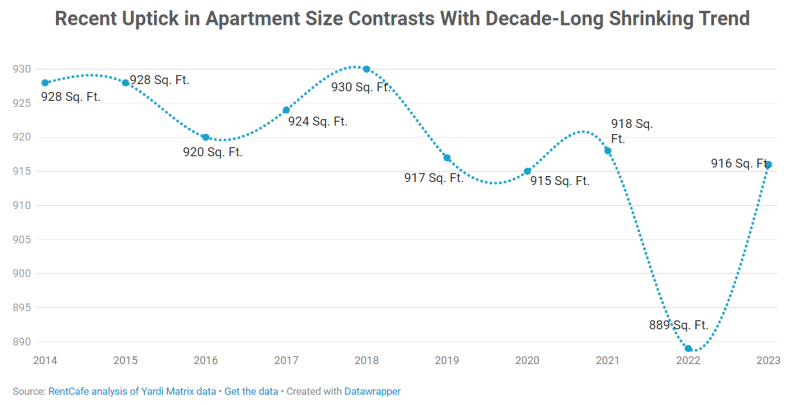

The average size of new apartments in the U.S. saw substantial growth in 2023, bouncing back to 916 square feet after a steep decline the previous year. This increase can be attributed to more spacious two- and three-bedroom apartments opening their doors last year as developers aimed to meet renters’ need for more space.

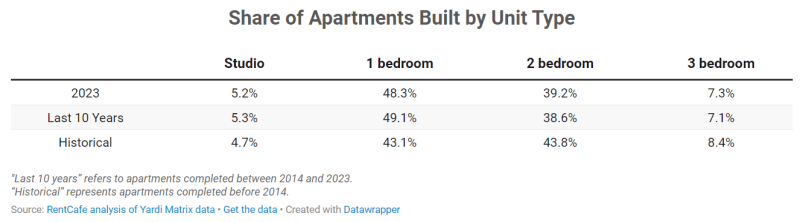

However, looking at what was built last year, one-bedroom apartments still dominated construction, comprising the largest share of new apartments (48.3%). This was also one of the factors that pushed down the average size of apartments in the last 10 years — a trend that persists despite the recent uptick.

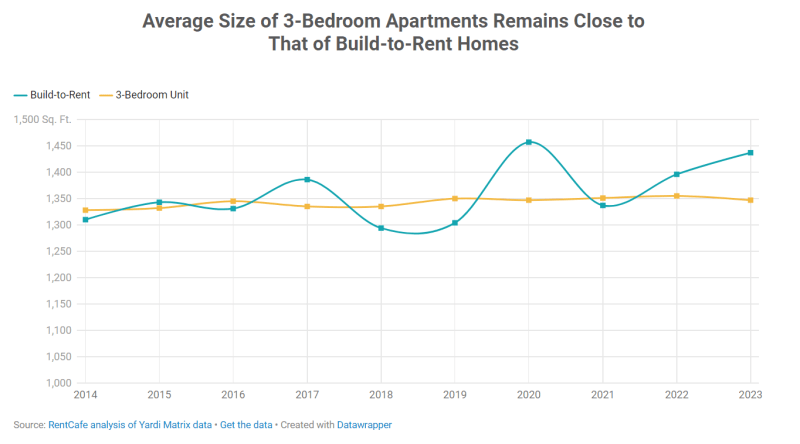

The average size of a single-family home for rent increased to 1,437 square feet in 2023. That’s 41 square feet more than the year before and second only to the numbers in 2020 (1,457 square feet).

Three-bedroom apartments have been steadily getting roomier and remain close to single-family homes for rent in terms of floor space and rent costs: The size of a build-to-rent house increased to more than 1,400 square feet in 2023 for an average rent of $2,096, while the norm for a three-bedroom unit was close to 1,350 square feet and $2,160 in monthly rent. This is why, in some locations, renters might find it more convenient to rent a house as opposed to a three-bedroom unit.

Source: RentCafe