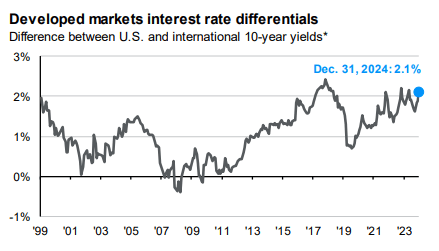

From J.P. Morgan’s Q1 2025 Guide To The Markets, a nice visual of how much higher the 10-year treasury is in the United States is vs. the rest of the developed world. This makes U.S. bonds look more attractive to investors and helps keep a cap on yields:

From J.P. Morgan’s 2025 Eye On The Market, for those concerned about a reduction in Federal employment impacting multifamily renters, the 3 million federal workers employed are the lowest level as a share of US employment in 85 years (about 2%).

______________________________________

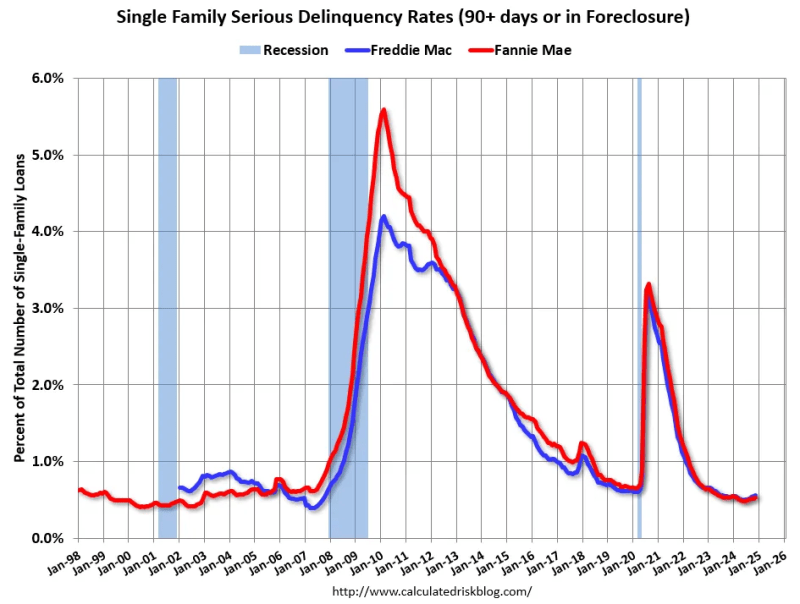

Fannie & Freddie serious delinquency levels are currently very low. These are mortgage loans that are three monthly payments or more past due or in foreclosure:

______________________________________

2025 Predictions From This Week’s Pensford Letter – 12/30/24

2025 Prediction #1 – The 10 Year Treasury Will Finish Below 4%

The 10T is oversold here. Inflation is contained enough to not be the main event.

- Growth will slow – Republican policies won’t really have much impact until 2026

- Labor Labor Labor Labor Labor

- Most of the globe is dealing with tepid or negative growth (cough cough Germany and China)

- Real rates

It’s important to remember that the US Treasury market is the world’s mattress. It behaves differently than any other asset in the world. Central banks, financial institutions, pensions, etc all have mandates that require a certain amount of Treasury holdings. Heck, our own Fed mandates Primary Dealers bid on Treasuries at every auction.

Here are the Top 10 bond markets in the world. What’s the realistic alternative to the US? Countries 2-10 combined equal US market size. Japan and China are both yielding sub-2%, are you dying to snatch those up? I want to be in the room when you pitch buying Brazilian bonds because they are yielding 7%.

The UK has a similar yield but is 1/10th the market size, so there’s only so much money that can flow into that market. And, it’s still just the same yield – it’s not an improvement over the mattress. And their economy is contracting. Maybe global yields don’t drive US yields lower, but they certainly keep a lid on them. Speaking of keeping a lid on yields, Real Rates will likely do the same at current levels. The higher the real rate, the more attractive the return. Real Rates are just yields adjusted for inflation.

While those keep a lid on rates, they don’t necessarily drive them lower. So why do I think the 10T will finish 2025 below 4%?

