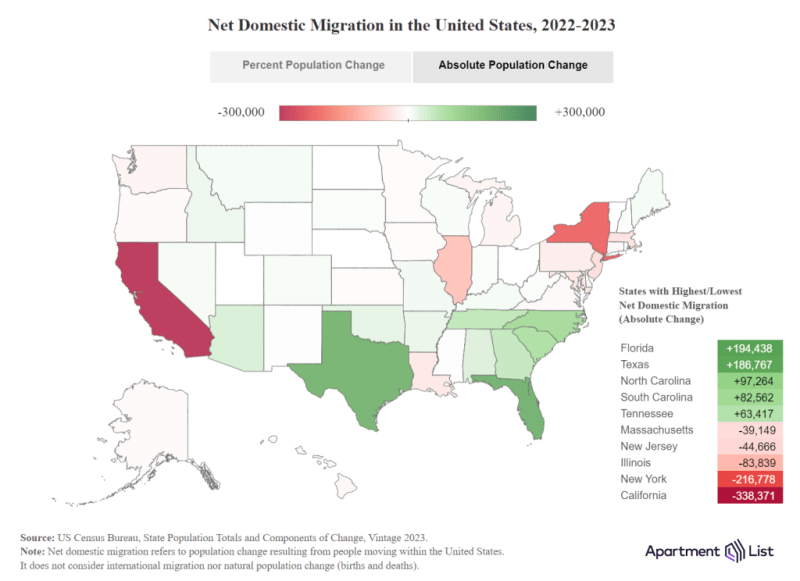

South Carolina experienced the highest annual percentage growth in population and North Carolina ranked third.

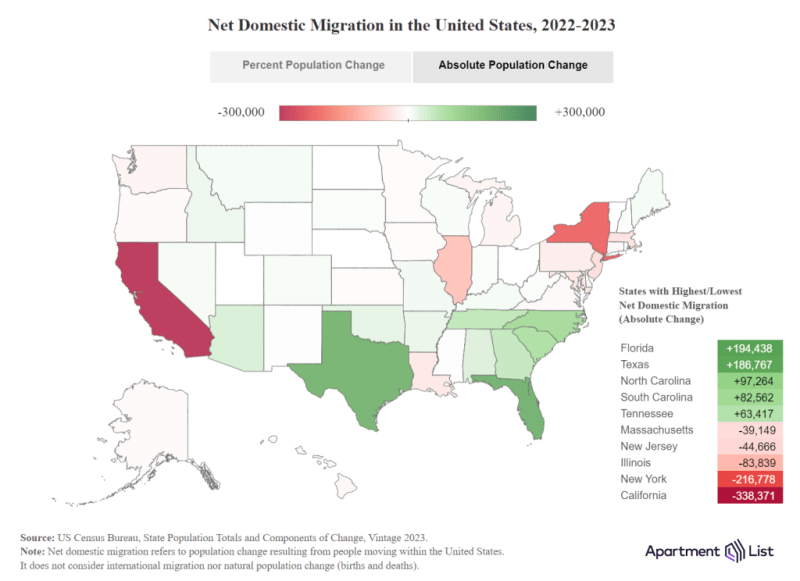

Based on total population change, North and South Carolina were in the top four:

South Carolina experienced the highest annual percentage growth in population and North Carolina ranked third.

Based on total population change, North and South Carolina were in the top four:

