Multifamily REIT CEOs have been commenting on earnings calls that the concessions (1 to 3 months of free rent) from class A buildings are now putting downward pressure on their class B property rents. This is not something they were experiencing in the first half of 2023. Many renters can now afford to move up to a class A community with these concessions in place (3 months of free rent is equivalent to a 25% drop in rents).

When the 10-year treasury hit 5% in October, builders suddenly felt pressure to hit 90% occupancy by year end to try and sell or put permanent financing on their buildings. This is creating a fire sale with rent concessions.

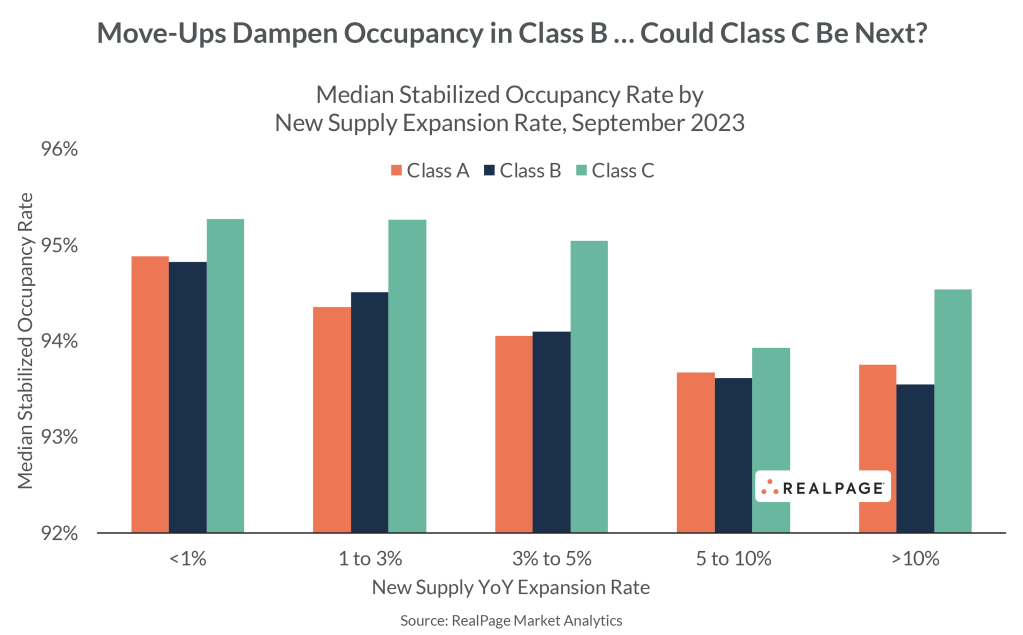

The greater the percentage of new supply relative to the current inventory of apartments in a city, the larger the impact on class B and C properties: