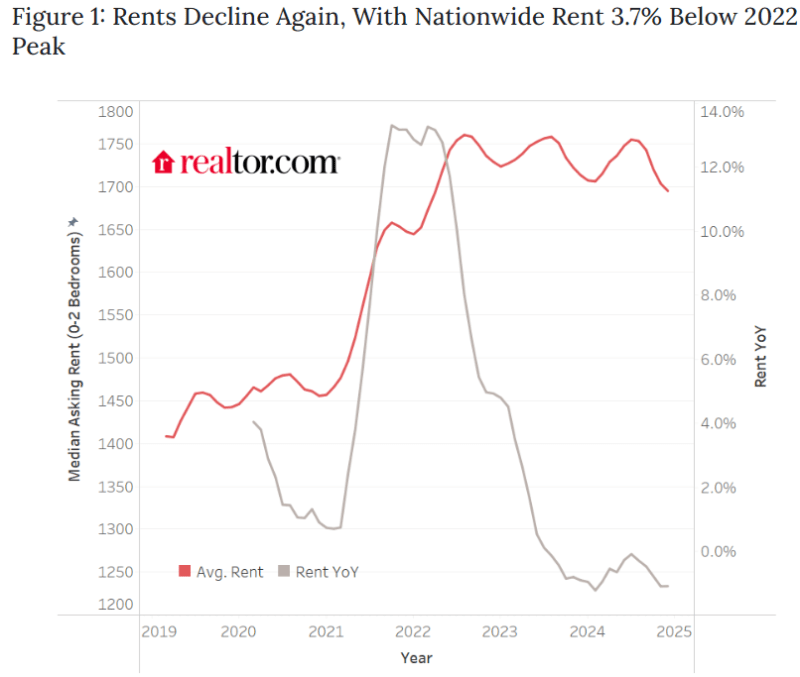

From the January 2025 Realtor.com Rental Report:

- It was the seventeenth consecutive month of year-over-year rent decline for 0-2 bedroom properties.

- Rents nationally were down by 1.1% from the previous year.

- The median asking rent fell to $1,695, dipping below $1,700 for the first time since April 2022.

- Median rent fell consistently across all units of all bedroom counts. Studios were down 1.3% year-over-year, 1-bedrooms and 2-bedrooms were both down 0.9%.

From Zillow’s January Rental Market Report:

- Multifamily rents fell 0.30% month-over-month

- 40.9% of rentals on Zillow offered concessions, a new record

- The share of rental listings offering concessions increased by 2.3% month-over-month

- The share of rental listings offering concessions increased by 8.3% from last year

- Rent concessions are up from year-ago levels in 48 of the 50 largest metro areas

- Since pre-pandemic, the income needed to afford rent has increased by 33.4%

________________________________________

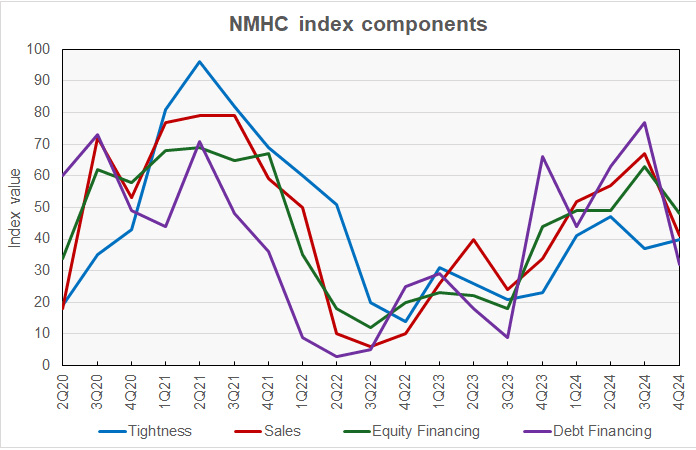

Apartment market conditions declined in the National Multifamily Housing Council’s (NMHC’s) most recent Quarterly Survey of Apartment Market Conditions. All four indices – Market Tightness (40), Sales Volume (41), Equity Financing (48) and Debt Financing (32) – came in below the breakeven level (50), signaling less favorable conditions this quarter.

__________________________________________

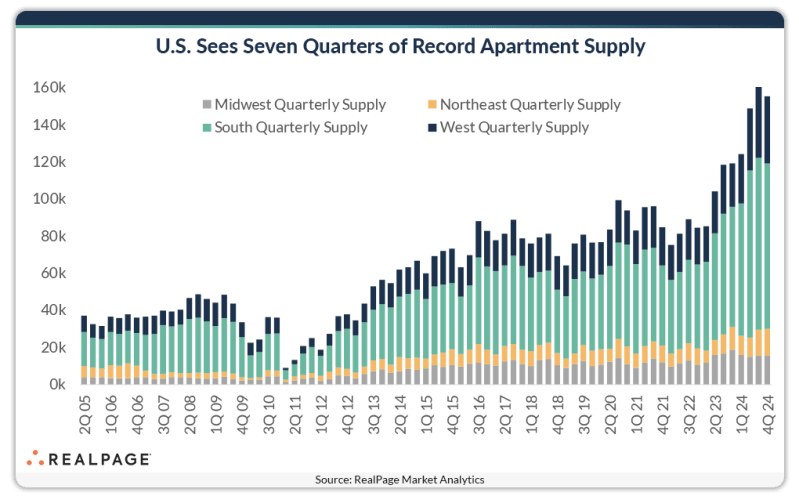

The U.S. apartment market has now logged seven consecutive quarters of record supply, with the last three quarters of 2024 seeing especially significant deliveries.