The Monthly BLS Jobs Report – March 7, 2025

- The unemployment rate rose 0.1% to 4.1%.

- The U6 underemployment rate rose sharply, by 0.5%, to 8.0%, its highest level since October 2021. Compared to the regular unemployment rate (called ‘U3″), the U6 rate includes:

- (1) people who want to work but haven’t looked for a job in the past 4 weeks

- (2) people who are working part-time but would prefer full-time work.

- Those who are not in the labor force but want a job now rose a sharp 414,000 to 5.9 million, the highest number in over three years.

- 151,000 new jobs were created (below expectations of 170,000), and this report only showed a decline of 11,000 federal workers. This likely means the majority of federal worker firings will come in the months ahead.

- What It Means: A weaker employment market makes the Fed more likely to cut interest rates.

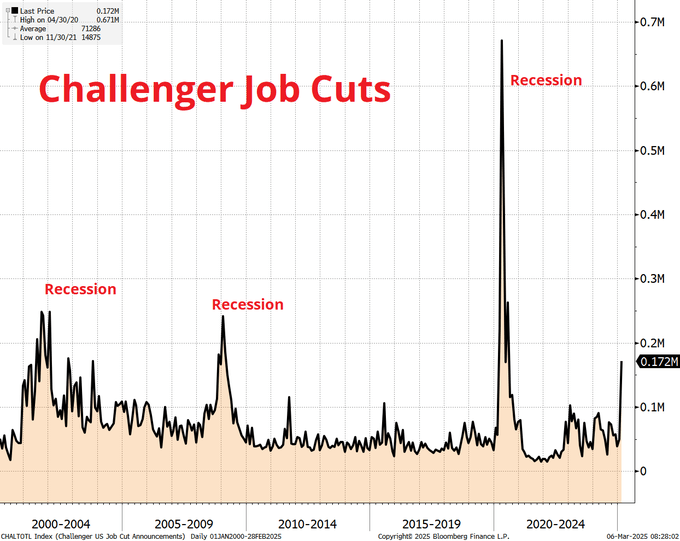

Challenger, Gray & Christmas Monthly Job Cuts Report – March 6, 2025:

- What It Is: Monthly report that tells us how many job cuts companies in the U.S. have planned.

- U.S. employers announced 172,017 layoffs for February, up 245% from January and the highest monthly count since July 2020 during the Covid panic. It marked the highest total for the month of February since 2009 during the global financial crisis.

- More than one-third of the total came from Elon Musk’s efforts to reduce the federal headcount. Challenger put the total of announced federal job cuts at 62,242.

- January’s planned reductions brought the total through the first two months of the year to 221,812, also the highest for the period since 2009 and up 33% from the same time in 2024.

- What It Means: Weak employment data will make the Fed more likely to cut interest rates in the coming months

_____________________________________________________

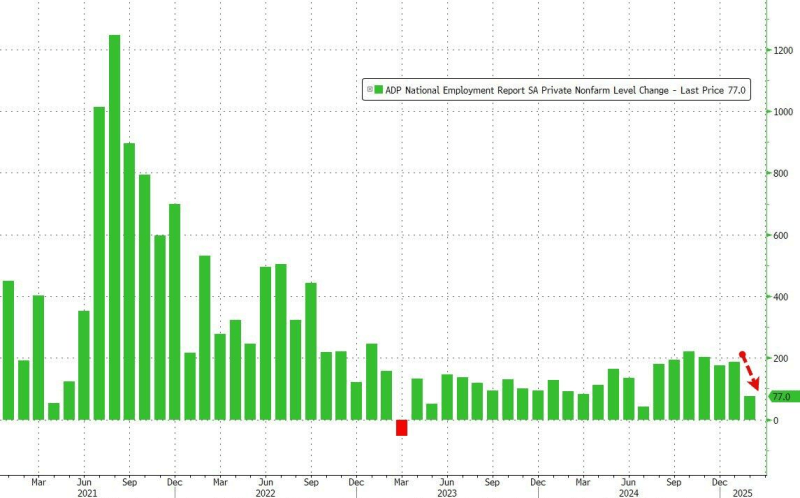

March ADP Jobs Report – Released March 5, 2025

- What It Is: Monthly report that gives an estimate of how many new jobs were added (or lost) in the private sector in the U.S. It’s put together by a company called ADP, which processes payroll for millions of workers.

- Private employers only added 77,000 jobs in February on expectations of 148,000

- From ADP’s Chief Economist: “Policy uncertainty and a slowdown in consumer spending might have led to layoffs or a slowdown in hiring last month. Our data, combined with other recent indicators, suggests a hiring hesitancy among employers as they assess the economic climate ahead.”

- What It Means: A weaker payroll report makes the Fed more likely to cut interest rates in the coming months

_____________________________________

- Truflation: What Is It? Truflation is a platform that tracks inflation (the rise in prices of goods and services) in real-time. Traditional inflation data, like the ones published by government agencies, is usually updated monthly and can be a bit slow. Truflation, on the other hand, uses real-time data from different sources, like prices from websites and stores, to calculate inflation more quickly.

- The Truflation rate dropped from 2.17% to 1.46% this week, the lowest inflation reading since January 11th, 2021, led by Transport & Utilities Services going from 2.60% for 1.79%, Core going from 2.11% to 1.4%, and Goods going from 1.07% to 0.76%.

- What It Means: The Truflation real-time data helps predict the delayed government inflation data that the Fed uses to make decisions on interest rates.

____________________________________________

- MacroEdge Job Cuts Tracker: What Is It? Developed to provide transparency into public job cut announcements and layoffs.

- Job cuts surged in the month of February

- What It Means: A weaker jobs market makes the Fed more likely to cut interest rates in the months ahead

___________________________________________