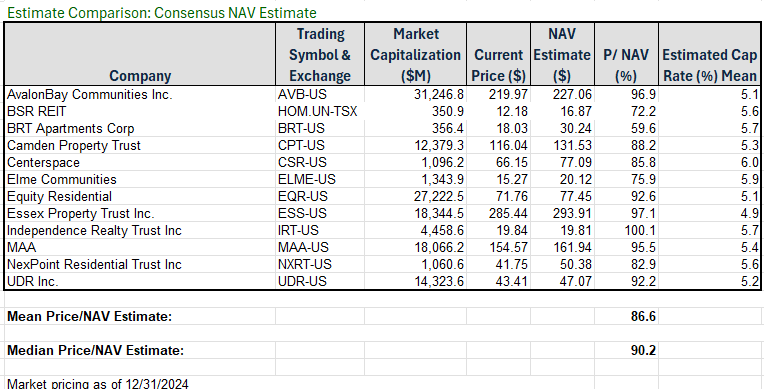

Multifamily REITs currently trade at discount of about 12% relative to their Net Asset Value. A discount to NAV means the stock prices is lower than the total value of the properties the company owns.

For example, if the total valuation of the company is $880 million, but the REIT (and the market) believes they can sell every property they own for $1 billion, then the stock trades at a 12% discount to its NAV.

The table below highlights specific multifamily REITs and their discount to NAV (the “P/NAV” column).

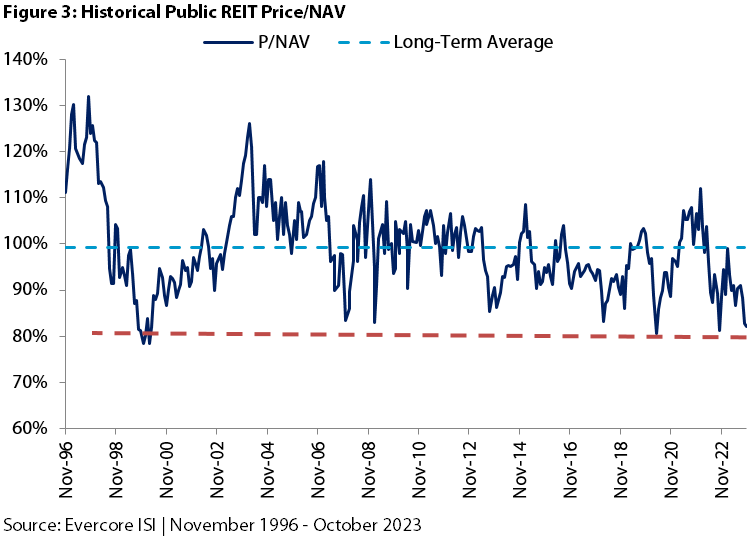

The graph below provides a historical view of all public REIT types going back to 1996, illustrating the fluctuations in price-to-NAV, where values above 100% represent a premium and values below 100% indicate a discount.

Sources: Multi-Housing News & Seeking Alpha