The BLS Jobs Report – 1.10.25 Release Date:

- What it is: The main jobs report for the United States released monthly. Includes how many total jobs were added or lost, the unemployment rate, wages and changes within industries.

- The number came in scorching hot: 256,000 jobs added vs. expectations of 165,000

- The two previous months were revised lower by a combined 8,000 jobs

- The unemployment rate dropped from 4.2% to 4.1%

- What it means: While a strong employment market is positive for tenants paying their rent, it reduces the likelihood for Fed rate cuts in the months ahead.

University Of Michigan Inflation Expectations Report – 1.10.25 Release Date:

- What it is: A survey where people are asked about their views on inflation. How much they think prices will go up in the short term (next year) and longer term (5 years ahead)

- Surged to 3.3% for both the short and longer term, the highest reading on the longer term since 2008

- What it means: If consumers and businesses expect inflation/prices to be higher in the future it causes them to make purchases sooner, which actually exacerbates the actual inflation in the economy (a self-fulfilling prophecy). The Fed tracks this data closely and will be less likely to reduce rates if inflation expectations are high

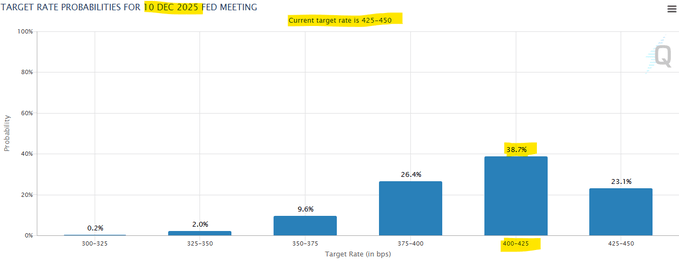

Following the BLS Jobs Report and UMich Inflations Expectation Report discussed above, the market is now pricing in only one rate cut in all of 2025: a 25-basis point cut bringing the Fed Funds rate down to 4.00 – 4.25% by year end.

As a reminder the 10-year treasury yield is historically 1.50% higher than the Fed Funds rate, which would put the 10-year treasury at 5.50% (it is at 4.75% today).

Weekly Unemployment Claims – 1.8.25 Release Date:

- The number of Americans filing new applications for unemployment benefits fell to an 11-month low last week at only 201,000, well below the forecast of 218,000.

- What it means: a stronger jobs market makes the Fed less likely to cut rates

ISM & JOLTS Report – 1.7.25 Release Date:

- The Prices Paid in the ISM (manufacturing and services) report came in at 64.4, up from 58.2 the previous month, showing an explosion higher in prices paid

- The Jobs Openings and Labor Turnover Survey (JOLTS) showed a higher-than-expected number of openings this month at 259,000, and also revised up an extremely strong previous month from 372,000 to 467,000

- What it means: Rising ISM prices and a high level of jobs opening lowers market expectations for Fed rate cuts in 2025 and sent rates higher following the data release

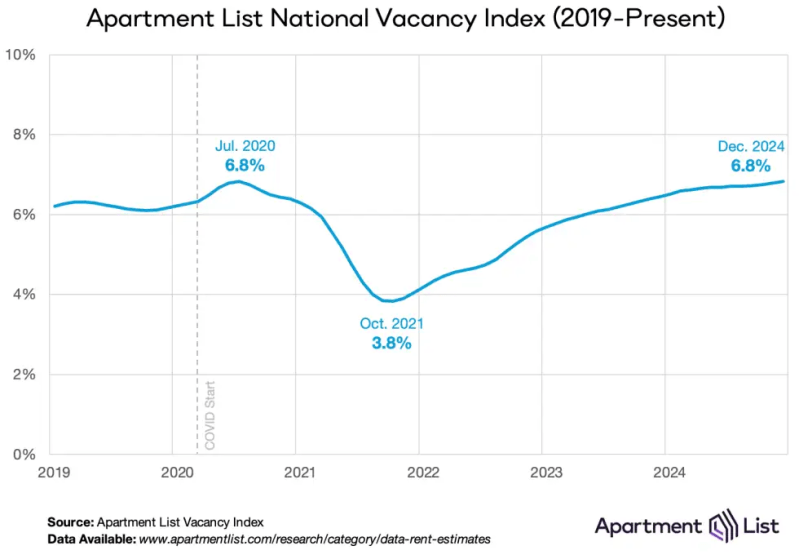

ApartmentList’s January rent report:

- The national median monthly rent fell 0.6% month-over-month

- Year-over-year rents were also down 0.6%

- Since the second half of 2022, rent prices have continued to ebb and flow with the seasons as they typically do, but with the overall trajectory trending modestly downward.

- The national median rent has now fallen below its August 2022 peak by a total of 4.8 percent.

- The median time a unit is on the market to rent reached 36 days this month; the highest reading seen for this metric in any month going back to the start of 2019, when the data series begins.

- The national vacancy index continues trending up slowly and currently sits at 6.8 percent, the highest reading since the onset of the pandemic.

- 2024 saw the most new apartment completions since the mid-1980s, and with nearly 800 thousand units still in the construction pipeline, the supply boom has runway to continue into 2025.