THE BULL CASE: Why Rates Should Fall & Multifamily Values Should Rise:

From The Pensford Letter on deficit fears (11/18/24):

If you’re scared of US fiscal health, pick another country’s 10-year bond yield to invest in instead of the United States’ 10-year which is currently at 4.45%:

- Germany – 2.35%

- Australia – 4.45%

- Japan – 1.05%

- UK – 4.47%

- Canada – 3.28%

- France – 3.08%

- Spain – 3.05%

- China – 2.06%

- Italy – 3.55%

- Greece -3.18%

Not a single developed nation has higher yields than the US. Shouldn’t that help keep a lid on US rates?

“But deficits!” A very solid point. Thankfully, we have precedence when markets get nervous about US fiscal health. What happened when the US lost its AAA rating in 2011? The 10-year yield fell from 3.0% down to 1.8%.

We’re at 120% of debt to GDP – not good. But we crossed that threshold in 2015, and rates didn’t spike. Inflation didn’t take off. The world didn’t end. Japan crossed 100% debt to GDP in 2000. They currently sit > 200%. Did their rates spike? No, it was gigantic news when their interest rates finally turned positive last year. Their 10-year is 1.05% currently.

Fannie & Freddie Announce 2025 Multifamily Lending Caps (11/18/24)

- Fannie Mae and Freddie Mac will each be provided with $73 billion in lending capital for multifamily properties in 2025 – a combined total of $140 billion.

- At least 50% of the capital must be put toward mission-driven affordable workforce housing and they have no limits on how much they lend on those properties

- The caps are up from $70 billion each in 2024, although Fannie Mae’s volume is only at $38.5 billion so far this year

- This means the GSE’s have plenty of ammunition to lend and will continue to provide liquidity to the multifamily debt market