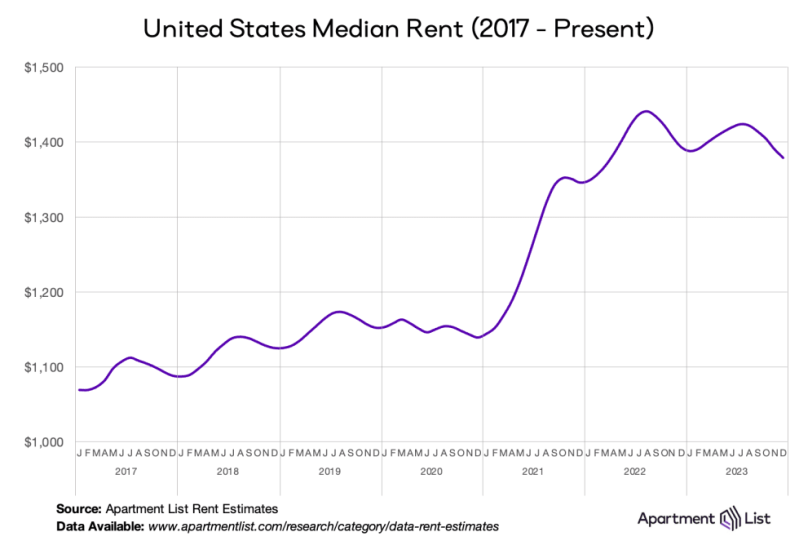

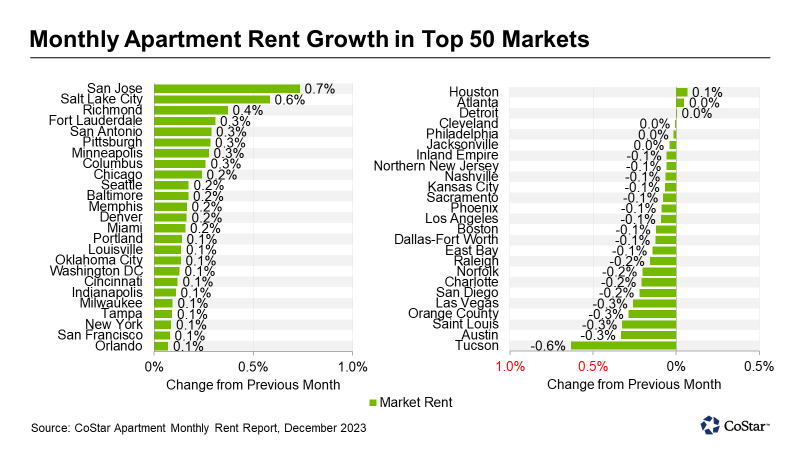

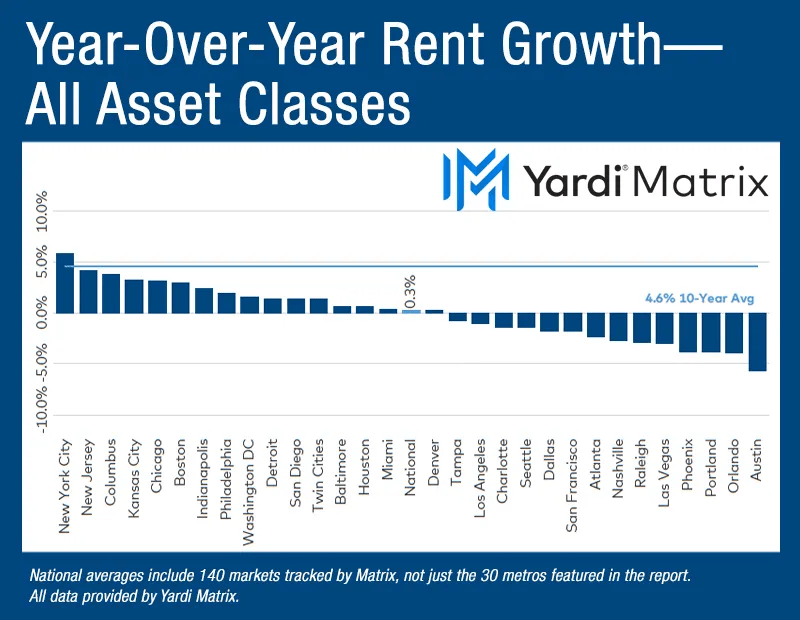

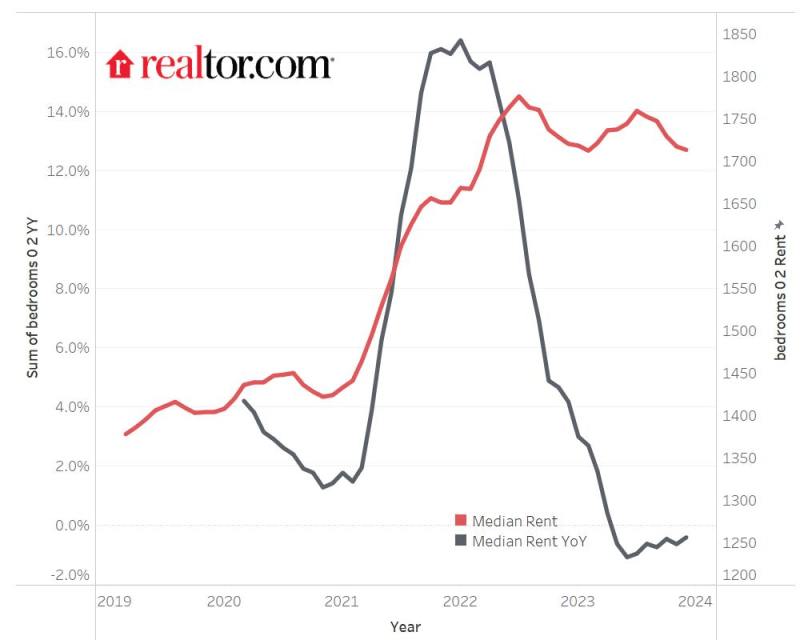

Monthly and annual rent changes through December:

| Source: | Month: | Monthly: | Annual: | Vacancy: |

| Apartment List | December | -0.80% | -1.00% | 6.50% |

| CoStar | December | 0.04% | 0.79% | 7.43% |

| Apartments Advisor | December | 0.12% | -3.03% | N/A |

| Apartments.com | December | 0.00% | 0.80% | 7.50% |

| Redfin | December | -0.20% | -0.80% | N/A |

| Zillow Single Family | December | -0.20% | 3.30% | N/A |

| Zillow Multifamily | December | -0.30% | 2.70% | N/A |

| Yardi Matrix | December | -0.23% | 0.30% | N/A |

| Rent.com | December | -0.11% | -0.78% | N/A |

| Realtor.com | December | -0.23% | -0.40% | N/A |

| Average: | -0.19% | 0.19% | 7.14% |

The National Multifamily Housing Council conducted a survey on tenant fraud and the results were alarming. 93.3% of owners reported experiencing fraud in the past twelve months and 70% said the cases are increasing. Within that group:

