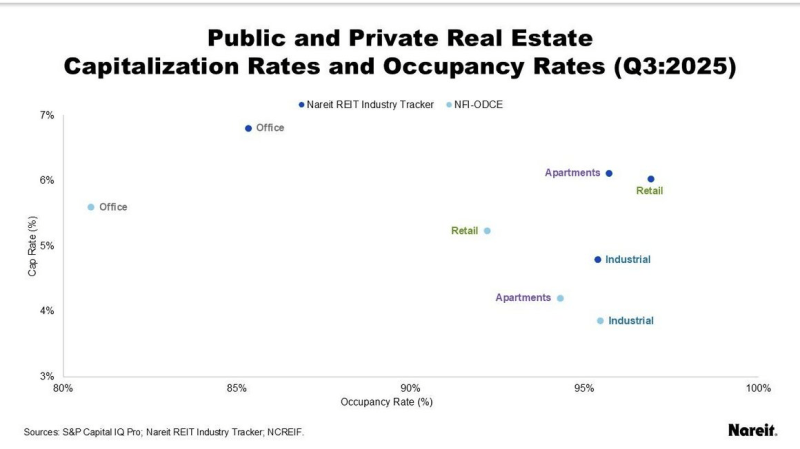

Publicly traded REITs (dark blue circles) currently have a higher occupancy and trade at a higher cap rate than private real estate (light blue circles) in the same category.

“I have less than 1 percent of my net worth outside of Berkshire, but basically I had that portion all in REITs. They were all small ones at that time. They were selling at discounts. At that time they were selling at discounts to the values of properties.”

– Warren Buffett 2005

“REITs are way more suitable for individual shareholders than for corporate shareholders. And Warren has enough residue from his old cigar-butt personality that when people became disenchanted with the REITs and the market price went down to maybe a 20% discount from what the companies could be liquidated for, he bought a few shares with his personal money. So it’s nice that Warren has a few private assets with which to pick up cigar butts in memory of old times – if that’s what keeps him amused.”

– Charlie Munger