The December BLS Jobs Report – Data Released 12/6/24

- What it is: A summary of the total jobs gained or lost in the previous month, the unemployment rate, wages and work hours

- 227,000 new jobs were created this month, beating expectations of 214,000

- The previous two months were revised higher by an additional 56,000 jobs

- The unemployment rate rose slightly to 4.2%

- Hourly earnings rose .4% month-over-month, beating expectations of .3%

- What is means: A stronger jobs report with higher-than-expected wage growth makes the Fed less likely to aggressively cut interest rates

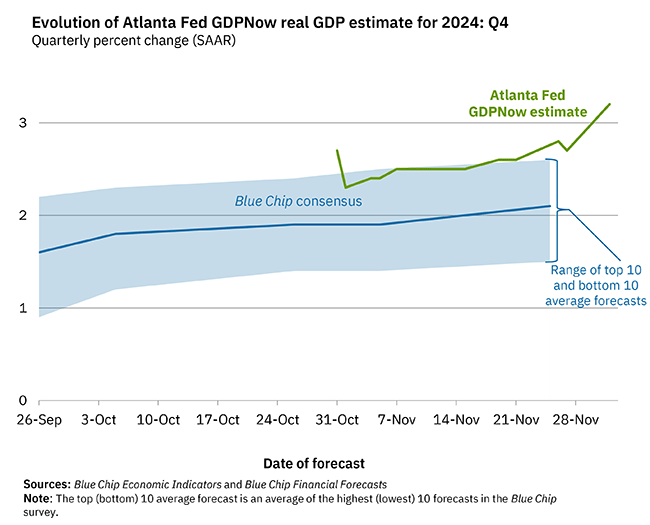

Atlanta Fed GDP Now Forecast – Data Released 12/2/24

- What it is: “The growth rate of real gross domestic product (GDP) is a key indicator of economic activity, but the official estimate is released with a delay. Our GDPNow forecasting model provides a “nowcast” of the official estimate prior to its release by estimating GDP growth using a methodology similar to the one used by the U.S. Bureau of Economic Analysis.”

- The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2024 is 3.2% on Dec 2, up from 2.7% on Nov 27.

- What it means: If GDP growth is accelerating, it will make the Fed less likely to cut interest rates

JOLTs Report (Job Openings & Labor Turnover Survey) – Data Released 12/3/24

- The number of jobs openings came in at 7.74 million (higher than the 7.48 million expected)

- More job openings indicate that employers are actively seeking to hire and signals a tighter labor market where employers struggle to fill positions

- Increased competition for jobs can lead to higher wages as companies offer higher compensation to attract employees

- The number of quits also rose, indicating more confidence among workers about finding another job

- What it means: The stronger than expected JOLTs data makes the Fed less likely to cut interest rates

Jerome Powell’s Interview At The Dealbook Summit – 12/4/24

- Powell again emphasized that there’s little urgency for the Fed to lower interest rates quickly, given the uncertainty in the inflation outlook and a solid current economic backdrop.

- “The economy is strong, and it’s stronger than we thought it was going to be in September,” Powell said. “The downside risks appear to be less in the labor market, growth is definitely stronger than we thought, and inflation is coming a little higher. So the good news is that we can afford to be a little more cautious as we try to find neutral.”

- What it means: The strength in the labor market and sticky inflation may slow the Fed down with interest rate cuts in the months ahead

The Beige Book – Data Released 12/4/24

- What it is: A report that gives a snapshot of the U.S. economy. It’s like a collection of stories and observations from different regions of the country about how businesses are doing.

- Though growth in economic activity was generally small, expectations for growth rose moderately across most geographies and sectors.

- The Fed’s districts reported that inflation was rising only modestly, and companies had more trouble passing on higher costs as consumers grew more discerning about pricing.

- Hiring was seen as subdued with low worker turnover, while layoffs were also limited. Business contacts said they expected steady to modest growth in employment.

- What it means: Relative to recent months that had a more negative tone (which Jerome Powell commented on after their first 50 basis point cut), this report reflects stronger growth and makes the Fed less likely to cut interest rates.

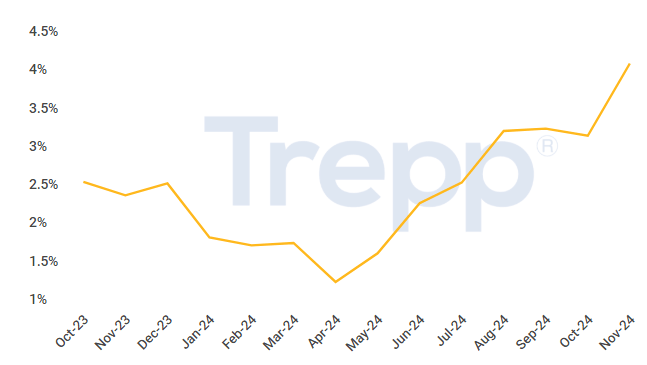

Multifamily CMBS Delinquency Rate Rose Sharply This Month:

- Multifamily delinquency rose 94 basis points to 4.18% this month. One year ago, it was at 2.46%

