Week Of November 10, 2024

The Bull Case: Why Rates Would Move LOWER From Here:

From Jerome Powell (The Fed Chairman)’s press conference and Q&A November 7 after cutting an additional 25 basis points:

- “We are on a path towards a more neutral stance and that has not changed at all.”

- “We don’t start modeling things like tax cuts until they are closer to becoming law.”

- “The labor market has cooled a great deal from two years ago. The labor market continues to cool.”

- “Inflation has moved down a great deal from its high two years ago. If you look at Core PCE over 3 and 6 months, it’s just 2.3% We would be concerned if we saw inflation expectations anchoring at a higher level, but that’s not what we’re seeing. We will not allow inflation expectations to drift upward.”

- “A couple of data points, good or bad, won’t really change the pattern now that we are this far down in the process.”

He repeatedly said they will be more sensitive to risks/noise after they get closer to neutral.

_______________________________________________________

The Bear Case: Why Rates Would Move HIGHER From Here:

From Jerome Powell (The Fed Chairman)’s statement and Q&A November 7:

- “We know the destination but don’t know the pace. “But nothing in the economic data suggests the Committee needs to be in a hurry to get to neutral.”

- “As we approach levels that are plausibly neutral, we could slow the pace of cuts.”

Right now, the market is pricing the neutral rate at 2.88% (orange line below). If that’s where the Fed ultimately lands with the Fed Funds rate, then historically the 10-year treasury is about 1.50% above that rate. That would put the 10-year at 4.38%, right about where it is today. If the neutral moves higher (it has been rising since March), then that resets the entire yield curve higher:

The five-year breakeven rate, the difference in yield between nominal and inflation-adjusted five-year treasuries (a gauge of inflation expectations) is up to 2.5% from only 1.8% in September. The 10-year breakeven hit 2% in September but has climbed back up to 2.4%.

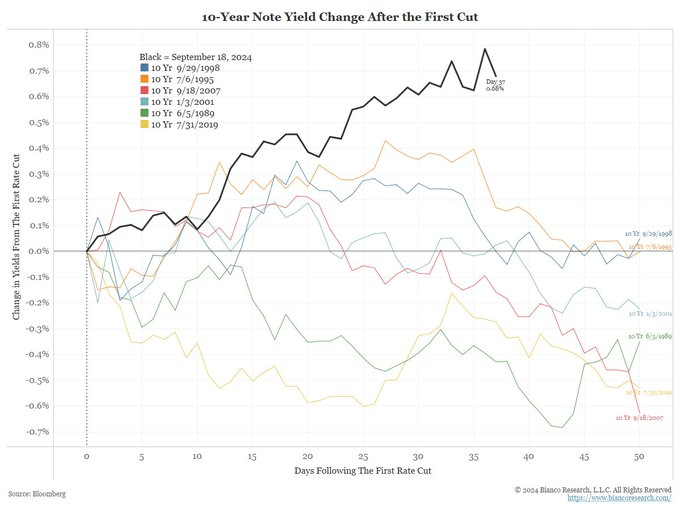

Powell seemed unconcerned at the press conference by the recent rise of the 10-year treasury yield after their first 50 point cut in September (see dark black line in graph below comparing the 10-year rise to how it behaved the last six times the Fed started cutting rates). He doesn’t see a correlation (yet) to the idea that cutting rates while the economy is so strong could perversely create a rise in the long end of the yield curve (rate cuts could reignite inflation, create stronger growth, weaken the currency, etc.).

From Powell: “I — look, I just think — the first question is how long will they be sustained? If you remember the — the 5 percent 10-year, people were drawing massively important conclusions, only to find, you know, three weeks later, that — that it — the 10 year was 50 basis points lower. So, you know, it’s — it (inaudible) — it’s material changes in financial conditions that last, that are persistent that really matter. And we don’t know that about these. What we’ve seen so far, you know, we’re watching it, we’re reading — you know, we’re — we’re doing the decompositions and reading others, but right now, it’s not a major factor in — in how we’re thinking about things.”

The MOVE (the bond market’s VIX – volatility index) has collapsed in the last two days, which is understandable now that the election and Fed meeting have passed. The fact that the MOVE fell, and the 10-year yield moved from 4.28% to 4.35% simultaneously suggests that this yield rise was not a response to higher volatility. Lower volatility may not help yields go down.

The two-year treasury yield, going back decades, has been a good forward indicator of the Fed’s upcoming moves. It is not projecting major easing ahead:

Strong Economic Data:

- The most recent GDP report showed the economy growing at 3%

- Atlanta Fed’s tracker estimates 2.4% GDP growth this quarter

- Unemployment is only 4.1%; historically low

Supply:

- The nonpartisan Committee for a Responsible Federal Budget estimates Trump’s spending plans could add up to $15 trillion in deficits over the next 10 years

The U.S. budget deficit is the largest among OECD countries (as a percentage of GDP):

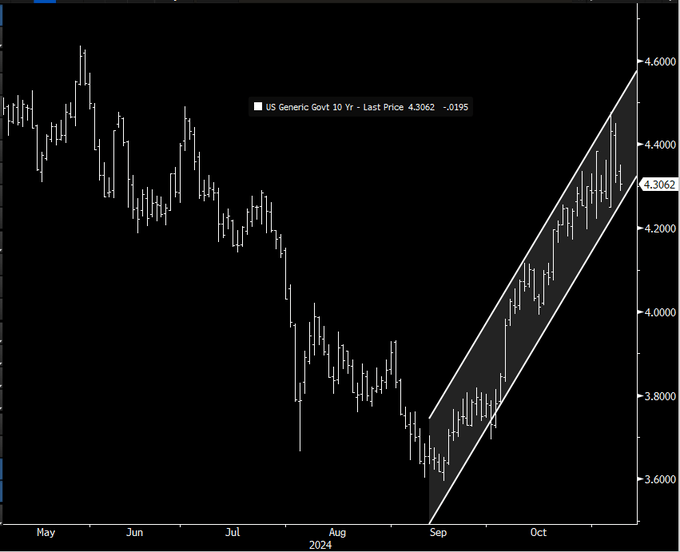

From a technical perspective, the move higher in rates has stayed within a steady channel which bond traders view as an uptrend:

Sources: Bloomberg, Apollo, Pensford, Jim Bianco