From The Pensford Letter on this week’s Fed decision and press conference (1/29/25):

- It’s clear Powell believes there are more rate cuts to come with this quote: “At 4.3%, we’re above everyone’s estimation of neutral. Our eyes are telling us our policies are affecting the economy.”

- There were zero mentions about rate hikes.

- He was asked what risks might challenge his confidence in the strength of the labor market (causing them to cut rates faster). He first described new hiring as weak and then said: “A spike in layoffs would lead to the unemployment rate going up very quickly because hiring is so low.”

- From Powell: “Homeowner’s equivalent rent is steadily coming down now, so we seem to be set up for further progress.”

- “We’ve never said we need to be at 2% to cut rates again” and since policy is “meaningfully restrictive” the Fed will cut again before that point.

- When asked if inflation needs to be better than forecasted to cut again, he seemed to push back: “The expectation is that we will continue to see inflation progress” which then leads to further easing.

- On inflation expectations: “Expectations have ticked up on the front end, but not on the longer end which is what really matters. Inflation expectations remained well anchored”

________________________________________

From Apartment List on the shelter component in the Consumer Price Index:

- If you strip out shelter, the remainder of the CPI price basket has increased by just 1.9 percent year-over-year as of December, right in line with the Fed’s long-term 2 percent inflation target. As shelter inflation continues to trend down, it will continue to help improve the overall inflation picture.

________________________________________

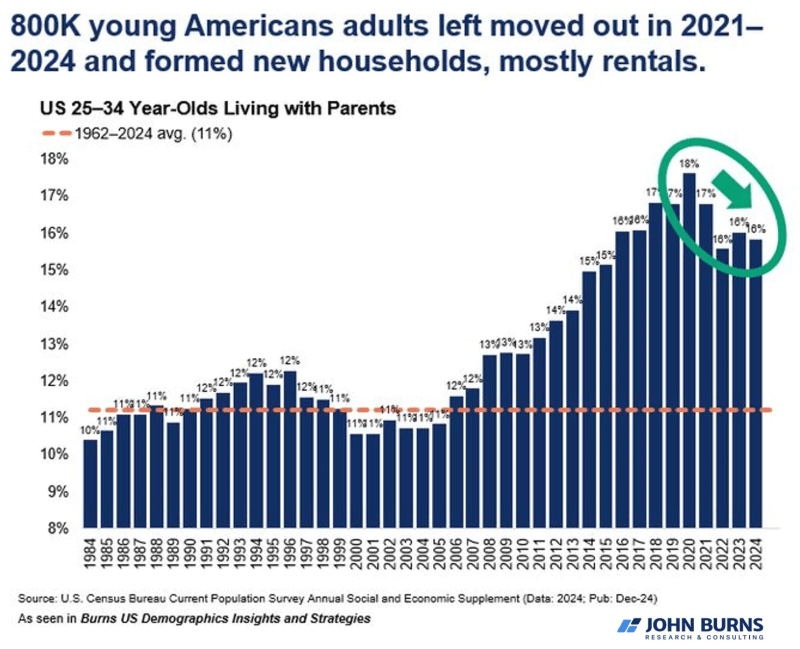

This chart shows the REVERSE of a trend that got a lot of attention during the 2010s — young adults living with parents. That share has been trending down since 2020 and likely helps explain some of the big demand for apartments we’ve seen in the last few years.

______________________________________

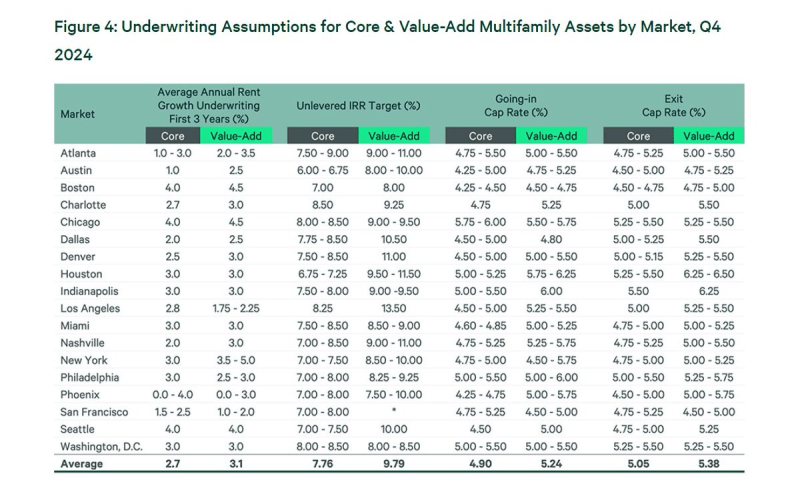

CBRE released their Q4 underwriting assumptions and the cap rates buyers are currently willing to pay while the 5-year and 10-year treasury yields hover around 4.50% are incredibly aggressive.

_________________________________________

From this week’s Pensford Letter – released 1/27/25:

- With Trump’s executive order to open up federal land and waterways, it should put downward pressure on oil prices. A $20/barrel drop in oil (which would put it back in line with Trump 1.0 averages) translates into about a 0.5% in headline inflation readings.