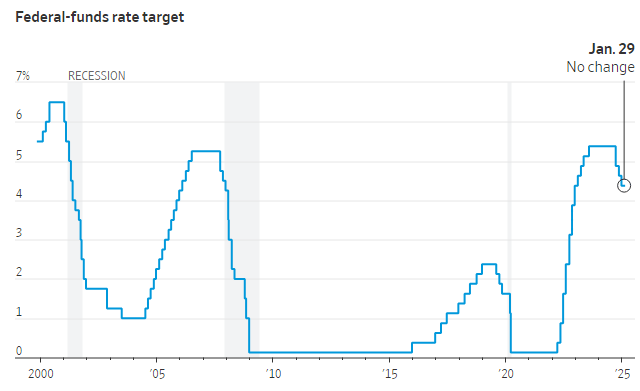

From Nick Timiraos of the WSJ on the Fed’s hawkish meeting and press conference (1/29/25):

- With interest rates now “significantly less restrictive” than they were before last year’s cuts, “we do not need to be in a hurry to adjust our policy stance,” said Fed Chair Jerome Powell.

- Powell said the Fed would need to see “real progress on inflation” or unexpected weakness in the labor market before considering further rate reductions.

- Powell said they want to see continued cooling of price pressures come true before moving rates down. “We seem to be set up for further progress” on inflation, he said. Being set up for progress is one thing, “but having it is another.”

________________________________________

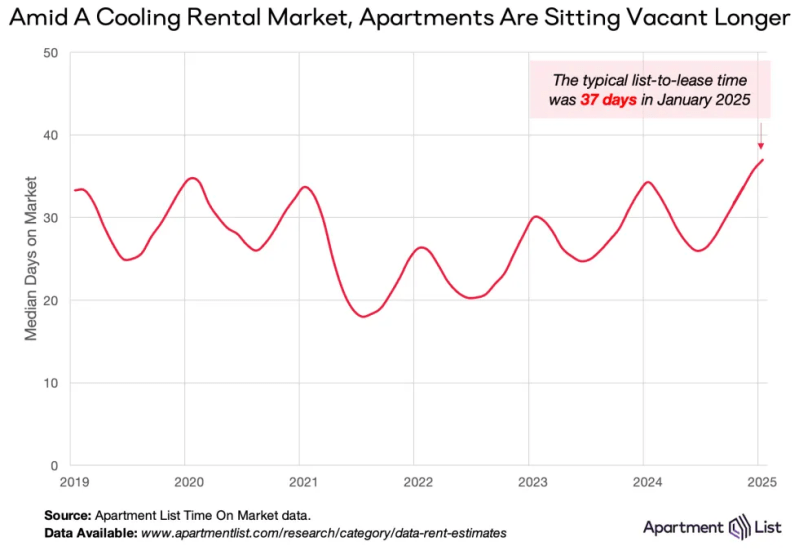

From Apartment List’s February National Rent Report:

- The national rent index experienced its sixth straight month-over-month decline, falling by 0.20% this month

- Year-over-year growth was also negative at -0.5%.

- Since the second half of 2022, rent prices have continued to ebb and flow with the seasons as they typically do, but with the overall trajectory trending modestly downward.

- This marks the third consecutive winter in which seasonal discounts have been notably sharper than the pre-pandemic norm.

- Year-over-year rent growth has now been negative since June 2023.

- After bottoming out in October 2021, vacancies have been opening up steadily for over three full years. Our vacancy rate ticked up to 6.9 percent, surpassing the previous peak of 6.8 percent to set a new record for the highest reading in the history of this data series, which goes back to the start of 2017.

- Among units that were leased last month, the median time on market was 37 days, up from 36 days in December.

- The median time on market of 37 days in January is the highest reading that we’ve seen for this metric in any month going back to the start of 2019, when the data series begins. Units are currently sitting vacant for 3 days longer than they were at this time last year, and for 11 days longer than they were in January 2022 when the market was just beginning to loosen.

_________________________________________

US High Yield Credit Spreads have moved down to 2.59%, their tightest levels since June 2007. Investors are reaching for yield and behaving as if there will never be another default cycle again.

______________________________________________

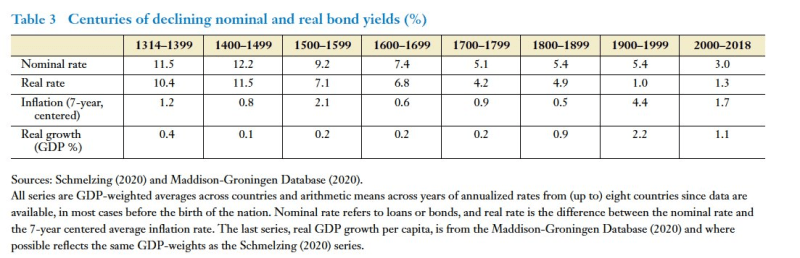

A historical look at interest rates across centuries. Has the 21st century been an anomaly of lower rates or part of a long-term trend of falling rates?

____________________________________________

Tough news from Colliers on the anemic state of commercial real estate fundraising. $80B raised in 2024, lowest since 2016. Cash stockpiles in existing funds dropped 40% as capital was deployed to buy, refinance or redeem.