From Fannie Mae’s December Multifamily Market Commentary:

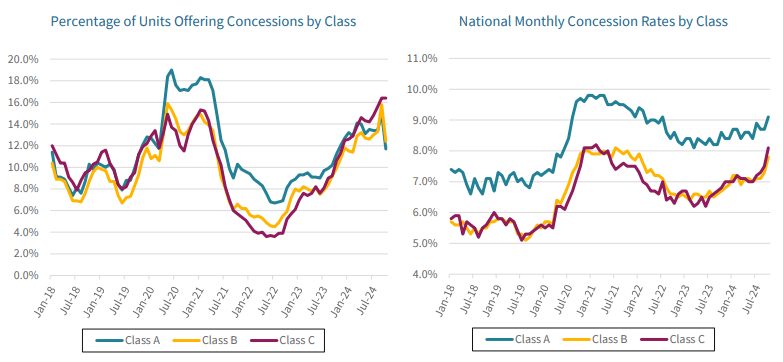

- 13.4% of all units offered concessions in October 2024, up from 10.4% in October 2023

- The value of concessions has risen from 7.4% of asking rent in 2023 to 8.2% in 2024 (about equal to a month’s free rent)

- Over the past year, as demand has been relatively softer, the value of concessions for class A units increased slightly, up to 9.1% in October 2024 from 8.6% in October 2023. The share of class A units offering concessions has also risen, albeit slightly, to 11.7% as of October 2024, up from 11.2% a year ago.

- The continued softer demand for apartments seen over the past year is even more evident in the skyrocketing percentage of units offering concessions in class B and especially class C units. These concession metrics increased considerably over the past year and are close to levels seen during the pandemic for class B and C units. As of October 2024, 12.4% of class B units were offering concessions, up from 9.9% in October 2023, and a remarkable 16.4% of class C units were offering concessions, up from 10.6% a year ago.

_________________________________________

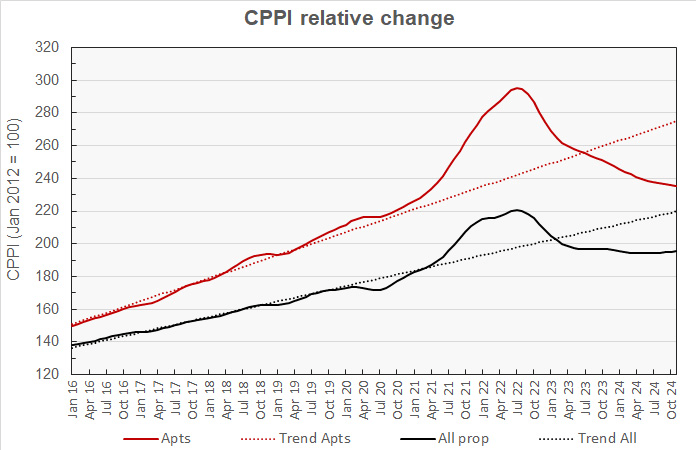

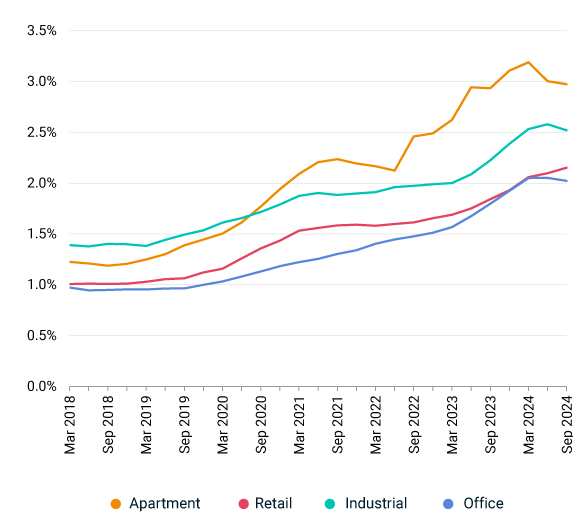

Multifamily Prices Continue To Fall – MSCI December Report

The latest commercial property price report from MSCI Real Capital Analytics said that multifamily property prices fell 0.3 percent from their level of the month before, and prices were down 5.7 percent from their level of one year ago. Prices are now down 20.4 percent their peak in 2022.