Respondents were required to write off an average of nearly $4.2 million in bad debt and a quarter (24.5%) of this bad debt, on average, could be attributed to nonpayment of rent due to fraudulent applications.

“There are entire online (tenant) communities that collaborate to discuss fraud,” said Daniel Berlind, who runs Snappt (a company that helps landlords identify fraud) as well as his own real estate firm, Berlind Properties. “There are videos on TikTok that have millions of views, showing how to edit documents. There are entire forums on Reddit that discuss properties and lease-up, what their concessions are and literally give walkthrough guidance to would-be fraudulent applicants and how they can circumvent the process.”

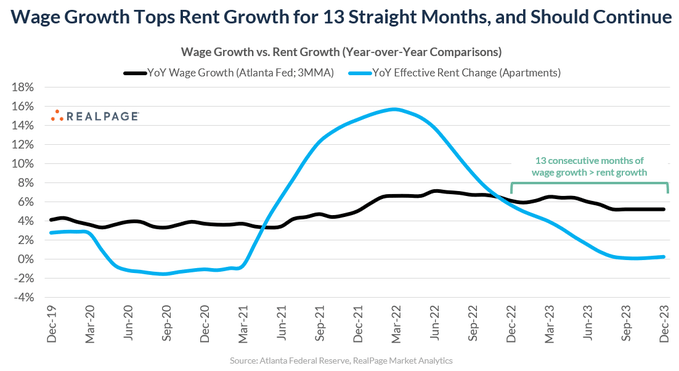

Wages have outpaced rent growth for 13 consecutive months. This trend is likely to persist in the near term helping to balance the massive rent outperformance in 2021.

In addition, wages rising by 4% have a much greater impact than rents rising by 4%. Why?