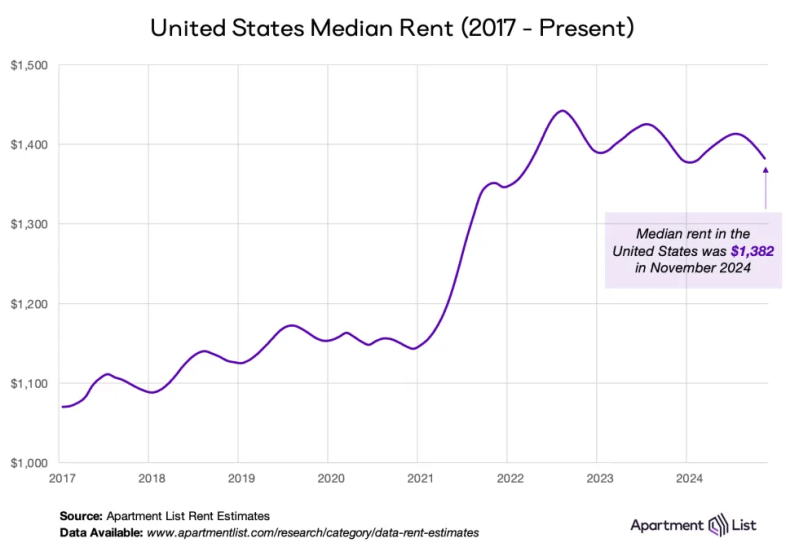

Apartment List December Rent Report:

- The national median rent dipped by 0.8% in November, as we get further into the slow season for the rental market. Nationwide rent fell $12 to $1,382, and we’re likely to see that number dip one more time before the year ends.

- Since the second half of 2022, the seasonal declines in rent prices that take place during the fall and winter have been steeper than usual and seasonal increases of the spring and summer have been milder. As a result, apartments are on average slightly cheaper today than they were one year ago. Year-over-year rent growth nationally currently stands at -0.6 percent and has now been in negative territory for nearly a year and a half.

- On the supply side of the rental market, our national vacancy index continues trending up slowly and sits at 6.8 percent, the highest reading since the onset of the pandemic.

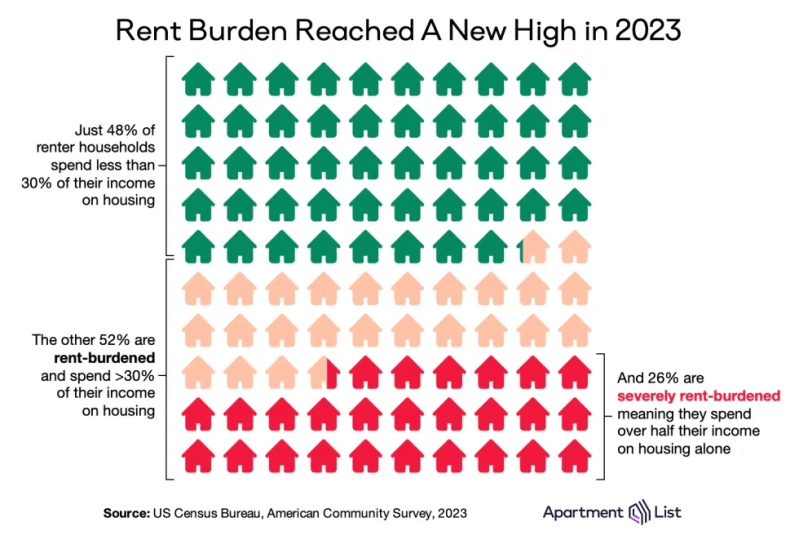

The Number Of Cost-Burdened Renter Households Hits All-Time High

- Broadly accepted financial wisdom dictates that a household should spend no more than 30 percent of its gross monthly income on housing costs.

- More than half spend above that level, qualifying them as “cost-burdened.”

- More than one-in-four renter households spend over 50 percent of their income on rent, making them “severely cost-burdened.”

- The cost burden rate could even be underestimating the degree to which housing affordability has worsened. A lack of affordability has deterred new household formation in recent years, as Americans are increasingly doubling up with family or roommates to save on housing costs. These individuals are struggling with housing affordability, but because they don’t represent their own households, they are not captured in cost burden statistics.

- Additionally, as the affordability of for-sale housing has eroded even more rapidly than that of rentals, more prospective homebuyers are continuing to rent. This subset of renters who have been sidelined from the for-sale market tend to be higher-income, and their presence in the denominator of the renter cost-burden rate could be depressing that rate slightly.

Scheduled Apartment Supply Peaks By Market (12/2/24)

Texas and the Carolinas are really going to test the depth of demand in the coming few quarters when their supply peaks in the first half of 2025. There may be a slower return to normal revenue growth levels due to sheer volume, and supply’s impact is cumulative over a multiple-year period.

CRE Investors Evaluate Distress Signals:

- Apartments have been a top investment target for many years, but tighter margins combined with economic headwinds have led to more investor jeopardy, especially for value-add multifamily product. There are some signals that suggest a wave of distress is incoming.

- “I believe the canary in the coalmine is property liens,” says Kidder Mathews SVP Nathan Thinnes. “Vendors are usually the first to not get paid, and we’re seeing a big uptick in accrued liens, specifically in the multifamily space.”

- “Any hopes borrowers have of a lower cap rate environment to aide in their workout solution is quickly fading.”