The Fed’s preferred measure of inflation (Core PCE) moved up to an annualized rate of 2.8% this month, the highest reading since April (Data released 11/27/24):

- The Fed’s inflation target is 2.0%, so if inflation data remains sticky in this range or continues to move higher, it will make it more difficult to continue cutting rates unless unemployment begins to rise to worrisome levels

A Wave Of Troubled Multifamily Maturities Loom:

- Trepp data reveals there are currently more than 5,800 multifamily loans representing $96 billion with a DSCR below one.

- 79% of these loans comprise of floating-rate debt with a weighted average interest rate of 7.8% today.

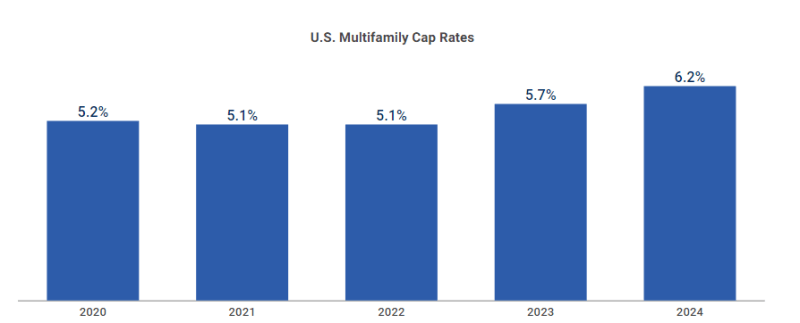

- The estimated cap at securitization for multifamily properties has been in the 5.2% to 5.7% range in recent years.

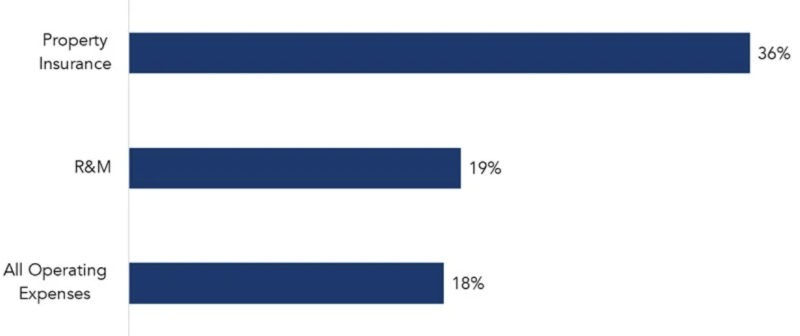

- In addition to higher borrowing costs, multifamily owners have been dealing with rising operating expenses in the form of higher property taxes, insurance, repairs and maintenance, and increased labor costs.

- Rental rate growth has remained largely lackluster as the market digests the current supply wave.

____________________________________________

A Perfect Storm Of Rising Insurance Costs:

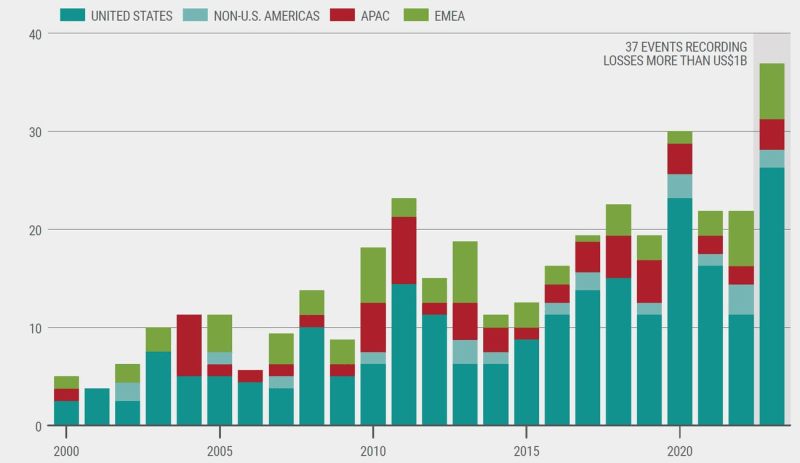

Increasing Frequency of Natural Disasters

- The year 2023 set records as the warmest on record, accompanied by 28 separate billion-dollar weather and climate disasters. These events caused $92.9 billion in damages nationwide.

- More frequent and severe natural disasters and the increasing development of high-value properties in areas prone to hazards have put increased pressure on the insurance industry.

- In 2022, U.S. losses accounted for 75% of total global insured losses.