The median income in the United States is $59,540. A 4% increase is $2,316. If you subtract out a third for state and federal taxes, that leaves you with a $1,529 take home gain.

The median multifamily rent is $1,379 or $16,548 annually. A 4% increase is $662. If both wages and rents rise by 4% then the wage earner is gaining $867 annually ($1,529 – $662).

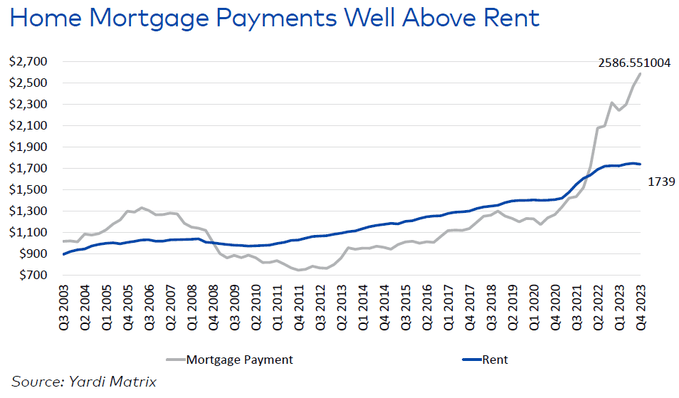

However, wages are currently rising by over 4% annually while rents are flat and falling:

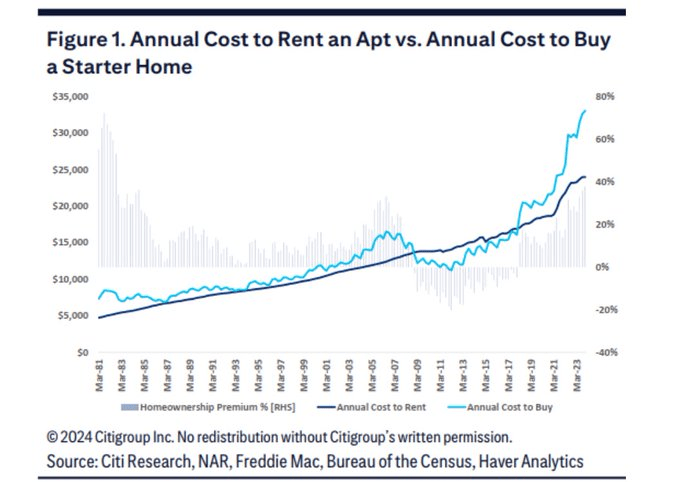

The delta exists even when looking at only starter homes:

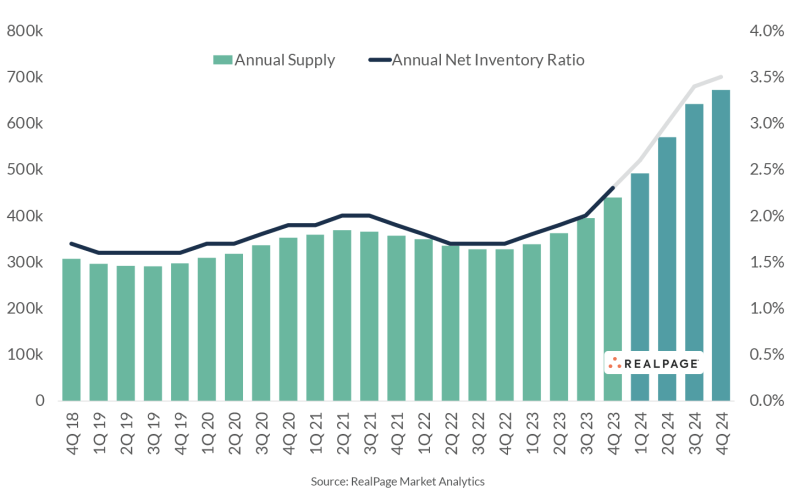

There were 440,000 multifamily units delivered in 2023 with 670,000 expected in 2024. This is the year when the new supply relative to current inventory will rocket higher:

