Bull Case – Why Rates Should Fall & Multifamily Values Should Rise:

From The Pensford Letter On Tariffs:

- Trump’s tariffs may end up being more bark than bite. If you look at every input component for PCE (the Fed’s favorite inflation index), Chinese imports make up only 3.1% of the total (contrast that with the shelter component at close to 20%, which moves on a lag and continues to help lower monthly inflation readings).

- During Trump’s first term enacting tariffs, PCE averaged only 1.6% before Covid hit. We live in a different world now in many ways, but tariffs did not send inflation skyrocketing his first time around.

Apartments.com Monthly Rent Report – released 11/12/24:

- Rents increased 1.0% year-over-year

- They expect new apartment supply to fall by 50% in 2025 compared to 2024

Redfin Monthly Rent Report – released 11/12/24:

- Rents increased 0.2% year-over-year

Monthly CPI Report (Consumer Price Inflation) – released 11/13/24:

- The shelter index (cost of renting) increased by 0.4 percent in November. This data is received on a lag and many economists believe it will fall significantly in the months ahead.

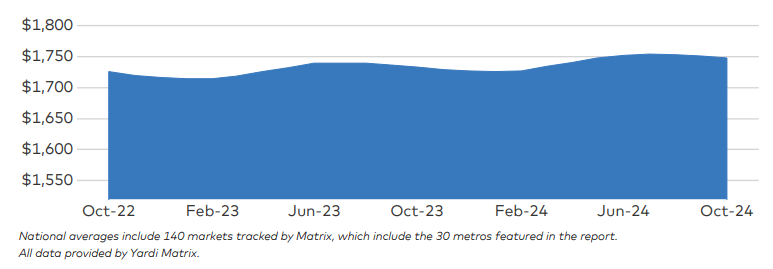

Yardi’s National Multifamily Monthly Report – released 11/13/24:

- Multifamily rents rose 0.9% year-over-year

- Single-family rents rose 0.3% year-over-year

- The decline in multifamily starts will cause deliveries to drop sharply in 2026-2027, potentially providing a strong boost to rent growth

- The U.S. has severely underbuilt housing since the 2008 recession

- Rents continue to steadily move higher:

U.S. Industrial Production Monthly Report – released 11/15/24:

- Declined 0.3% month-over-month and was revised lower for the previous month

- It was the ninth downward monthly revision in the last ten months

- Capacity utilization fell to only 77.1%, its lowest since April 2021

- This weaker-than-expected economic data could speed up the Fed’s rate cuts

- Dues are rising faster than inflation for many of the roughly 76 million residents of communities that keep shared pots to pay for expenses.

- Condo association dues are up 6% nationwide this year versus last

- Nearly a third of the U.S. housing stock is part of community associations

- In 2024, 9% of homeowners will pay more than $500 a month in HOA fees, compared with 6% in 2020

________________________________________________________

Bear Case: Why Rates Should Rise & Multifamily Values Should Fall:

Redfin Monthly Rent Report – released 11/12/24:

- Rents fell 0.6% month-over-month

- Asking rent per square foot fell 1.1% year-over-year, the 18th consecutive month with a decline

- Raleigh, NC experienced the largest rent decline in the country, falling 8.8% year-over-year. Rents fell 10.2% on a per square foot basis

Monthly CPI Report (Consumer Price Inflation) – released 11/13/24:

- Headline CPI rose 0.20% month-over-month, which re-accelerated the year-over-year rise up to 2.6% (moving further away from the Fed’s 2.0% target)

- For the 53rd straight month, core consumer prices rose on a month-over-month basis (0.3%) with the year-over-year re-accelerating to +3.33% (moving further away from the Fed’s 2.0% target)

- Supercore inflation, a key metric the Fed follows, is at 4.4% year-over-year

- Shelter inflation rose 4.9% year-over-year and has been above 3.0% for 37 straight months

- These higher-than-expected inflation readings could slow down the Fed’s pace of rate cuts

Yardi’s National Multifamily Monthly Report – released 11/13/24:

- Multifamily rents fell 0.17% month-over-month

- The worst 11 performing markets are all in the southeast and southwest

- Single-family rentals declined $8 month-over-month, the worst monthly drop in years, and occupancy fell to 95.1%

- Supply has grown more than absorption in 2024, with the average occupancy rate falling to 94.7%

Monthly PPI Report (Producer Price Inflation) – released 11/14/24:

- Headline PPI rose 0.2% month-over-month (as expected) but September was revised higher from 0.0% to 0.1%.

- Annually, headline PPI rose 2.4%, higher than the 2.3% expected (moving further away from the Fed’s 2.0% target). September was revised higher from 1.8% to 1.9%.

- Core PPI (excludes food and energy) rose to 3.1% year-over-year, hotter than the 3.0% expected. The prior month was revised up from 2.8% to 2.9%. This was the second hottest print since March 2023.

- These higher-than-expected inflation readings could slow down the Fed’s pace of rate cuts

- “The economy is not sending any signals that we need to be in a hurry to lower rates”

- “The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

- He said the economy was sending no distress signal that might prompt the Fed to accelerate rate cuts, and to the contrary “if the data let us go a little slower, that seems a smart thing to do.”

- Powell said the current situation was actually “remarkably good.”

- The economy’s strengths include a still-low 4.1% unemployment rate, growth at what Powell called a “stout” 2.5% annual pace that remains above Fed estimates of its underlying potential, consumer spending driven by rising disposable income, and growing business investment.

Retail Sales Monthly Report – released 11/15/24:

- Retails sales rose by 0.4%, beating expectations of 0.3%

- The previous month was revised up to 0.8%

- This higher-than-expected economic data could slow down the Fed’s pace of rate cuts

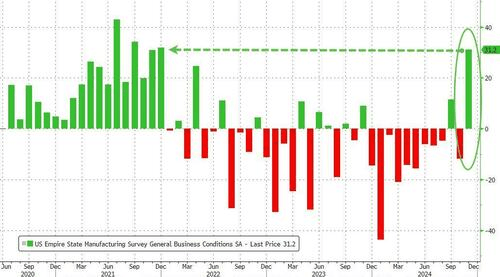

Empire State Manufacturing Monthly Survey – released 11/15/24:

- The general business conditions index climbed forty-three points to 31.2, its highest reading since December 2021. There was also a sharp increase in orders and shipments.

- It was the second largest month-over-month jump in the survey’s history

- This higher-than-expected economic data could slow down the Fed’s pace of rate cuts