The Federal Reserve’s Interest Rate Decision, Statement & Press Conference – 3/19/25

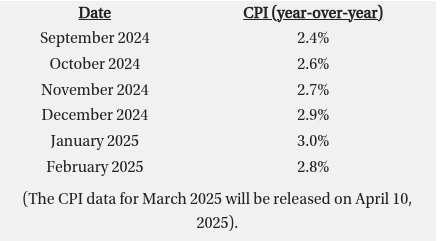

Inflation moving in the wrong direction: The trend reversed suddenly in October 2024 when inflation rose to 2.6%. It then rose further in November 2024 hitting 2.7% then rose again to 3.0% in January 2025, the highest rate since last July. The reading for February 2025 was 2.8%, (the latest data available).

From Powell: “A good part of [expected inflation] is coming from tariffs” and “inflation may be moving up due to tariffs.” Powell added that, “There are going to be tariffs and in the short-term they tend to bring inflation up.”

__________________________________

CRE & Multifamily Debt: Extend & Pretend Continues Into 2025

- Nearly half of all commercial real estate loan maturities expected to hit this year were pushed back from years prior as the extend-and-pretend game continues.

- Of the $957 billion in commercial real estate debt coming due in 2025, $348 billion was due last year and was pushed into 2025

- Multifamily represents the highest volume of extensions within all CRE sectors

- There’s an additional $663 billion in CRE debt that needs to be refinanced in 2026

___________________________________

The Rising Cost Of Insurance Continues To Challenge Multifamily Operations

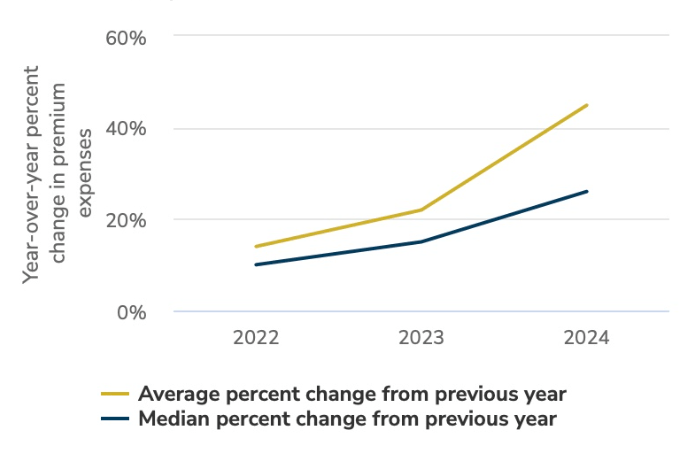

- Over 50 percent of the overall operating expense inflation for multifamily housing owners since 2020 can be attributed to increases in property insurance premiums.

- From 2021 to 2022, respondents reported an average annual premium increase of 14 percent, followed by 22 percent from 2022 to 2023, and a staggering 45 percent from 2023 to 2024. By 2024, property insurance premiums were, on average, double those in 2021.

- Rising property insurance costs are forcing owners to choose between increasing deductibles or reducing coverage to mitigate higher costs, leaving them vulnerable in the event of property damage.

- Owners are frustrated with the increasing number of coverage exclusions, indicating that fewer causes of damage are eligible for reimbursement. They are saying that there are so many exclusions that a new policy is like a book. You nearly need an attorney to read it to see if you actually have any coverage.

- Insurers most often tie premium increases to weather risks, claims histories, and buildings’ physical characteristics, explanations that survey respondents generally found unsatisfying.

- Rising insurance costs have particularly dire implications for affordable housing providers. They have less flexibility to raise rents to cover increasing insurance costs and often face stricter limits on rent increases due to funding requirements.

__________________________________________

A New Problem For Fractured Condo Investors: Insurance – 3/17/25

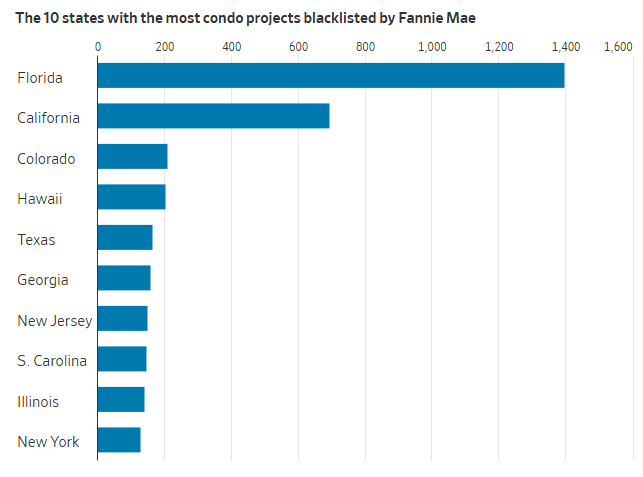

- Condominium owners across the country are facing a paralyzing problem: They can’t sell their properties because of a fast-growing and mostly secret mortgage blacklist.

- The blacklist is maintained by Fannie Mae and includes condo associations that the mortgage finance giant thinks don’t have adequate property insurance or need to make critical building repairs. Being on the list can make it harder for potential buyers to get a mortgage.

- Fannie Mae greatly expanded the list after the Surfside condo collapse in Florida in 2021 killed 98 people. Compounding the problem, a nationwide insurance crisis is making it more expensive for condo associations to afford adequate coverage.

- The number of properties that fail to meet Fannie Mae’s standards has risen to 5,175 this month from a few hundred before Surfside