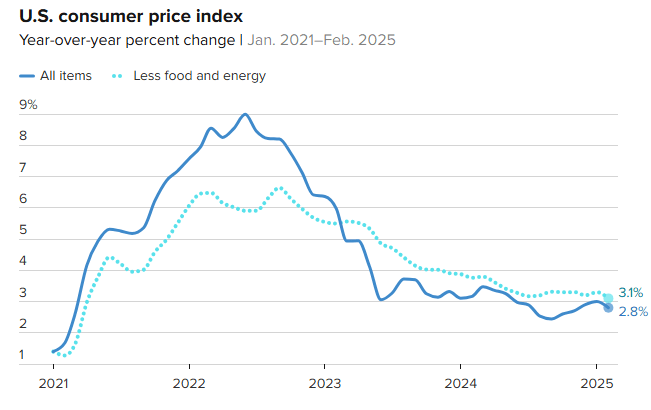

Monthly Consumer Price Inflation (CPI) Report – March 12, 2025

- Rose 0.2% on the month and 2.8% year-over-year, which were below expectations

- Core CPI (excludes food and energy) also rose 0.2% on the month and 3.1% annually, which were also below expectations

- What It Means: A lower-than-expected inflation print provides the Fed more room to cut rates in the months ahead if the employment market shows weakness

- CPI rent inflation (a notably lagged measure of rents) continues its rapid cooling and is now within just 36 basis points of pre-COVID norms.

- If you exclude rent/shelter inflation, headline CPI is already at 2.0% (the Fed’s target)

________________________________________

The government’s CPI data is for the month of February. The Truflation index is a private data company that measures inflation based on real-time inputs. It has shown a sharp decline starting at the end of February and is now down to only 1.32%:

__________________________________________

Apartment retention in February hit the highest level in 2.5 years. It was also the highest February retention rate in 15 years, behind only February 2022.

_______________________________________

Another reason why tenants are continuing to rent instead of trying to buy a home:

__________________________________

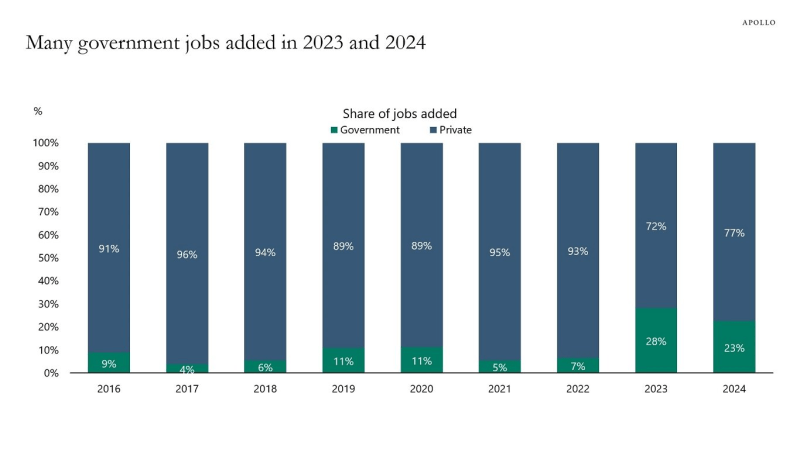

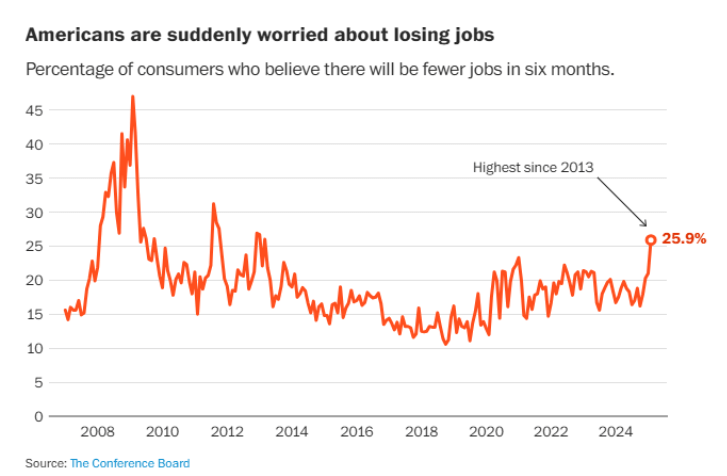

25% of jobs added in the US economy over the past two years were government jobs, up from 5% in 2021 and 7% in 2022. If hiring turns into net layoffs in 2025, it could severely impact the jobs market (leading to the Fed cutting interest rates faster than anticipated).