Weekly Jobless Claims – Data Released 12/12/24

- What It Is: Show how many people filed for unemployment benefits during the past week

- Claims jumped from 225,000 last week to 242,000 this week, much higher than expected

- What It Means: A weaker jobs market could make the Fed more aggressive cutting rates in the months ahead

This Week’s Pensford Letter (12/9/24): If This Month’s Employment Report Focused On The Unemployment Rate, Instead Of The Headline Payrolls Number, Here Is How It Would Read:

- The labor market deterioration accelerated in November as the economy shed another 355k jobs.

- The unemployment rate ticked up to 4.2% but benefitted from rounding down. The true print was 4.246%, which gets reported as 4.2%. Had just 6,700 more people reported being unemployed, the headline UR would have been 4.3%. It was 3.3% a year ago.

- Over 7.1 million Americans are now unemployed, an increase of nearly one million from last year. The number of workers settling for part-time jobs due to weak economic conditions has ballooned to 4.5 million, up from 4.0 million last year.

- Long-term unemployment, a key indicator of structural labor market problems, is up 41% over the past year. 1.7 million workers have now been jobless for over 6 months, up from 1.2 million a year ago.

- The employment-population ratio continues its worrying decline, dropping to just 59.8%. More Americans are simply giving up looking for work, with labor force participation falling to 62.5% – extending a concerning downward trend that began last December.

- The unemployment to employment ratio, which measures the % of unemployed that became employed last month. Excluding covid, it’s at its lowest level in 10 years.

- The overall hiring rate fell to 3.3%, lowest since June and comparable to 2013 levels.

- Job openings are still down 36.4% from March 2022 peak.

- Full-time jobs fell 111k, part-time down 268k.

- Multiple job holders increased by 275k.

- Permanent layoffs are trending higher, now above 1% of labor force.

- Average monthly job revisions of -36k since December 2022, a level rarely seen outside recessions.

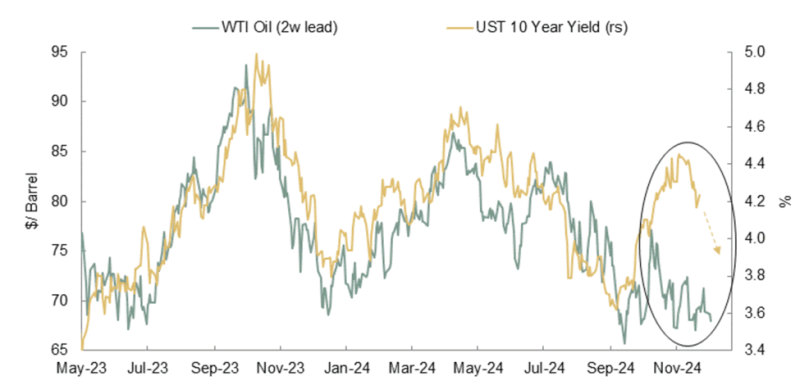

This is why the market’s odds of a Fed rate cut rose to 86% after the jobs report. But what about the 10 Year Treasury? Given the high correlation between oil and rates, it looks ready to fall below 4% in the weeks ahead:

_______________________________________

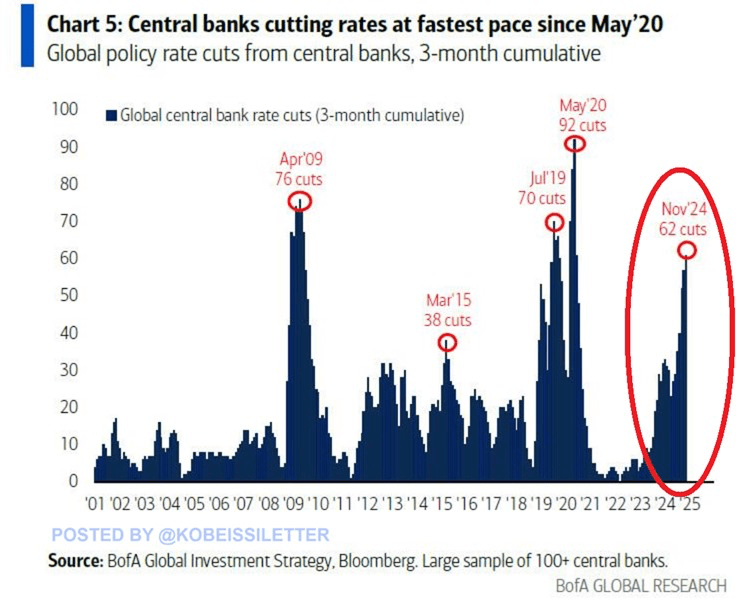

Global central banks have conducted 62 rate cuts over the last 3 months, the most since the 2020 pandemic. This is the 4th fastest pace of rate cuts this century. To put this into perspective, during the peak of the Financial Crisis in 2009, global central banks implemented 76 rate reductions.

What it means: If rates are falling around the world it makes United States yields, included multifamily cap rates, more attractive to global investors.