2025 Prediction #2 – Labor Market Deterioration Will Dictate Interest Rates

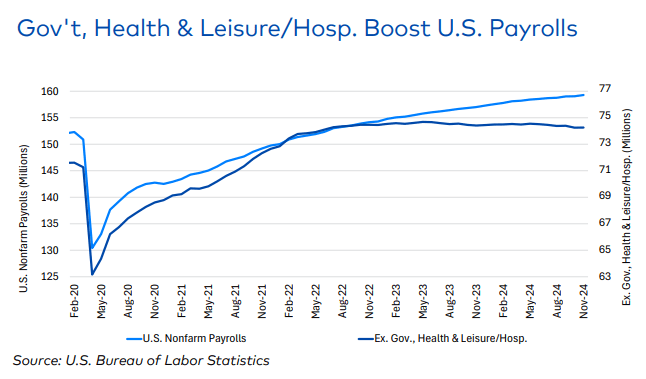

Even if markets continue to react to NFP as if it’s gospel, you have learned it’s garbage noise. Plus, over half of the gains are from government/healthcare. What happens when a new administration, hell bent on reducing government spending, stops hiring government positions? Or requires government workers to return to office?

Month after month, we see big downward revisions. The last annual revision added a further downward revision of over 800k. The QCEW, generally considered the most accurate job report (but with a terrible lag), continues to diverge substantially from the headline NFP reports. For the love of all that is holy, stop reacting to the NFP report!

But let’s say you think I’m an idiot and believe NFP is a great indicator of overall labor market health. Here’s the monthly NFP average over the last three years.

2022: 413k

2023: 238k

2024: 190k

Remember, 0 isn’t the Mendoza line. Somewhere around 125k is to keep pace with population growth. In other words, NFP below 125k is contractionary. Household Survey (UR) last month showed a loss of 355k jobs while NFP showed a gain of 227k. Someone’s lying. Other fun labor market stuff…

- Unemployment Rate – up from 3.4% to 4.2%.

- Continuing Claims – up 600k from the first hike and at its highest level in over 3 years. The median unemployment timeline is now 10.5 weeks.

- JOLTS – job openings down to 7.7mm from over 12mm.

- Unemployment to Employment Flow Index – this measures unemployed people finding employment and is at its lowest level in a decade.

The labor market is in decent shape, but it’s not overheated. More importantly, the trend is worrisome. The labor market, more than anything else, will dictate Fed policy and interest rates in 2025.

2025 Prediction #3 – The Fed Will Cut at Least 0.75%

This time last year, the Fed projected 0.75% in cuts in 2024. It ultimately delivered 1.00%. I think the Fed misses by at least one cut again. It is projecting 0.5%, but I think it will be at least 0.75%. That would put Fed Funds around 3.62% this time next year. It’s important to remember the 0.5% assumes no further economic deterioration. The Fed believes rates are still restrictive, so rate cuts are just easing off the brakes to avoid bringing the economy to a screeching halt. Even with a strong economy, the Fed will continue us on a path towards neutral. And if I’m right about the labor market, it will cut faster to preserve jobs. What would it take for the Fed to deliver fewer than 0.5%? Some combination of un-worrisome jobs data and worrisome inflation data.

2025 Prediction #4 – Core PCE Will Average Below 3%

China is exporting deflation. Not disinflation, deflation. In Trump 1.0, tariffs didn’t get enacted until the end of his first year. I think those are a concern for next year. Oh, and that laggy Shelter component will continue to exert downward pressure throughout the year. Inflation progress might be slow and even temporarily stall, but that’s not the same as reaccelerating. If the target was 3% instead of 2%, wouldn’t the narrative be entirely different? Just like early 2024, we may get some worrisome reports early in the year. Ride out the media storm and on the far side of it is an inflation story that is still mostly good.

_________________________________________

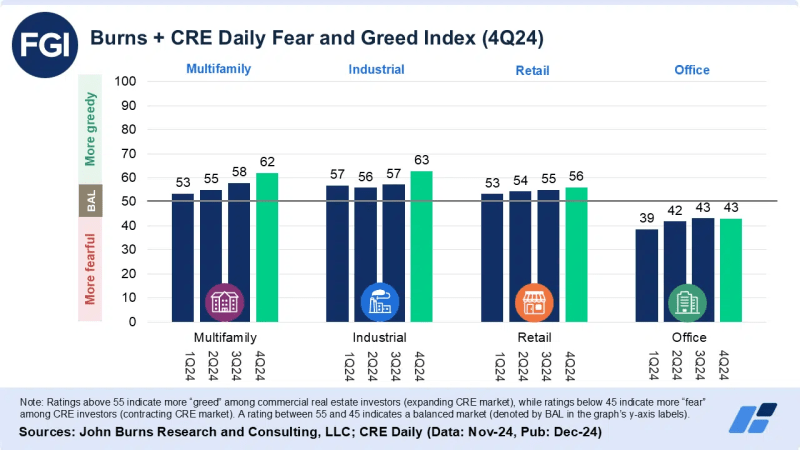

John Burns: Commercial Real Estate Optimism Is Rising, Namely Apartments – December Report:

Index values below 45 indicate a contracting market, while those above 55 suggest expansion:

65% of investors expect to increase their exposure to multifamily over the next 6 months, and access to capital is improving:

_________________________________________

From Yardi’s U.S. Multifamily Outlook (December Release):

If you remove government and hospitality/leisure jobs from the payroll reports, jobs have been stagnant and declining for over 2 years. The new administration’s focus on cutting government spending could slow government job growth and provide room for the Fed to cut rates more dramatically.