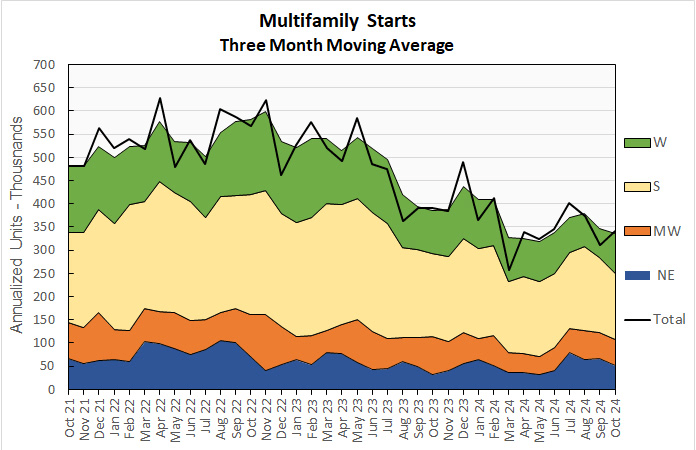

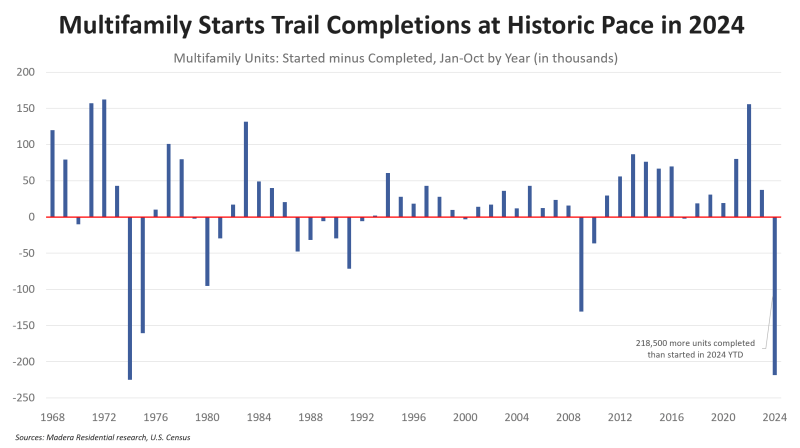

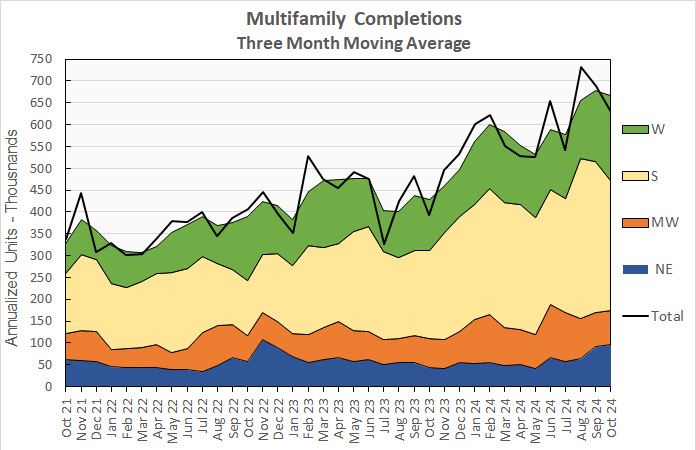

Multifamily starts for October came in lower than any October in the last 12 years. Year-to-date, completions are outpacing starts by 218,500 units. This is a massive deficit that will significantly reduce apartment supply in 2026. Source: Jay Parsons (11/19/24)

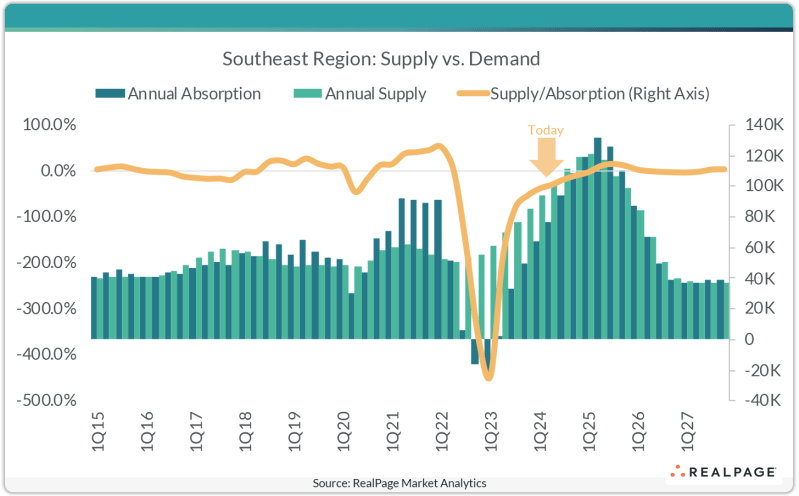

RealPage: Multifamily demand catching up to supply in the Southeast (11/19/24):

Apartment demand has been significant in the Southeast and is catching up to record supply levels. The Southeast region of the country, which covers markets across Florida, Georgia, Alabama, South Carolina and North Carolina, has seen sizable supply volumes recently. Roughly 111,200 units delivered in this region in the year-ending 3rd quarter 2024. Atlanta was the region leader with over 25,000 units coming online in the past year.

Meanwhile, apartment demand across the Southeast has been catching up as the region absorbed more than 93,600 units in that same time frame. Again, Atlanta was the region’s leader for demand, with 20,100 units absorbed in the past year. While demand is still about 17% behind concurrent supply volumes in the Southeast, that marked a significant improvement from the 80% delta from one year earlier. In the near-term outlook, demand is expected to get even closer to supply, closing the gap even further.

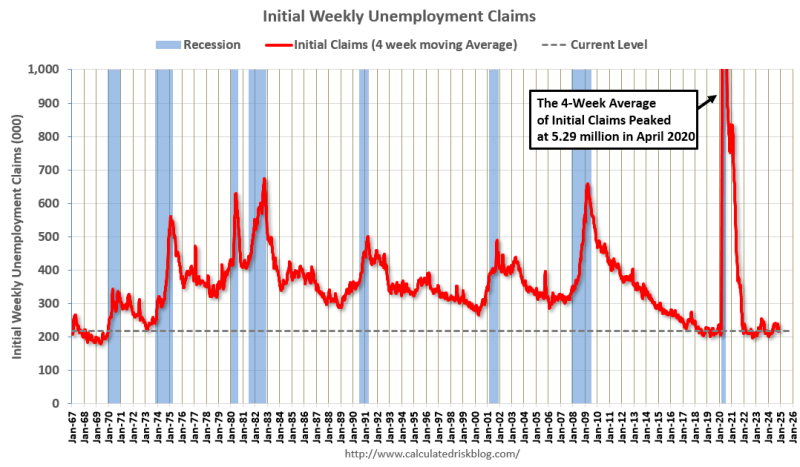

Under the hood, though, the jobs market is stagnating: (11/20/24):

- The rate at which workers quit their jobs in September was 1.9% — the lowest since June 2020 and, outside of Covid, a level last seen in 2015.

- The number of job openings in September was 7.4 million — a decline of 1.9 million from the previous year.

