Monthly CPI (Consumer Price Inflation) Report – Release date 2/12/25

- What It Is: Tracks a basket of commons items people by like food, gas, rent, healthcare and clothing. Compares the prices to the previous month and provides percentage change.

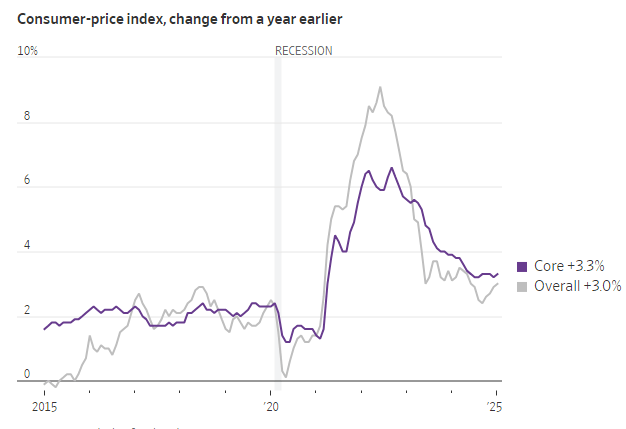

- Jumped 0.5% on the month and brought the annual rate up to 3.0%, which were higher than expected

- This is the seventh straight month of accelerating month-over-month CPI prints

- Core CPI, which removes more volatile food and energy prices, rose 0.4% monthly and 3.3% annually, which were higher than expected

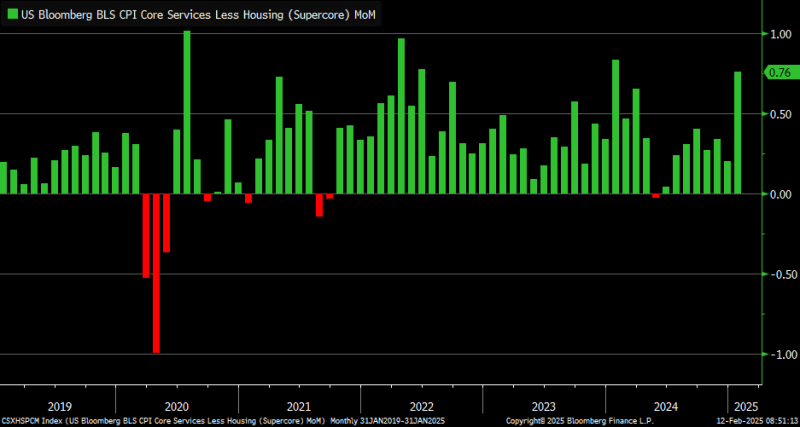

- The Supercore CPI (excludes food, energy and shelter) exploded higher to 0.7% month-over-month bringing the annual rise to 4.0%

- What It Means: A hotter than expected CPI report makes the Fed less likely to cut interest rates in the coming months

_______________________________________________

There were only $12 billion in total 1031 exchanges last year, the lowest since $9 billion in 2012. The chart below shows multifamily 1031 exchanges ($4 billion in 2024):