Federal Reserve Rate Decision & Press Conference – 12/18/24

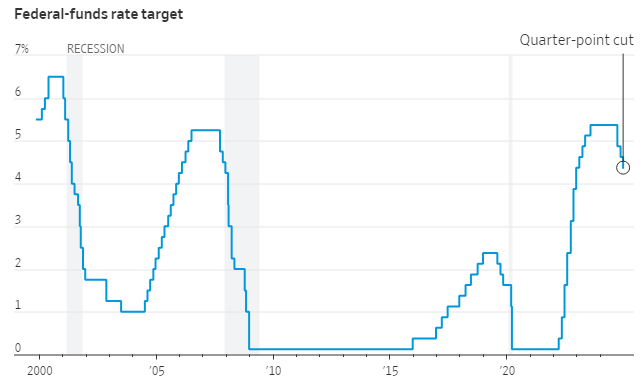

- The Fed cut rates 25 basis points, as expected, but the good news ended there

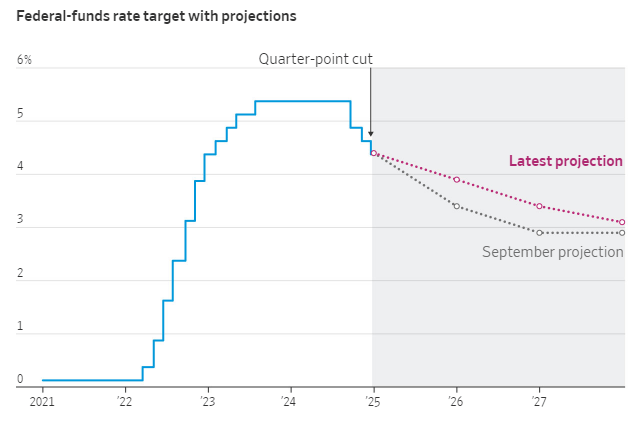

- They reduced the number of cuts they expect next year from 4 (-1.00%) down to 2 (-0.50%)

- Powell: “We expect to slow the pace of cuts”

- Historically the 10-year treasury average is about 1.50% above the Fed Funds rate (to compensate for the risk in holding bonds longer in duration). That means the 10-year treasury should be at 5.75% today and should end up at about 5.00% at the end of 2028 based on their current projections:

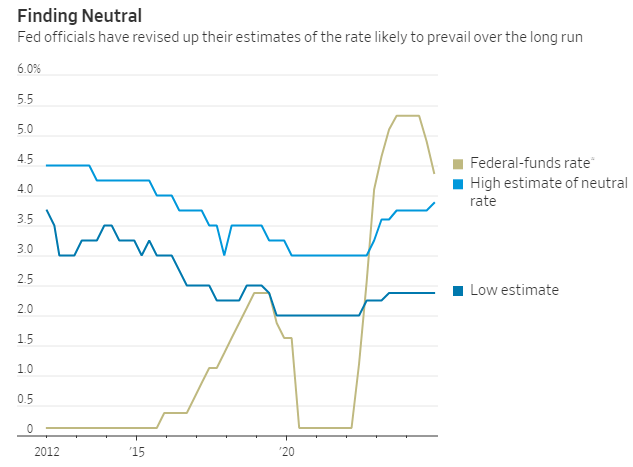

- The Fed continues to raise estimates of where the neutral Fed Funds rate needs to be (where it does not stimulate the economy or cause it to slow it down). If it lands at the higher end of estimates, they are almost done cutting.

- They raised the longer run Fed Funds rate to 3.0%, up from 2.50% a year ago

- The odds of the next rate cut currently do not exceed 50% until the June 2025 meeting

- They raised their 2025 PCE inflation forecast from 2.1% to 2.5%

- Powell when asked why he didn’t use the word “recalibration,” said, “We’re not renaming the phase yet, but we may get around to that. We are in a new phase of the process. We are significantly closer to neutral and it’s appropriate to proceed cautiously.”

- Powell mentioned that some FOMC members attempted to project Trump’s (inflationary) policies into their models.

__________________________________________

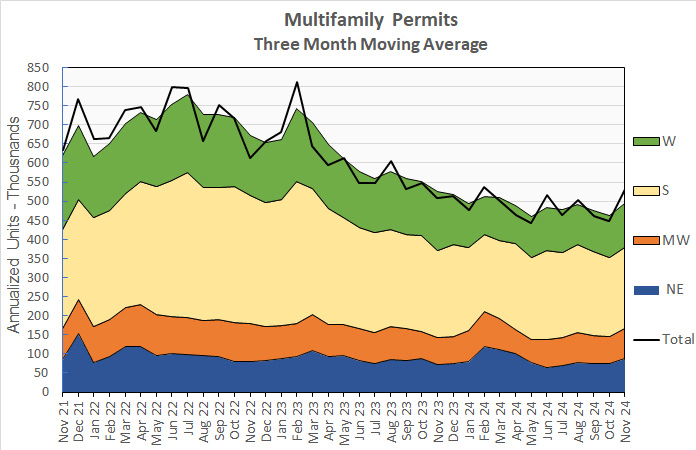

Multifamily Permits Surge In The December Data Release – 12.18.24

- What It Is: Before starting construction, builders need permission from local authorities. A permit ensures the project follows safety codes and regulations. It’s considered the first step in the process to building new units, so it’s an early indicator of future supply

- Permits were up 22.1% from the previous month at 481,000 on a seasonally adjusted annual basis. They were up 4.8% from their year-earlier level and up 11.1% from the trailing 12-month average.

- What It Means: While permits do not mean a developer will definitely move forward with construction, it’s a worrying sign for current property owners hoping for less new supply to compete against in the coming years

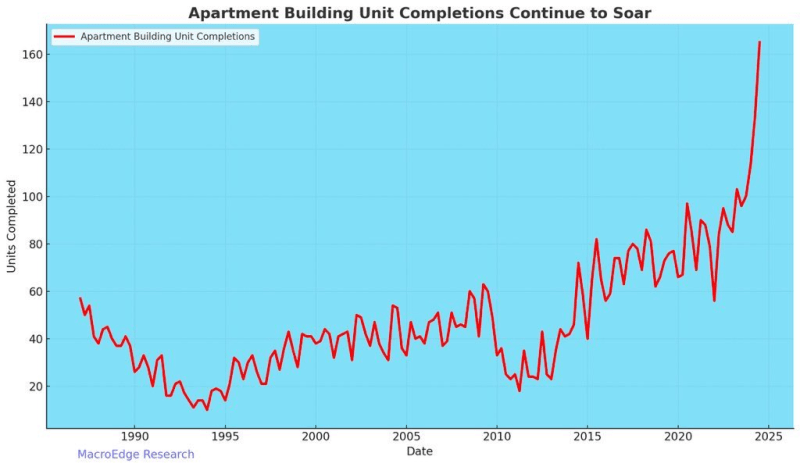

Multifamily Completions/Supply Continues To Surge:

____________________________________________

From Apartment Advisor’s National Rent Report In December:

- Studio Units: -1.5% month-over-month decline

- 1 Bed Units: -3.1% month-over-month decline

- 2 Bed Units: -2% month-over-month decline

- 3 Bed Units: -2.3% month-over-month decline

From Redfin’s Rent Report in December:

- The median U.S. asking rent fell 0.7% year over year in November to $1,595, the lowest level since March 2022.

- Rents were down 1.1% on a month-over-month basis.

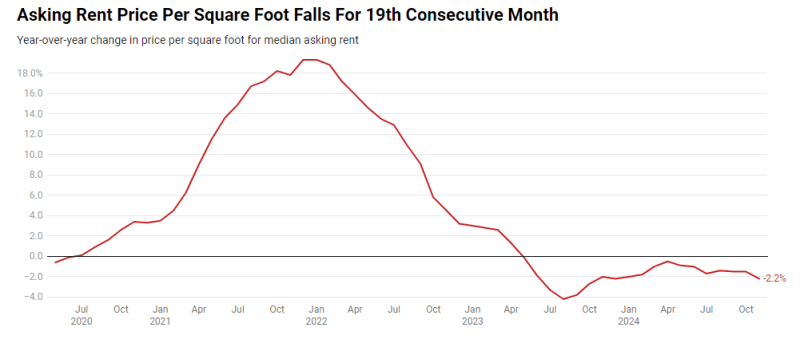

- The asking price per square foot for rental apartments fell 2.2% year over year to the lowest level since December 2021

- Rents dropped across all bedroom counts for the fifth consecutive month.

- The median rent is now 6.2% lower than when it hit an all-time high of $1,700 in August 2022

- Nationally, apartment completions rose 22.6% year over year to the highest level in over 12 years in the second quarter. As a result, the vacancy rate for buildings with five or more units rose to 8% in the third quarter, the highest level since early 2021.

From Yardi’s Multifamily National Report in December:

- Multifamily rents fell .29% month-over-month

- Single family rents fell .32% month-over-month

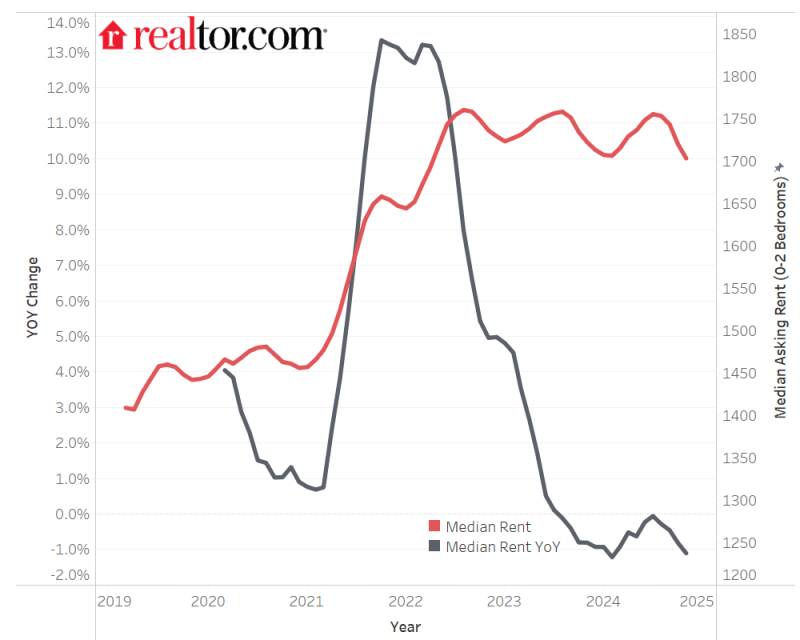

From Realtor.com’s Rental Report in December:

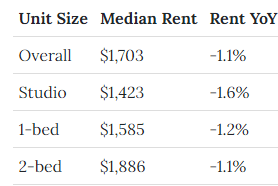

- It was the sixteenth month of year-over-year rent decline in a row for 0-2 bedroom properties. Asking rents dipped by $19 or -1.1% year-over-year.

- The median asking rent registered at $1,703, down by $17 from last month (-1.0%) and down $57 (-3.24%) from the August 2022 peak.

From Zillow’s Rental Market Report in December:

- Rents fell 0.3% month-over-month

- The share of rental listings on Zillow offering a concession set a new record at 38.6% in November

- Income needed to afford rent increased by 3.4% year-over-year in November to $79,301

- Since pre-pandemic, the income needed to afford rent has increased by 33%