From this week’s Pensford Letter (11/25/24):

- When the Fed Funds interest rate is higher than the inflation rate, we have positive real interest rates. That, in turn, applies the brakes on the economy. With Fed Funds at 4.5% – 4.7% and Core PCE at 2.7%, we have positive real rates of 2%, aka braking action.

- This is why Powell continues to stress that rates are restrictive. CPI has fallen from 9.1% to 2.6%. Monthly job gains have dropped from 550k to 150k.

- The neutral rate is a hypothetical rate where the Fed is neither encouraging or discouraging growth, then you add inflation.

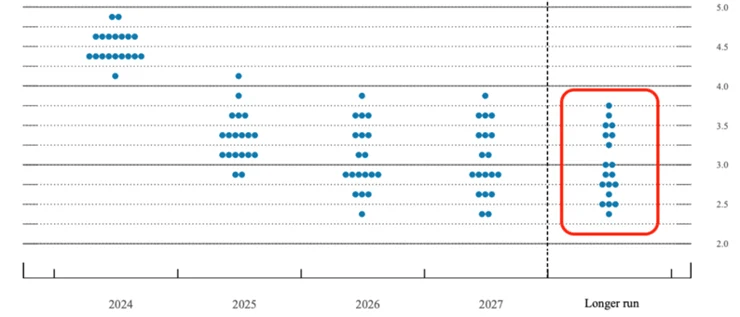

- Every other meeting the Fed provides forward guidance through the blue dots seen below. It’s where they think the Fed Funds rate will be at that point in time.

- When you read a headline that the Fed’s expectation for long term neutral is 2.8%, it’s really the median blue dot of these projections. Here’s September’s projections:

- If the 3.75% dot is accurate, we are just 0.75% away from neutral. If the 2.25% dot is accurate, we are still 2.25% away from neutral. The range is 2.3% – 3.75%. That’s a huge range, which signals uncertainty and a widening difference of opinions.

- But every single one of them is below the current level of 4.5% – 4.75%, which is why it’s reasonable to conclude they will keep cutting. It’s also why Chicago Fed President Austan Goolsbee said, “I still think we’re far from what anybody thinks is neutral. We still got a ways to come down.”

____________________________________________________

Collier’s Quarterly Market Snapshot:

- For the second consecutive quarter, the multifamily market has posted year-over-year sales gains. The number of properties traded has settled, indicating that the market is finding an equilibrium.

- Volume over the past two quarters is in line with quarterly averages from 2015-2017. While it doesn’t match the levels seen during the booming days of 2021 and 2022, it still reflects a time of healthy market activity and liquidity. Given the sector’s continued tailwinds, multifamily looks to remain the most traded asset class for the foreseeable future.

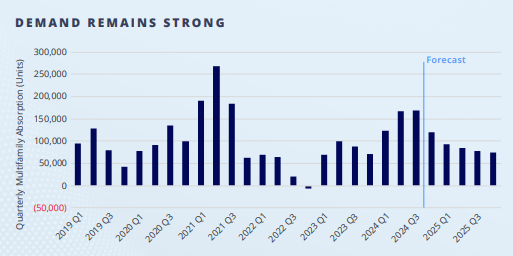

- Market fundamentals are nearing an inflection point. New deliveries, which are at multi-decade highs, have been met with near-record demand. Occupancies have slipped, but not to the extent expected given the supply-side pressure.

- As this construction cycle abates, and limited groundbreakings follow, occupancies are projected to improve, supporting future rent growth in the quarters, and years ahead. This trend should bring additional capital off the sidelines as investors gain confidence in a near-term market rebound.

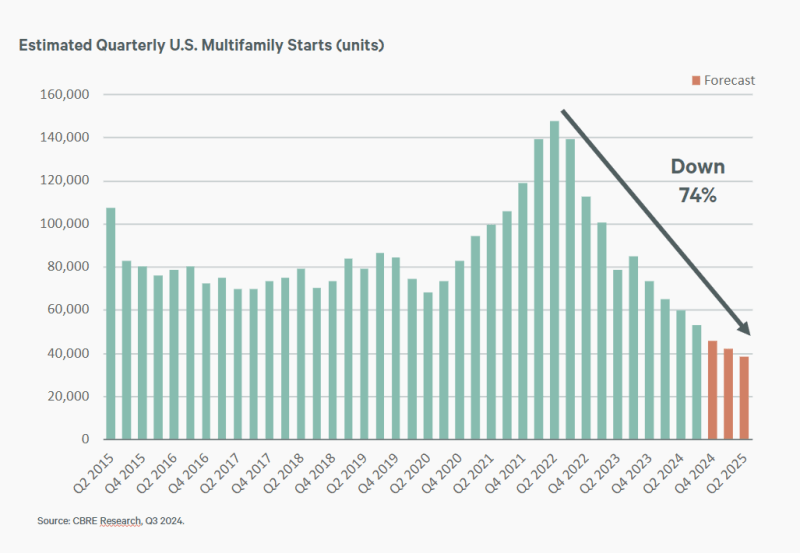

New starts are down 74% since mid 2022: