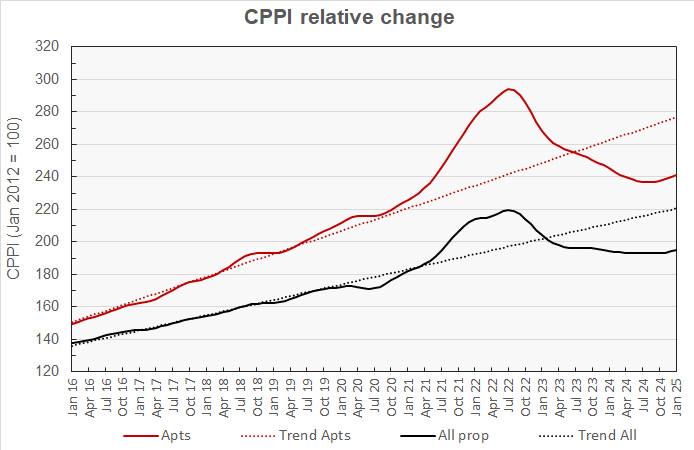

MSCI Real Capital Analytics reported multifamily property prices rose 0.7% month-over-month. The chart below (red line) shows that multifamily prices bottomed in February 2024, and over the last 5 months prices have been moving higher at a speed that nearly matches the pre-pandemic trend.

____________________________________

The Monthly PCE Report – released 2/28/25

- What It Is: Personal Consumption Expenditures: Measures how prices are changing in the economy.

- The PCE price index (the Fed’s preferred inflation measure), increased by 0.3% month-over-month as expected, bringing the annual rate to 2.5%

- Core PCE, which excludes food and energy, also rose 0.3% month-over-month, bringing the annual rate to 2.6%

- PCE Supercore fell to just 0.22% month-over-month from 0.38% last month. Supercore focuses only on the least volatile items like rent, medical services and other goods that have more predictable prices changes.

- What It Means: The report was good (but not great), and provides some room for the Fed to continue cutting if the employment market shows weakness in the coming months

____________________________________

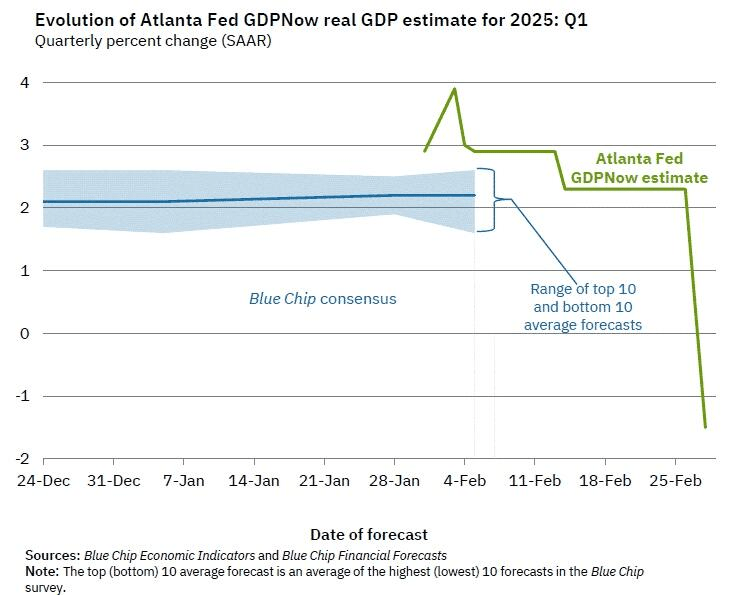

The Atlanta Fed’s GDPNOW model, forecasting US economic growth, just downgraded its estimate of Q1 2025 GDP growth from positive 2.3% to negative 1.5%. A slowing economy makes investors more likely to be defensive (buy treasuries) and makes the Fed more likely to cut interest rates.

_______________________________________

Bloomberg Economics estimates that if DOGE attempts to go for savings of $600B per year, GDP could fall by 2% by the end of this year, the unemployment rate could rise by nearly a percentage point, and CPI year-over-year could fall by nearly 0.9 percentage points.

The Fed has a dual mandate, low inflation and low unemployment, so this scenario would dramatically speed up their rate cutting cycle over the next 18 months.

