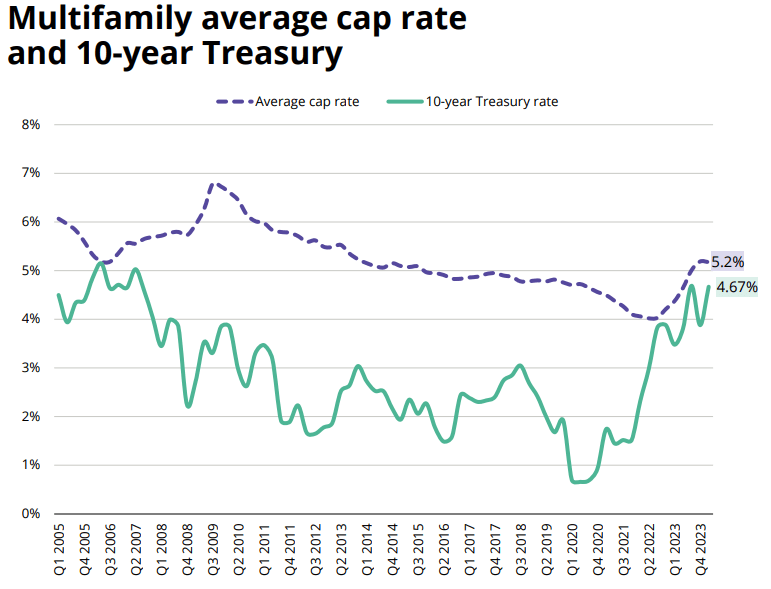

Cap rates and the 10-year treasury do not always move in lockstep. In 2006, cap rates and the 10-year converged just above 5% (almost exactly where cap rates are today).

Over the next 4 years, cap rates rose to almost 7% while the 10-year treasury moved below 3%.

Cap rates reflect sentiment toward real estate. In 2009, rents and multifamily property prices were falling as many tenants lost their jobs and were unable to pay. Buyers required a higher return to take on what they perceived as higher risk.

Source: Avison Young