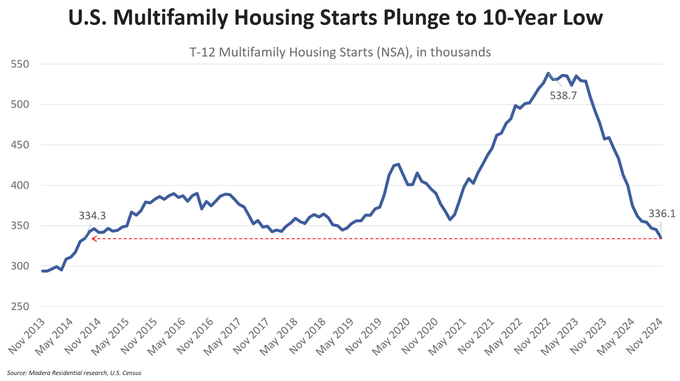

Multifamily Starts Continue to Fall – 12/18/24

- Monthly starts came in at 264,000 units, down 24.1% (84,000 units) from the revised (+22,000 units) figure from the previous month.

- The previous month’s starts were revised lower by 2,000 units to 295,000

- Compared to the year-earlier level, multifamily housing starts in buildings with 5 or more units were down 28.8 percent. The reported starts figure was 23.9 percent lower than the trailing 12-month average.

- What It Means: It typically takes about 2 years to complete a new multifamily project, so as new starts continue to decline it will create dramatically less available housing supply in 2026-2027. Less supply helps current owners raise rents.

Monthly Multifamily Completions Fall – 12/18/24

- Monthly completions came in at 544,000 units on a seasonally adjusted, annualized basis, down 11.1% (68,000 units) month-over-month. The previous month was also revised down 3,000 units.

- Compared to the trailing 12-month average, completions were down 5.3 percent.

- The total number of units under construction (780,000 on a seasonally adjusted basis) continued its downward trend. This is down 45,000 units from the previous month and 20.9% lower than the number of units under construction a year earlier.

- What It Means: While the number of completions (new supply) continues to be high, we are approaching the moment of “peak new supply” which will crest, descend rapidly, and stay low through 2026. We can see this based on the starts data discussed above.

Federal Reserve Rate Decision & Press Conference – 12/18/24

- The Fed cut interest rates 25 basis points, as expected

- While the statement and press conference were more hawkish than expected, things can change dramatically as we get more economic data in the weeks and months ahead. Last year at this time the Fed was projecting 0.75% in rate cuts. They ended up cutting 1.00%.

- When asked if the Fed would consider hiking rates, Powell said, “That doesn’t appear to be a likely outcome.”

- Powell noted that core PCE falling to 2.5% next year would be considered meaningful progress (meaning even though it’s still above their 2.0% target, they would still consider themselves on track)

- If the Fed raised the core PCE forecast to 2.5% with 2 cuts, they have actually lowered the bar for more than 2 cuts

- Powell stressed that labor is not creating inflationary impulses

- Powell: “We think the labor market is cooling in a significant way.” He stressed the want to avoid further deterioration in the labor market.

From Yardi’s National Multifamily Report in December:

- After two years of rapid increases, multifamily expense growth is beginning to moderate. Through October, expenses in U.S. market-rate properties rose an average 4.0% year-to-date, down from 9.0% in 2023 and 7.1% in 2022.

- Property insurance increases have leveled off in 2024, as the higher premiums have helped insurers get back on solid footing.

- Growth in other expense categories such as labor and maintenance have also moderated and should remain muted unless driven up again by an exogenous event.

- Net operating income growth continues to be positive as revenue streams remain positive. Income growth of 2.6% year-to-date has produced a 1.9% increase in NOI. Affordable properties have recorded 6.0% revenue growth year-to-date through October, producing a 7.1% increase in NOI over that time.

From Zillow’s Rental Market Report in December:

- Zillow forecasts multifamily rents to grow 2.8% in 2025, up from the current pace of 2.4%

- Zillow forecasts single-family rents to grow 4.1% in 2025, down from 4.4% year-over-year growth as of November

From Zillow’s Home Value & Sales Forecast in December:

- Zillow expects home values to grow 2.4% over the next 12 months, and by 2.2% in the calendar year 2025.

- Higher-than-expected mortgage rates are likely to reduce demand for home purchases, shifting it towards rentals.

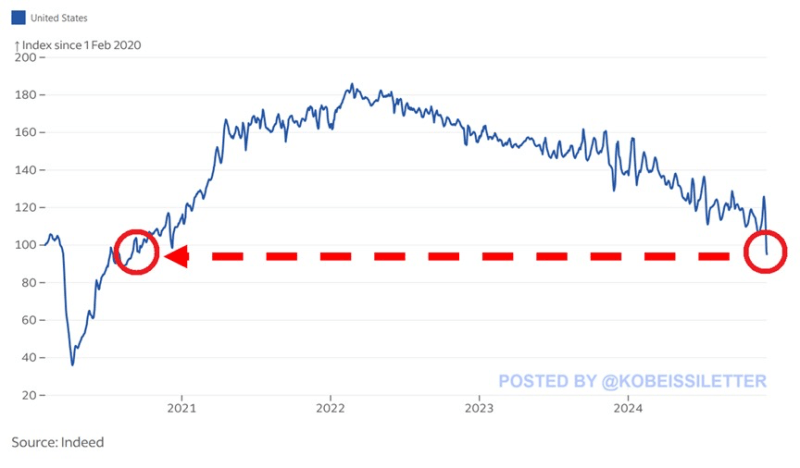

Indeed is showing a sharp decline in the strength of the jobs market:

- What Is Indeed?: job matching and hiring platform

- New job postings on Indeed fell 38% year-over-year last week and now stand at the lowest level since August 2020.

- Job postings have dropped for nearly 3 years straight and are now down 49% since the February 2022 peak.

- As a result, new available vacancies are 5% below pre-pandemic levels.

- Data provided by Indeed is more current than the government data

- What It Means: If the jobs market is weakening more than expected under the surface, it will make the Fed more likely to cut aggressively in the months ahead as this data begins to show up in the government’s employment data