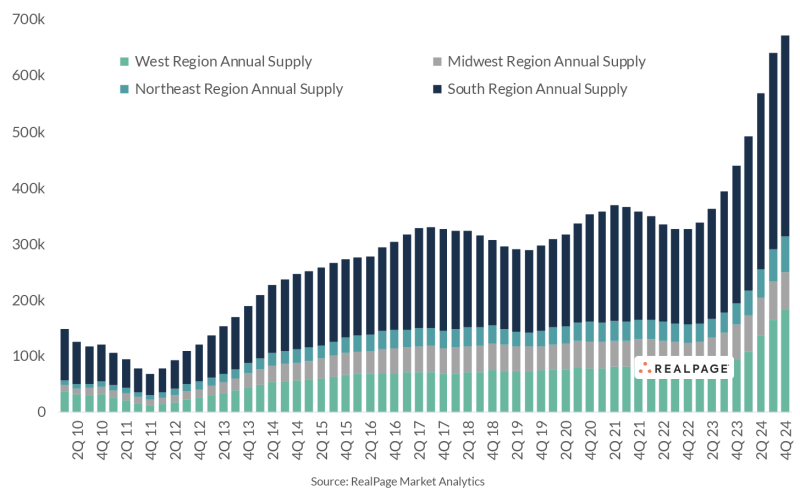

The south region is contributing over 50% of the new supply:

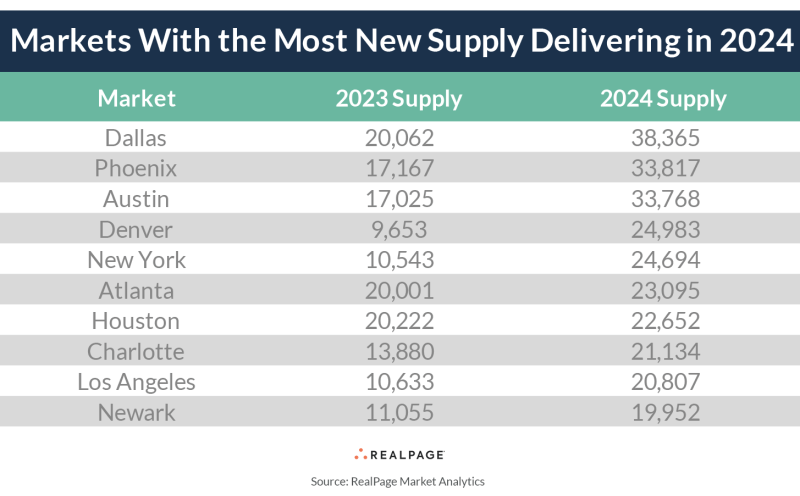

The major supply markets of 2023 will experience a tidal wave in 2024:

The following are the top 20 markets for new supply in 2023 relative to the size of their current inventory. All 20 of these markets were ranked in the top 22 for net absorption (demand). The supply/demand battle will be one to keep a close watch on as we move forward.

48% of Americans don’t own a home (36% rent and 11% live at home with their parents or other family members).

Due to the surge in rental costs over the past few years, about 25% of renters say they can no longer afford to make the payment, and they will have to move in with their family or friends.

For those who are able to remain in their current housing, 21% say they’re dependent on money from their family to do so – especially millennials and Gen Z (31% and 25%, respectively).

From the summer of 2022 to the summer of 2023, the U.S. population grew by 1.6 million people, with 1.4 million of them—almost 87%—in the South, according to U.S. Census Bureau estimates. But Mississippi essentially missed out on that growth. It gained just over 750 residents during the same period.

This October, according to U.S. Bureau of Labor Statistics data, Mississippi’s civilian labor force had shrunk 1.4% from what it was a decade earlier, even as the South’s workforce overall has grown exponentially.

Only about half of the graduates from Mississippi’s public universities work in the state three years after graduation. Many leave for growing metropolitan areas in other parts of the South. The state has had one of the highest poverty rates in the nation for years. About 12.6% of the state’s population under the age of 65 have a disability, compared with 8.9% overall in the U.S.

Troubles in the capital city of Jackson, the largest city, have pushed many to leave the state. Jackson has seen its population decline from 173,500 in 2010 to 146,000 in 2022, according to Census estimates.