________________________________________

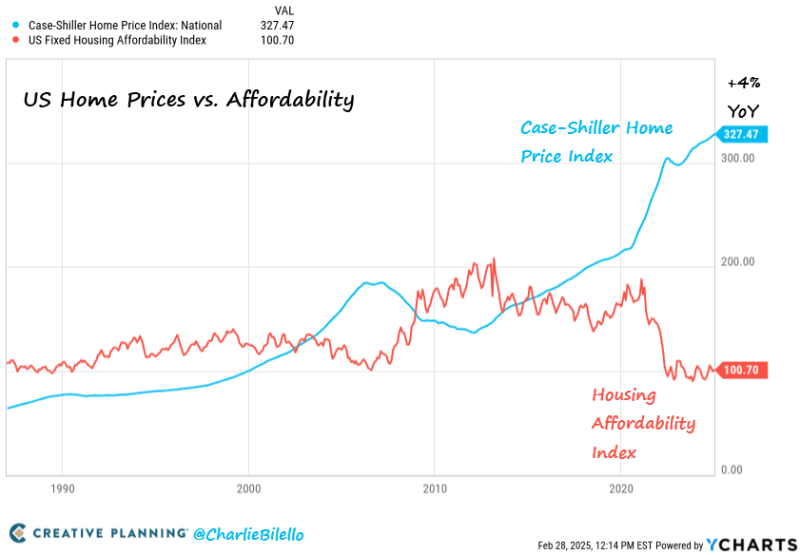

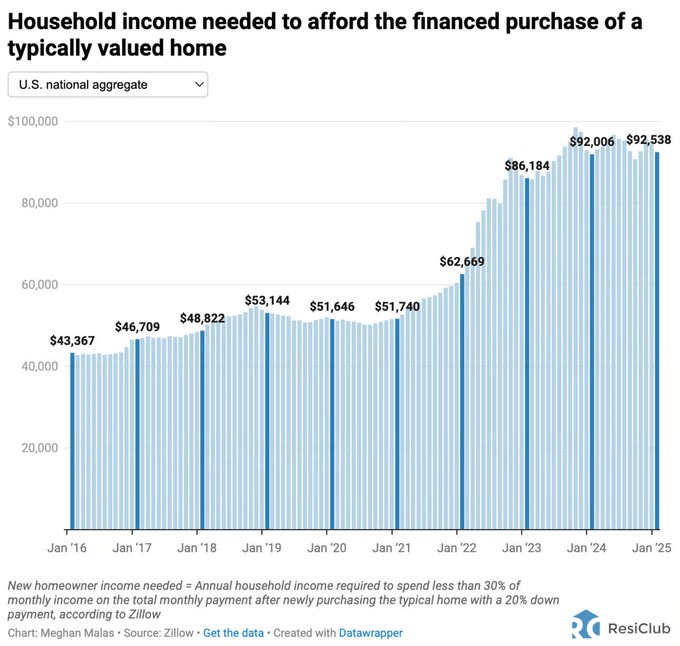

The Case-Shiller Home Price Index reached a new all-time high this month, rising over 4% from the prior year. Affordability remains near record lows for home buyers:

________________________________________

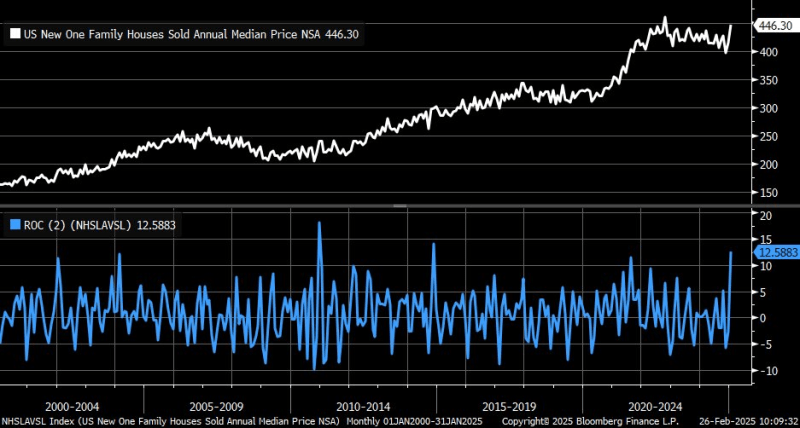

The median new single-family home prices spiked to $446,300 this month. The 2-month change is now up to +12.6%, which is the largest increase since November 2014. Rising home prices push affordability even further way for current renters.