_________________________________________

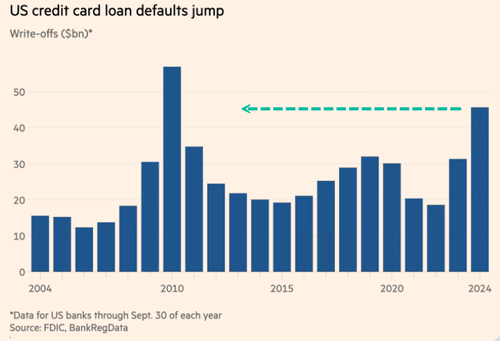

U.S. credit card defaults have soared to levels not seen since 2010, coming out of the Great Recession. The head of Moody’s Analytics, Mark Zandi, noted, “High-income households are fine, but the bottom third of US consumers are tapped out,” adding, “Their savings rate right now is zero.”

Two thirds of the country own their home and one third rents. The renter households are more likely to be those impacted by credit card defaults, making it more difficult to handle rent increases and qualify for a new apartment.

_________________________________________

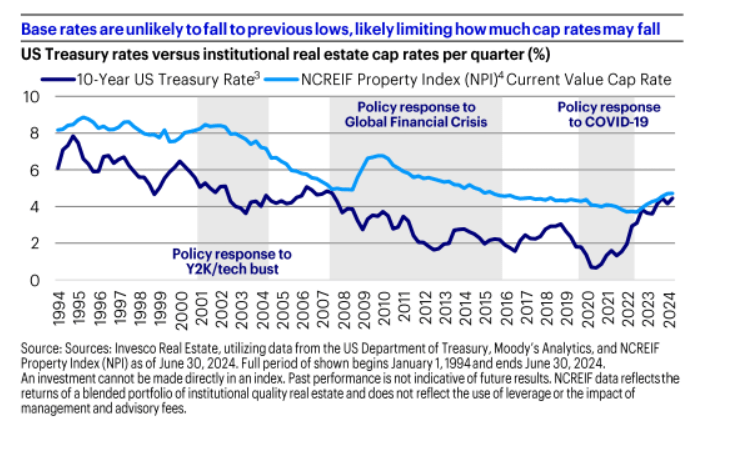

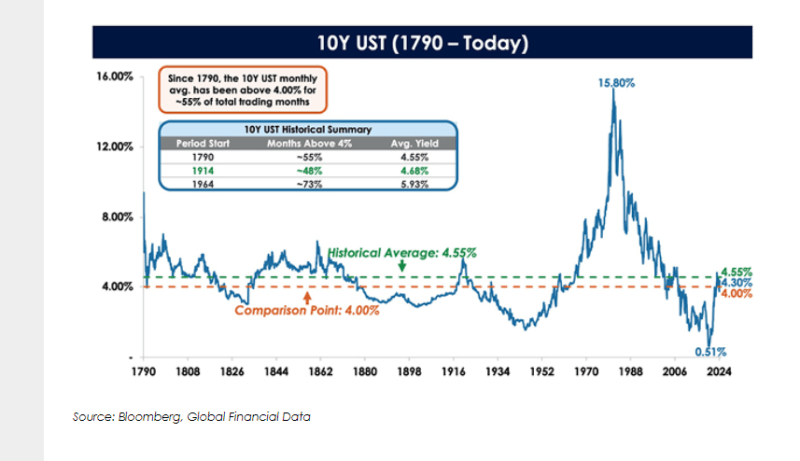

Cap rates typically average about 100-200 basis points above the 10-year treasury yield. To get back to average levels from where we are today, either cap rates need to rise, or the 10-year treasury needs to fall. Significantly.

_____________________________

If you zoom out and look at a chart of the 10-year treasury going back hundreds of years, it has averaged 4.55%. If you begin measuring from 1914, it has averaged 4.68% and if you begin measuring from 1964, it has averaged 5.93%.

The low rates we experienced from 2012 – 2022 were an anomaly that has never happened in history, other than a brief period around World War 2 when the Fed had to execute yield curve control (QE) to force rates down and keep them low to finance the war.

________________________________________

__________________________________________