- An increasing share of those who do job hop are settling for lower paychecks. Some 17% of job switchers this year took a pay cut.

- Employers are sitting tight, says Daniel Zhao, lead economist at job site Glassdoor. Companies aren’t making big changes to hiring strategy. That means “fewer opportunities for workers to climb the career ladder.” They’re still plugging away at the same role they’ve had for years without the opportunity to move up internally or at a new company.

- 65% of the 3,400 professionals surveyed by Glassdoor last month said they feel stuck in their current role.

- A weaker jobs market would increase the Fed’s speed and quantity of rate cuts

Construction employment has been a bright spot in the jobs market. That could be about to change: (11/21/24):

- With permits, starts, and housing units under construction all down from their peaks, at levels at least close to consistent with an oncoming recession, the big item to look for is employment in residential construction, and construction generally.

- If manufacturing employment remains negative, and construction employment turns down, that would strongly indicate that more likely than not a recession is approaching.

- A weaker jobs market would increase the Fed’s speed and quantity of rate cuts

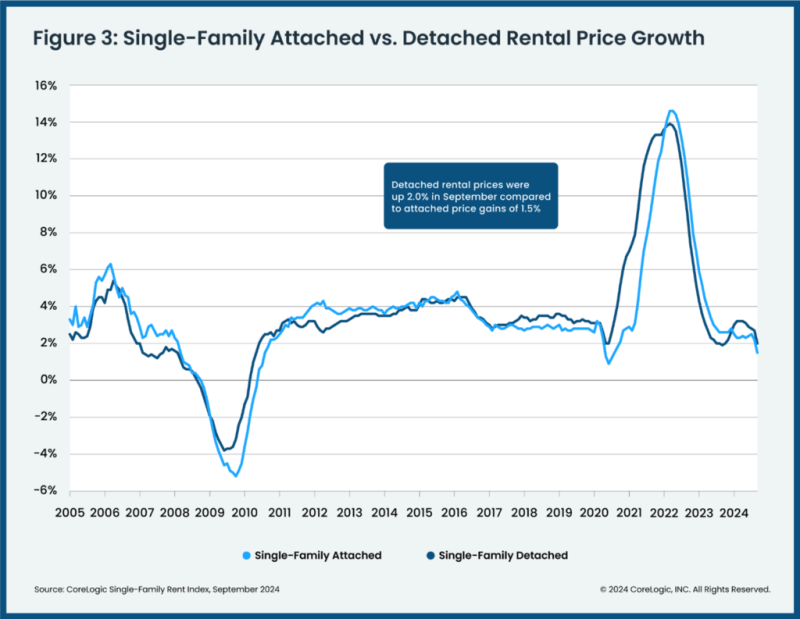

CoreLogic’s Single-Family Monthly Rent Data (11/21/24):

- Annual U.S. single-family rent growth registered a 2% increase, continuing a slowing trend that began in early 2024

- Single-family rents are a large component of the CPI (inflation index). It tracks on a lag, so if rents continue to cool for single-family homes, it will continue to lower monthly inflation readings in the months ahead (allowing the Fed more room to cut rates)