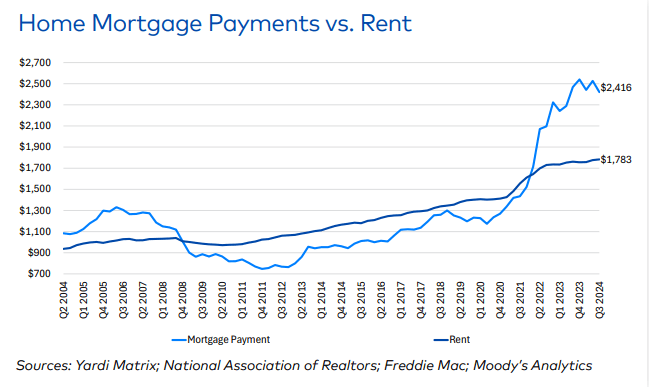

The cost to purchase a home vs. renting remains at a historically high, a tailwind for rent prices entering 2025:

_________________________________________

From Gray Capital’s 2025 Multifamily Forecast:

Wage growth has remained above inflation for almost 2 years, allowing renters to pay higher rents:

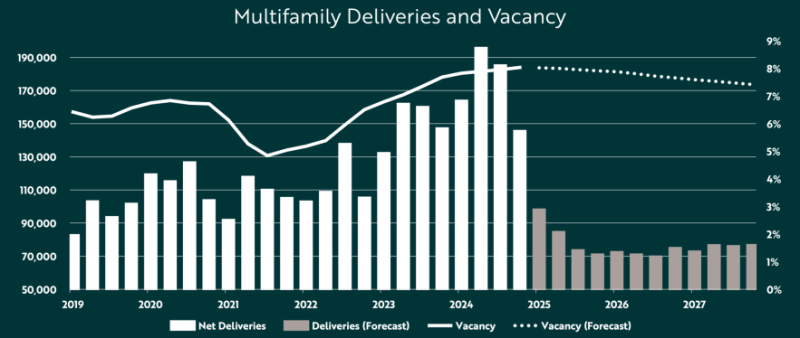

New multifamily supply (deliveries) will decline dramatically in the coming years:

_________________________________________

Forbes: Multifamily Trends For 2025:

- Lower vacancies, higher rents – The last few years have seen historic levels of new apartment construction, but that’s begun to ease. According to CBRE, multifamily construction starts should be 30% below pre-pandemic averages by mid-year. For that reason, 2025 should begin to bring about lower vacancies and 2.6% higher rents in the midst of continued strong renting demand.

- Growing apartment appeal – Uncertainty gripping the housing market and a cloudy interest rate picture is leading many would-be home buyers to pick renting instead of purchasing. Benefits traditionally associated with renting –flexibility, freedom from maintenance, opportunities to meet new friends – will be prioritized by those who in earlier generations likely would have been home buyers. The trend is reflected in the National Association of Realtors Profile of Homebuyers and Sellers, revealing median home buyer age has risen from 35 to 38. It’s also seen in Entrata’s New American Dream Report, divulging that 66% of renters report renting rather than homeownership is a better lifestyle match for them.

- AI spurs personalization – As AI continues to mature in the year ahead, the repetitive tasks traditionally undertaken by multifamily community property managers and staff will increasingly be assumed by technology. That should liberate apartment community employees to attend in more personalized ways to residents’ preferences. The coming year should witness a surge in new apartment community amenities, such as community concierge services, that will enable residents to build more robust social ties with fellow residents and staff.

____________________________________________

From Fitch Ratings: U.S. Banks To Weather CRE Exposure In 2025:

- U.S. banks will face continued pressure from commercial real estate (CRE) in 2025, but stresses and potential losses are expected to remain within ratings sensitivities for most lend, as loan loss reserves should insulate bank performance and ratings.

- The largest banks with assets over $100 billion have reported the highest levels of non-performing non-owner occupied CRE loans and charge-offs. However, overall relative exposure is much lower than for regional and mid-sized banks.

- Credit losses are not likely to burden earnings in 2025. Most Fitch-rated banks have been proactively reserving against potential office CRE losses, while the large banks also benefit from diversified business models.

_____________________________________________

Third quarter multifamily volume saw the highest levels since 2022. Year-to-date volume was up 8.5% through Q3.

___________________________________