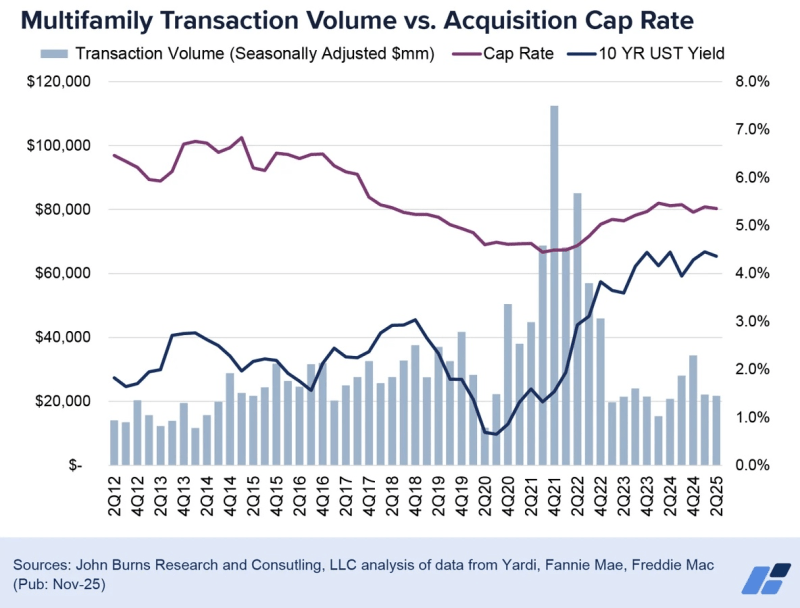

Trailing 4-quarter multifamily transaction volumes are 24% lower than 2018/2019 on a dollar basis and 42% lower on a unit basis.

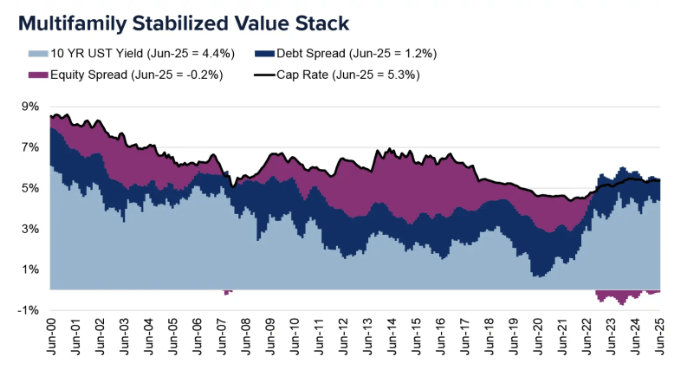

With stabilized cap rates sitting at 5.3 percent, well below the long-term average of 6.2 percent, owners are generally holding their properties rather than accepting reduced values in a murky pricing environment.

Cap rates are lower than interest rates for the eighth consecutive quarter, meaning debt is dilutive to cash flow upon acquisition. Expense growth has outpaced revenue growth since 2023, negatively impacting NOI growth.

Source: John Burns