ADP Jobs Report – Release Date 1.8.25:

- What it is: a monthly report that gives an estimate of how many jobs were added or lost in the U.S. private sector during the previous month. It’s published by ADP, a company that processes payrolls for businesses

- 122,000 jobs in December, worse than the 140,000 expected. The lowest number since August.

- Wage growth also cooled: workers who changed jobs saw a 7.1% increase in pay, while those who stayed saw a 4.6% gain. These were the lowest since mid-2021.

- What it means: weaker jobs reports make it more likely the Fed will cut rates

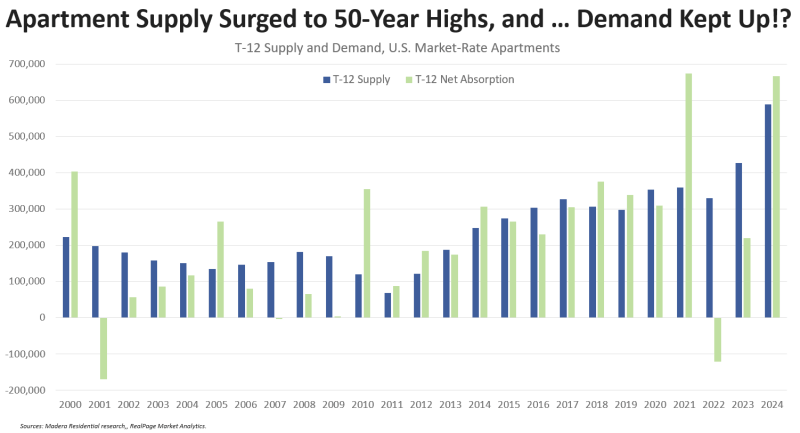

From RealPage: U.S. apartment demand hit its highest level in nearly three years in 2024’s 4th quarter and easily outpaced concurrent new supply. “The U.S. apartment market has responded to the fears of oversupply with resounding appetite,” RealPage Chief Economist Carl Whitaker said.

- In the October to December 2024 quarter, the U.S. absorbed 230,819 market rate apartment units, buoying annual demand to 666,699 units – the highest annual recording since 1st quarter 2022.

- As such, the imbalance between supply and demand has reversed, allowing for the first true absorption surplus of apartment demand since mid-2022.

- With demand outpacing supply, the U.S. posted a meaningful annual occupancy bump to stand at 94.8% in December.

- “The data suggests that the multifamily industry has ‘found the floor’ in 2024,” Whitaker said. “And it’s equally important to note that the past year has set the stage for operators to view the upcoming year as arguably the most ‘normal’ set of conditions seen since the turn of the decade. While the theme of some locally soft apartment markets will carry forward into 2025 (largely areas working through massive waves of new supply), it’s becoming increasingly evident that the apartment market at-large turned a corner in 2024 with 2025 setting up to be a year characterized by continued improvement.”

More from Jay Parsons on the incredible multifamily demand numbers:

- Renters signing new leases for market-rate, professionally managed apartments are coming in well qualified with rent-to-income ratios below 23%.

- Imagine what would be happening with rents right now if not for new apartment supply nearing 600k units in 2024 — the biggest number in 50 years. We just saw the 2nd best year on record for apartment demand.

___________________________________________

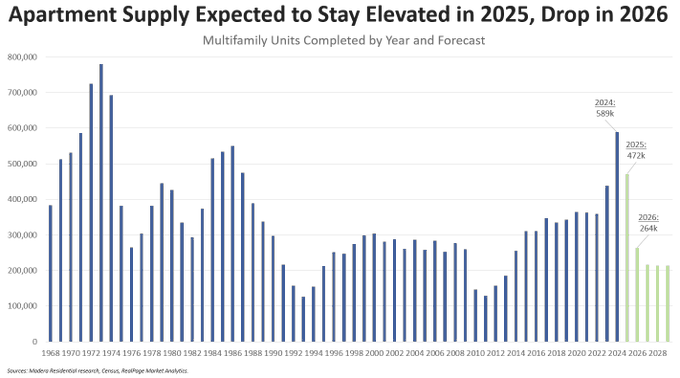

From Jay Parsons: New apartment supply in 2024 hit the highest levels since the mid-1970s. That’s why rent growth was flat nationally (and negative in many markets) even though demand was massive.

2024 was the supply peak, but more supply hits in 2025 before the big plunge in 2026. Starts are down to 10-year lows, and the ongoing total construction volume is nearly half it was at peak a couple years ago, so there’s good evidence to support the forecasts for low supply levels by 2026.

___________________________________________

CoStar reported:

- Rents rose 0.6% in December, typically a difficult seasonal month to see gains

- Rents rose 0.9% year-over-year in 2024

___________________________________________

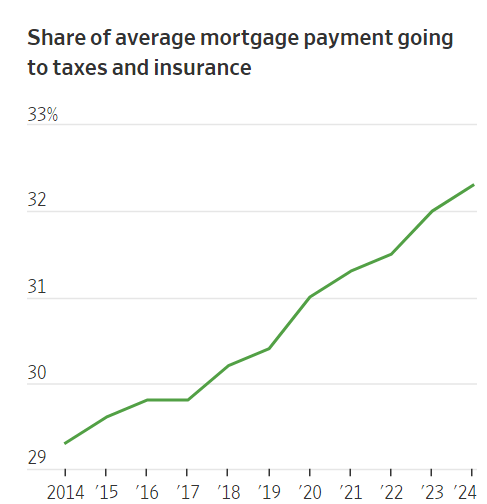

It’s not just increasing monthly mortgage costs raising the barrier to homeownership and keeping more Americans renting. The cost of insurance and taxes for homeowners continues to rise dramatically. From the Wall Street Journal this week:

_____________________________________________