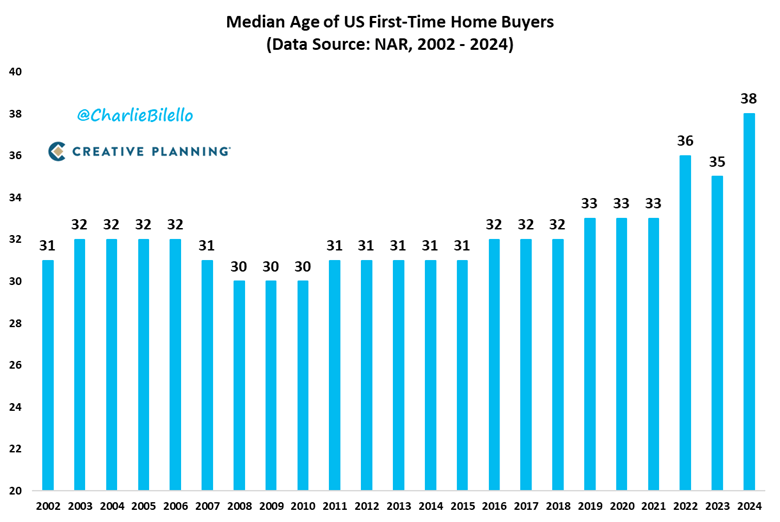

The median age of first-time home buyers continues to rise, creating more demand for rental units:

____________________________________________

Annual U.S. household income needed to purchase typical U.S. home has risen by 79% over the last 5 years.

__________________________________________

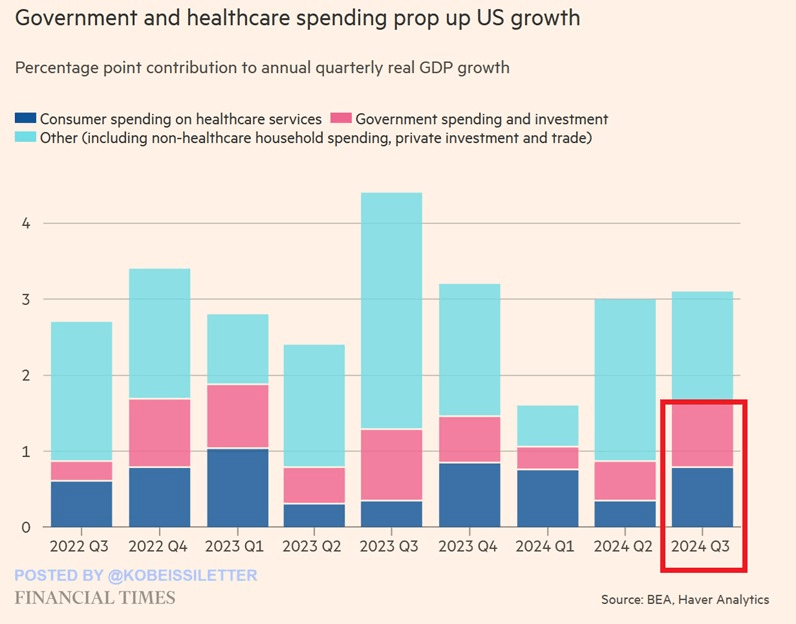

- US consumer spending on healthcare and government expenditures accounted for over 50% of US GDP growth in Q3 2024.

- Consumer spending on healthcare services alone accounted for 25% of GDP growth in Q3 2024. Government spending accounted for 28%, a combined total of ~53%.

- The majority US economic growth now comes from healthcare and the government through taxes and debt.

- Since January 2023, the government has created more jobs than the tech, finance, construction, and manufacturing sectors COMBINED.

- If DOGE continues cutting these jobs, the Fed will be far more likely to accelerate rate cuts in the coming months.