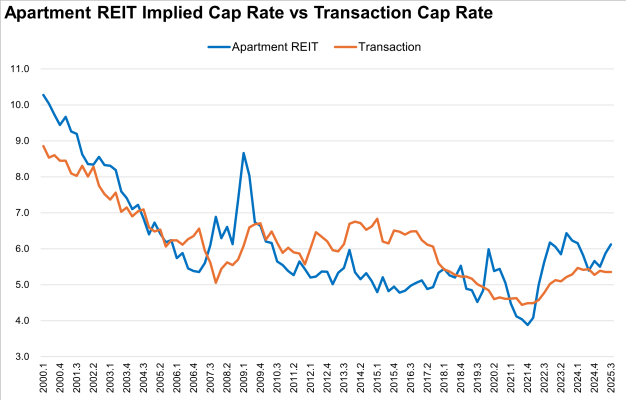

Since 2000, apartment REIT implied cap rates and private transaction cap rates have both averaged ~6.2%. REIT cap rates were lower 48% of the time, and higher 52% of the time. When REIT cap rates are higher, it generally means the stock trades at a discount to Net Asset Value (often determined using the transaction cap rate), implying the underlying real estate is more valuable than ownership of REIT shares.

Transaction cap rates were lower than REIT implied cap rates for most of the 2000s, however, REITs traded at a premium from 2010 through 2019 (5.2% vs 6.0%). Since 2022, REIT implied cap rates have come in 50 to 150 bps lower than transaction cap rates, translating to a significant NAV discount. The current 100 bp spread (6.5% vs 5.4%) translates to a ~20% REIT NAV discount for apartments overall.

When MAA sees an acquisition opportunity, say a mid-2010s vintage mid-rise in Dallas – they will likely need to pay a low 5 cap rate. They could instead use the cash to buy their own shares back at a 6.7% cap rate – quite the difference. Furthermore, they could choose to dispose of this asset (as they already own a few mid-2010s midrises in Dallas) at a low 5 cap and use the proceeds to buy back shares.

Source: Wes Stayton’s LinkedIn