- Swiss Re, a leading reinsurer (insurance company that insures insurance companies), anticipates insured losses could double in the next decade due to extreme weather events

Rising Claims Costs, Litigation Pressures, and Construction Cost Inflation

- Litigation costs from plaintiffs pursuing substantial compensation for injuries or additional payments for disputed property damage have steadily increased by an average of 2 percent annually since 2015. These claims have added to increased insurance costs, which get passed down to the consumer.

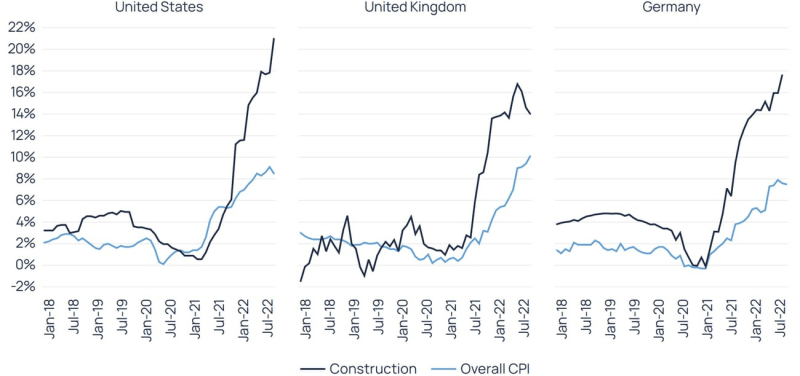

- Inflationary pressures on material and labor costs have increased the price to rebuild damaged properties, further escalating claims costs.

Dramatic Cost Increases

- For residential apartments, insurance costs as a percentage of total expenses rose from 4% to 7% in 2024, according to the National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index, but some areas are seeing even worse increases.

Strained Operating Margins

- Operating expenses for commercial real estate increased by more than one-third from 2017 to 2022, with insurance costs rising by 73% during this period.

______________________________________________

Immigration & Deportation Policies Under The New Administration:

- Reduced rental demand: Slowing immigration could lower the number of renters entering the market, decreasing occupancy rates and cooling some of the strength we’ve seen in absorptions during recent quarters, which also coincided with record levels of immigration.

- By our estimates, from 2022–2024, immigration was responsible for all of the 1.0 million net growth in renter households.

______________________________________________

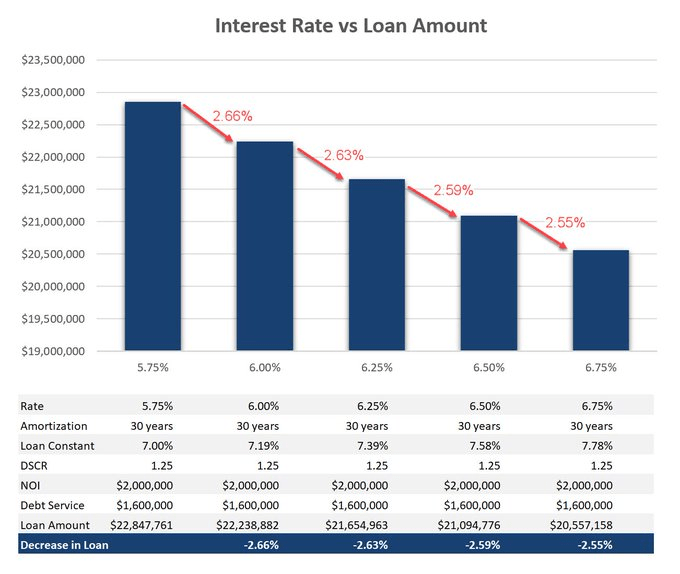

The impact of interest rates on proceeds:

- For every 25-basis point increase in interest rates, loan proceeds decrease by approximately 2.6%

- If rates have gone up 50 basis points since you last updated your model, then your loan amount will be ~5.2% lower

- The example in the chart below uses a $2MM NOI, but the same relationship exists regardless of NOI

- Loan Constant = Your annual debt service divided by the loan amount. It takes into account the amortization, so if a loan is interest-only, then your interest rate and your loan constant are the same.

- DSCR = Debt Service Coverage Ratio. This is your NOI divided by debt service. Most lenders typically want the NOI to be at least 1.25x the annual debt service.

- The 10-year treasury yield has risen 70 basis points since mid-September, which reduces loan proceeds and estimated IRR returns