From Bloomberg:

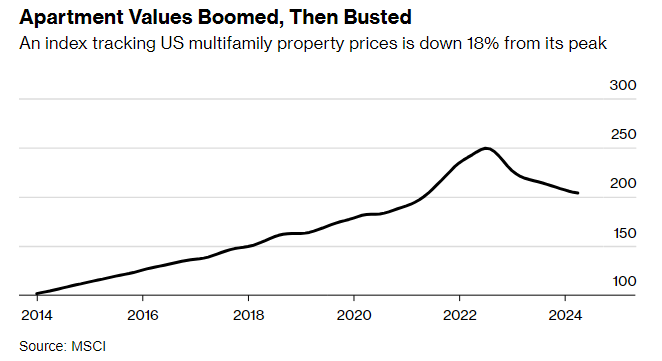

By June 2022, all sorts of trouble began to appear at once. The Federal Reserve had started hiking interest rates at the fastest pace in a generation. A swelling supply of newly built apartments contributed to flattening rents. And as the debt market dried up, sales of apartment buildings plummeted to $28 billion in the fourth quarter of 2023, down more than 80% from two years earlier, according to MSCI.

Rents have continued to ease, with a measure of those costs falling 0.8% in the 12 months ending in May 2024, according to Apartment List.

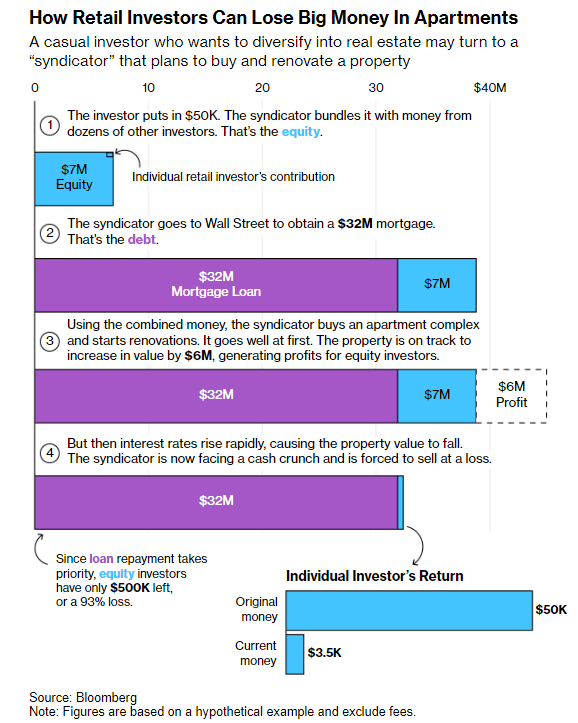

Large institutional players who bought buildings with traditional financing, without as much leverage, were in a better position to weather the turmoil and hold onto their buildings until values appreciated. But the floating-rate debt that had supercharged profits when rates were low has become a millstone for some syndicators. With loan payments soaring and capital for renovations drying up, they risked losing buildings to foreclosure or selling for a loss, with equity investors typically last in line for payment.