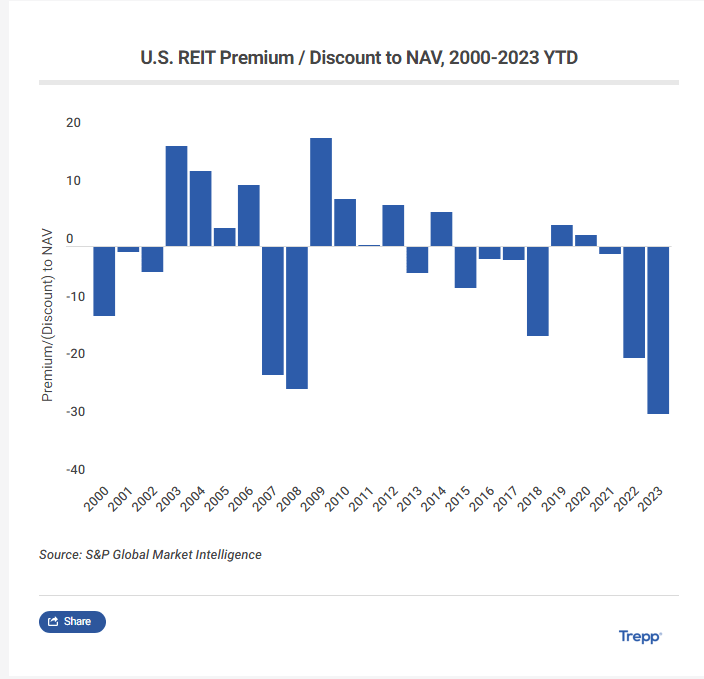

Publicly traded REITs can be priced above or below their Net Asset Value (NAV), which is an estimate of what the real estate they own is worth right now.

A discount exists because REITs (which are essentially traded like stocks) look forward to where they think prices are going in the future. If the market is bearish on the sector and believes the underlying values will fall from where they are today, then REITs will “price in” the decline and trade at a discount to their NAV.

The opposite is true when the market is bullish on the sector; REITs will “price in” a positive NAV.

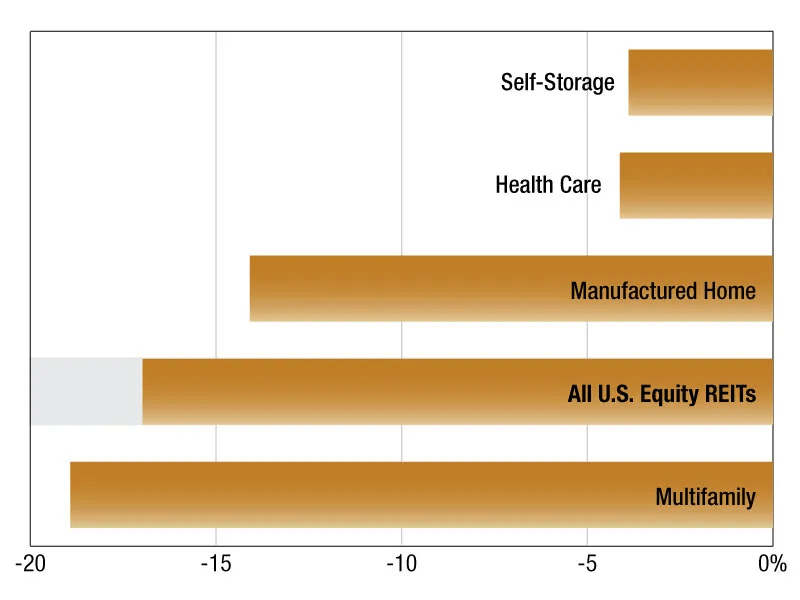

Here is a snapshot of where the multifamily sector is today compared to other REIT categories:

This is not unusual. This following graph shows the historical U.S. REIT premium/discount to NAV going back to 2000:

Source: Multihousing News & Trepp