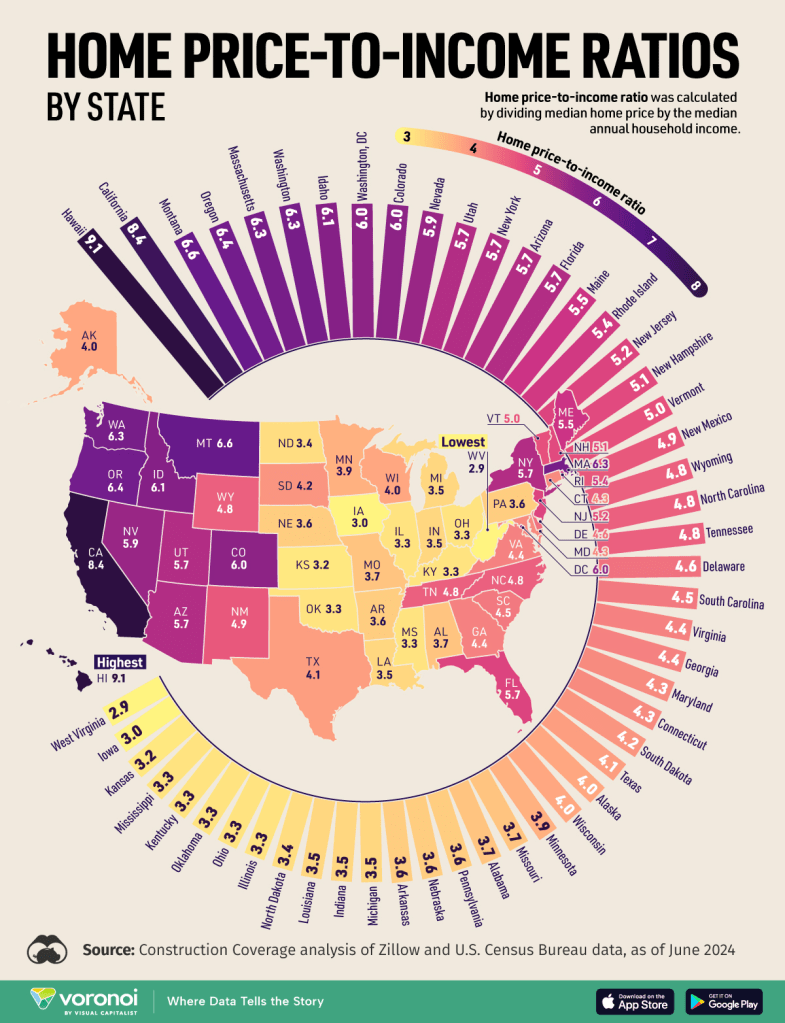

The heat map below shows home price to income ratios by state. The higher the number (darker states), the more unaffordable home ownership is in that state. While this is unfortunate for potential home buyers, it will keep tenants renting longer in those states:

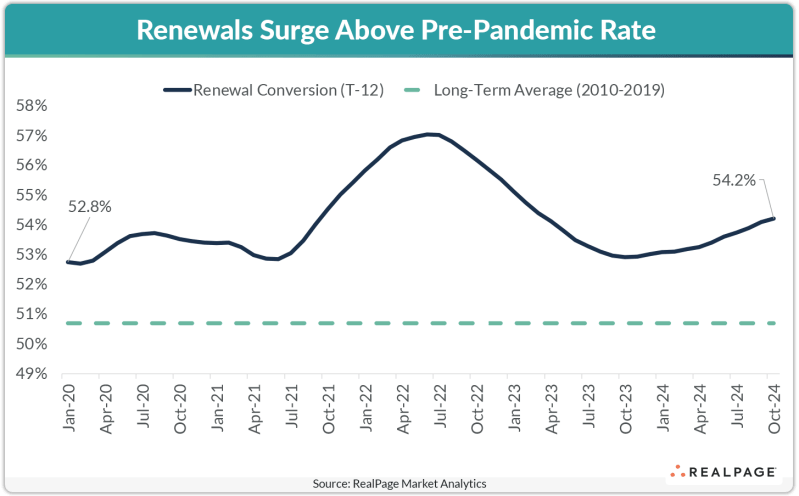

Tenant retention rates continue to climb as buying a home becomes more unaffordable with rising rates: (11/22/24)

- Just over 54% of renters in market-rate apartments renewed their leases in the year-ending October 2024, which was a 120 basis point (bps) climb over last year

_________________________________________________________

THE BEAR CASE: Why Rates Should Rise & Multifamily Values Should Fall:

Bloomberg Speaks With Jim Bianco On Interest Rates (11/20/24):

Famous short seller Carson Block of Muddy Waters sees trouble ahead for multifamily (11/21/24):

- “A lot of multi-unit residential in the US — particularly in the Sun Belt — is in trouble,” the chief executive officer of Muddy Waters Capital LLC, said in an interview in London. “That’s the shoe that hasn’t really dropped yet, but that we think will.”

- Even before the pandemic, many properties were trading at negative capitalization rates, Block said. Cap rates measure how much net operating income a property generates compared to its value.

- Almost $76 billion of apartment complex loans are at risk of distress, according to MSCI Real Assets. That’s partly because many landlords took on floating-rate loans to modernize the properties and have been hit hard by a spike in borrowing costs in recent years.

- “A lot more of these things were purchased with ultra cheap money,” Block said, noting that now “financing costs are massively up.”

- Wall Street is also on the hook, after many of the debts were bundled into commercial real estate collateralized loan obligations. The share of such instruments that are experiencing some form of distress now stands at more than 12%, according to data provider CRED iQ.

____________________

The Fed Chairman struck a hawkish tone in his press conference last week, tempering market expectations for rate cuts. Other Fed officials have also been cautious on the trajectory of rate cuts. Bloomberg created a Federal Reserve sentiment indicator based on a language processing model, which has risen notably the past few weeks (more hawkish):

- Prices are now down 20.2% from their peak in August 2022